Gold prices settled at $1290.38 an ounce on Friday, gaining 2.5% on the week, as recent volatility in global equity markets and a weaker dollar boosted prices. Some investors abandoned stocks and flocked to the gold market after the U.S. and North Korea traded threats. On the economic data front, inflation figures came in weaker than expected, fading prospects for a Fed rate hike in September. “We have the luxury of waiting to see what actually happens ... before we decide where to go with monetary policy,” Minneapolis Fed President Neel Kashkari said on Friday.

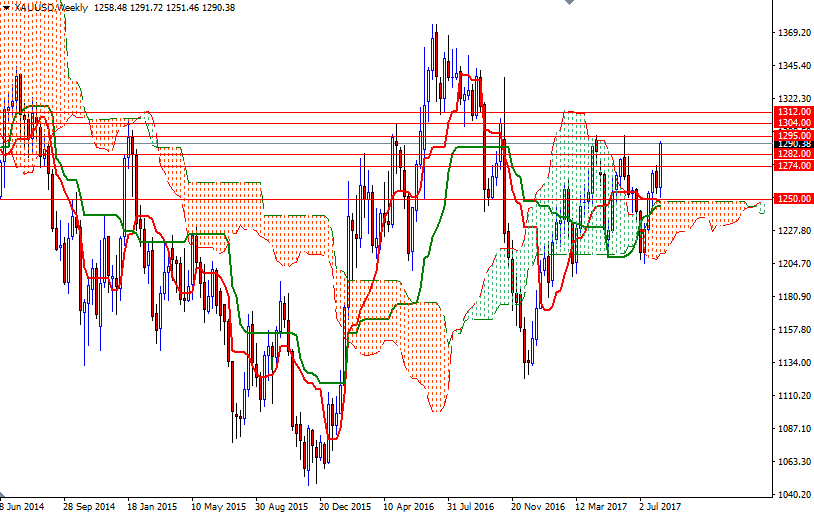

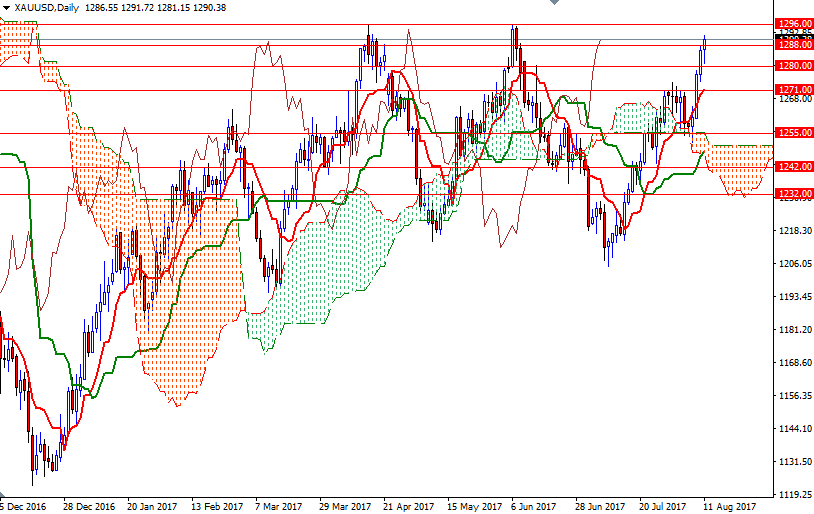

It appears that gold will remain supported amid geopolitical risks as well as fading expectation for the Trump administration’s growth-friendly reforms. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 148837 contracts, from 129672 a week earlier. The medium-term charts are bullish, with the market trading above the weekly and the daily Ichimoku clouds. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

To the upside, the 1296/5 zone stands out as an obvious resistance and the bulls will need to take out this strategic point to gather momentum for 1308/4. Closing above 1308 on a daily basis would indicate that XAU/USD could extend its gains. In that case, look for further upside with 1312 and 1319 as the next targets. However, if the the 1296/5 resistance which blocked the bulls’ way back in April and June remains intact, the market may return to 1282/0 or 1274/1 before heading up. A break down below 1271 may lead to long-side profit taking and pave the way for 1263/0.