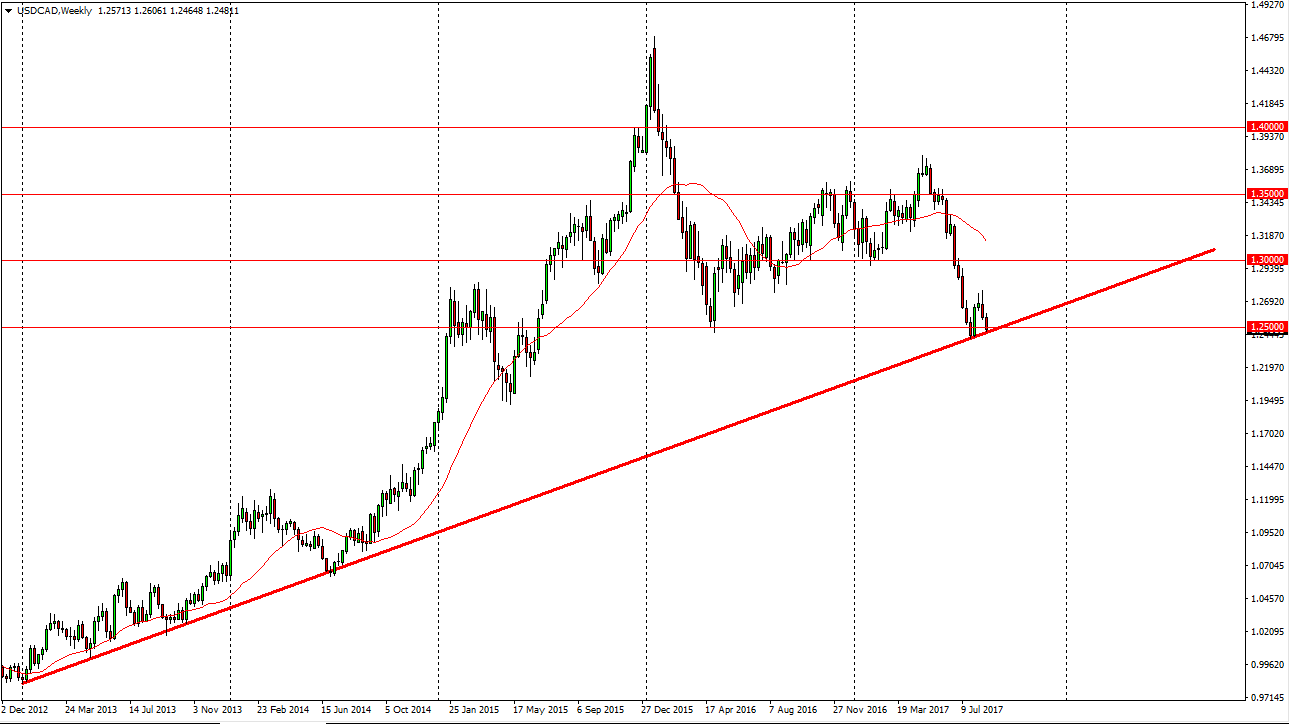

USD/CAD

The US dollar fell significantly during the week, testing the uptrend line on the longer-term charts. Because of this, I think if we can break down below the 1.2450 level, the market should continue to go much lower and I think we could see the end of the uptrend if that happens. However, it’s not until we make a fresh, new high that I would be a buyer. Ultimately, I think this market could be an interesting pair to play this week.

