Gold prices settled at $1291.46 an ounce on Friday, gaining 0.6% on the week, as a drop in the U.S. dollar index lent some support to the precious metal. The greenback has been weighed down by uninspiring U.S. economic data and concerns over Donald Trump’s ability to carry out his promised growth-friendly reforms as well as his aggressive style of leadership. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 208438 contracts, from 187734 a week earlier.

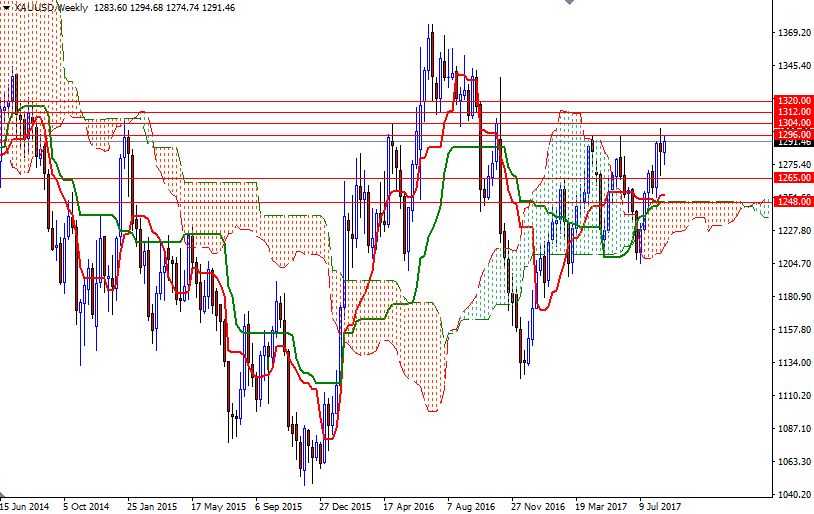

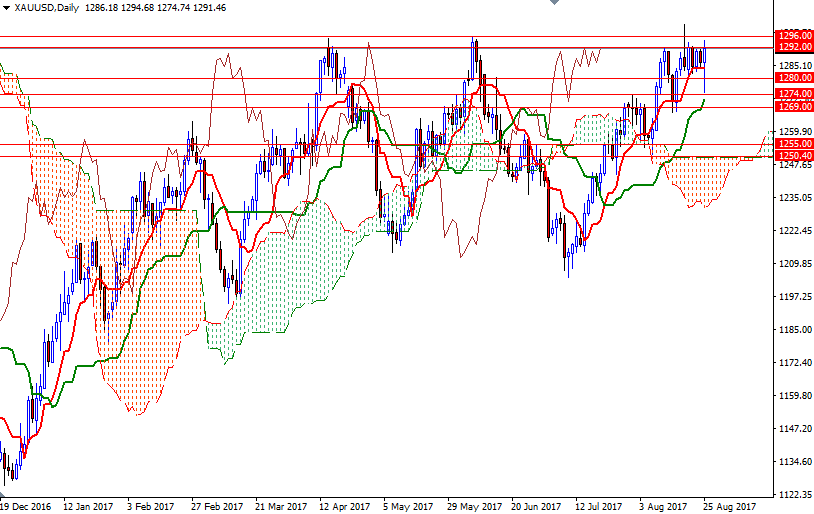

Gold bulls are maintaining their firm control of the technical charts. XAU/USD continues to trade above the Ichimoku clouds on the weekly and the daily time frames. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

Despite this positive picture, the bulls will have to overcome the barrier in the 1296/2 area in order to set sail for 1308/4. If XAU/USD can confidently break above 1308, it is quite likely that it will proceed to 1320/19. On its way up, expect to see some resistance at 1312.However, if the market fails to anchor somewhere above 1296 and prices close below 1280, then 1274 and 1265 will become the next targets. A break down below 1265 implies that the market will probably head down to 1250.40-1248, where the top of the daily cloud and weekly Kijun-sen converge.