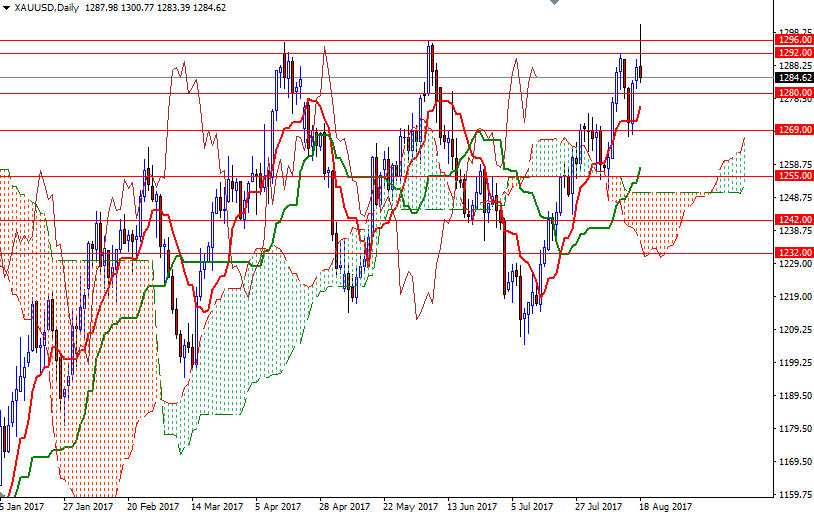

Gold prices settled at $1284.62 an ounce on Friday, as the market’s inability to hold above the $1296 level and better-than-expected U.S. economic data prompted investors to unwind bullish bets. The yellow metal, which hit the highest level since November 9 earlier in the session, saw pressure after the University of Michigan’s preliminary consumer confidence reading for December came in at 97.6, above July’s final reading of 93.4.

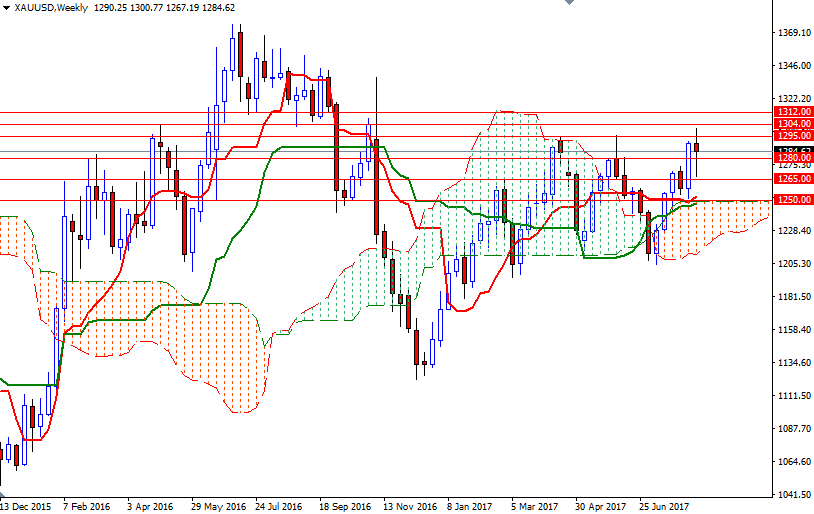

The tall upper shadow of Friday’s candle implies a retracement downwards from here is likely, though trading above Ichimoku cloud (on almost all time frames) suggests that gold is likely to maintain bullish trend over the medium term. The subsequent strength of the dip buying will tell us about how willing the investors are of staying in the long side of the trade. Signs of destabilization in the risk environment and a weak dollar should help gold’s case. The minutes of the last Fed meeting, released on Wednesday, raised doubts about whether the central bank will raise interest raise rates again in the coming months.

However, as I mentioned several times in the past weeks, there are strong barriers ahead such as 1296/5 and 1308/4 and price won’t have much room to go as long as they remain intact. If XAU/USD breaks through 1308/4, look for further upside with 1312 and 1319 as the next targets. To the downside, the initial support sits at 1280, followed by 1274. A break below 1274 indicates that 1269 or perhaps 1265/2 will be the next target. The bulls have to convincingly pull price below 1262 if they intend to challenge the bulls on the 1250 battlefield, the top of the weekly cloud.