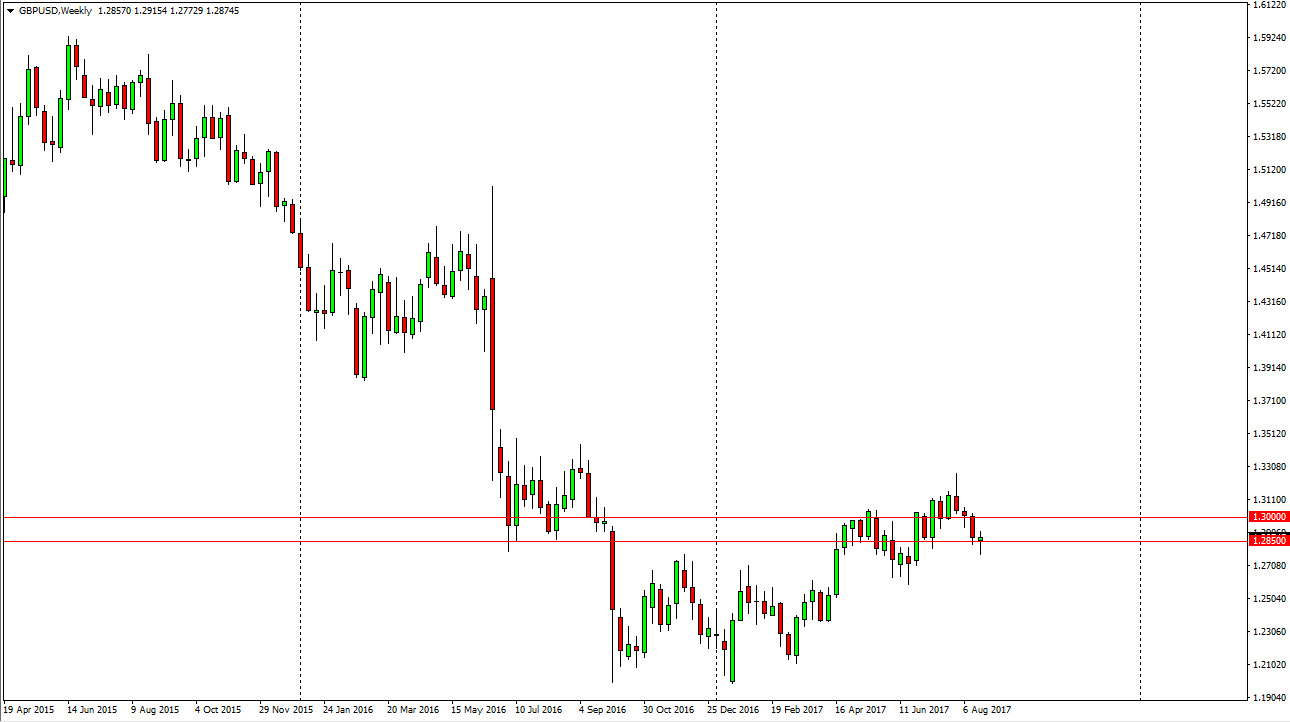

GBP/USD

The British pound fell initially during the week but turned around to form a hammer. If we can break above the top of the hammer, I think the market will probably go towards the 1.30 level above. I think that’s an area that should show some resistance though. Alternately, if we break down below the lows of the week, that could be very bearish. If that happens, I suspect we are going to go looking towards the 1.2650 level.

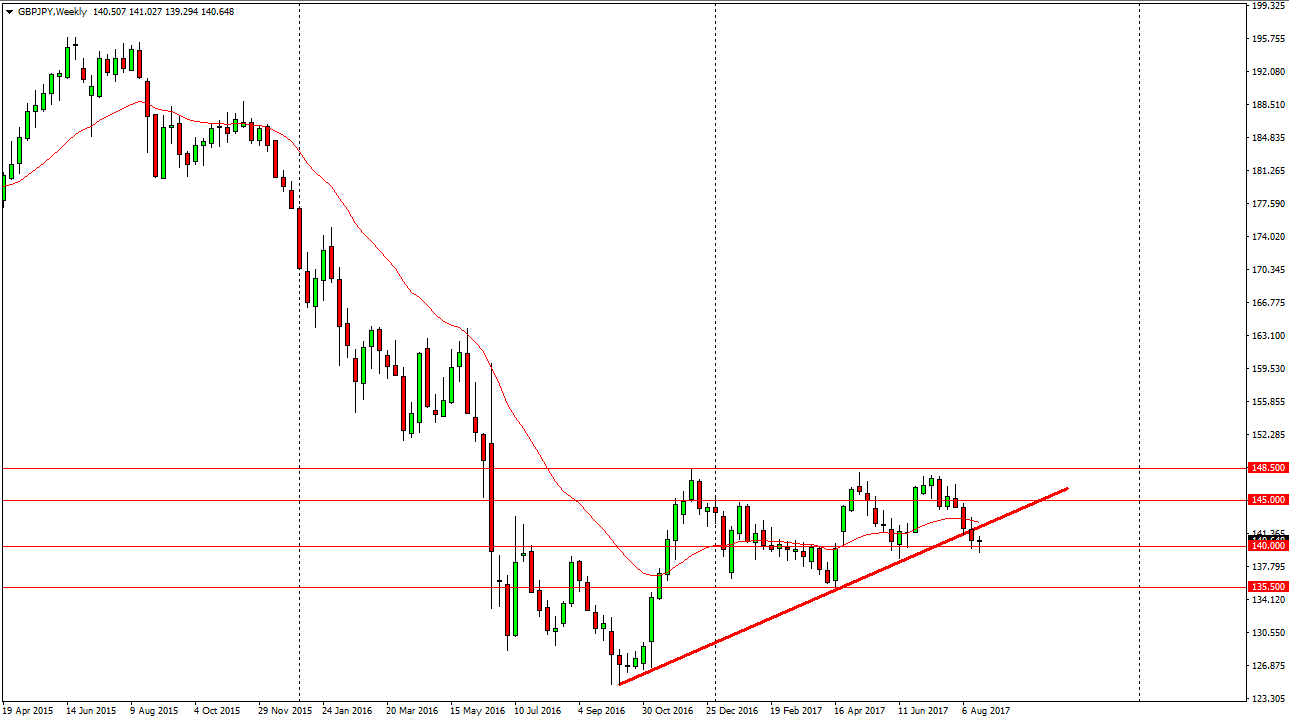

GBP/JPY

The British pound initially fell during the week but turned around to form a hammer against the Japanese yen as well. The 140 level underneath offers support, so I think that some type of breakdown below the bottom of the candle would be bearish. In the meantime, I suspect we will try to test the uptrend line that we have just broken. Because of that, I’m looking to sell closer to that level.

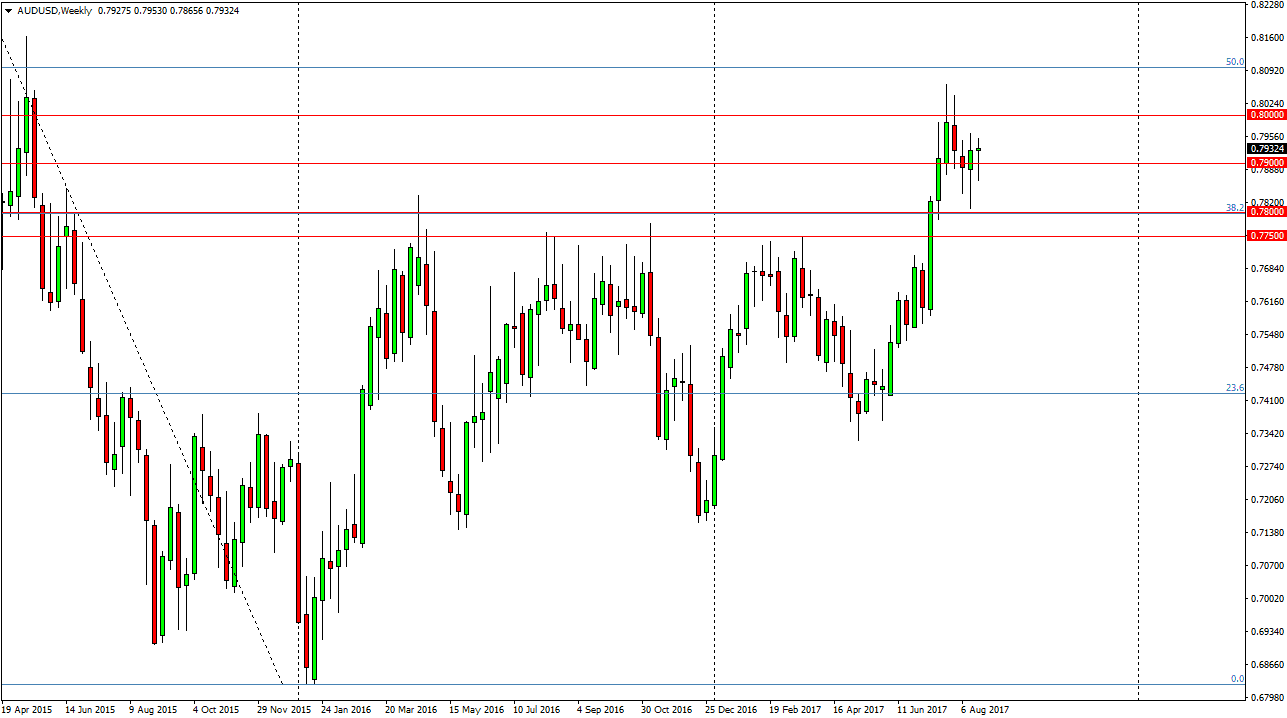

AUD/USD

The Australian dollar fell during the week, breaking down below the 0.79 level. By doing so, the market turned around to form a hammer and therefore I think that we will continue to see buyers. However, the market has a massive amount of resistance at the 0.80 level. As a result, I am not a buyer until we close on a daily chart above that level.