Gold prices ended Wednesday’s session down $11.44, touching the lowest level in a month, as the dollar strengthened on the back of the better-than-expected U.S. data. XAU/USD broke down below the $1288 level after a report from the Commerce Department showed demand for durable goods jumped 1.7% in August. Comments from Federal Reserve chief Janet Yellen that the central bank needs to continue with gradual rate hikes despite broad uncertainty about inflation have cemented expectations for a year-end policy tightening.

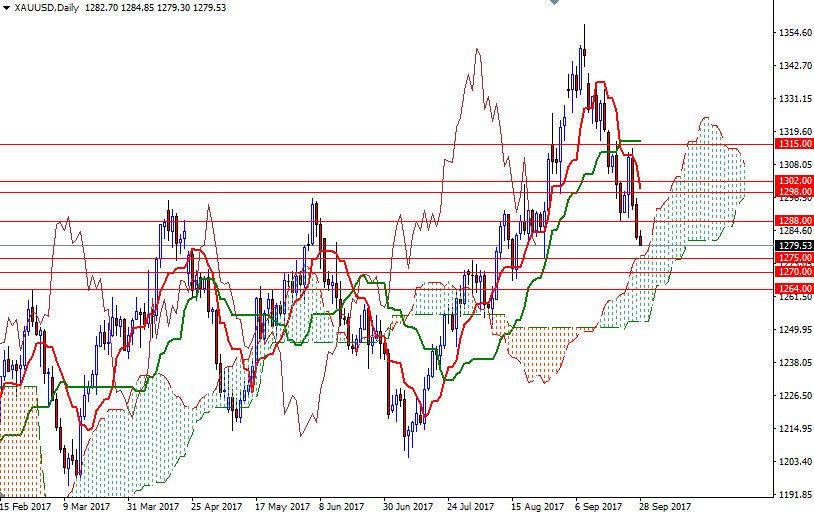

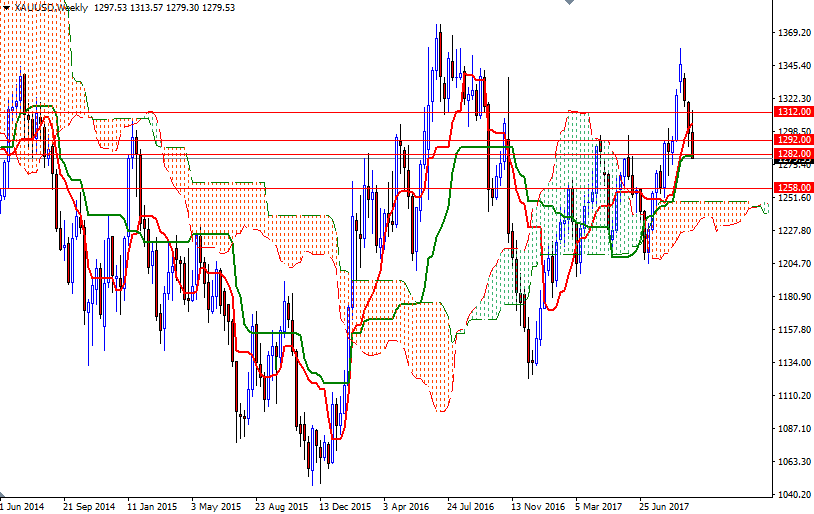

Prices continue to feel bearish pressure from the Ichimoku clouds and negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the H4 and the H1 charts. Down below we have the daily Ichimoku cloud and it is likely that it will act as support. The top of the cloud currently sits in the 1276/5 zone so the bears have to drag prices below 1275 to tackle the support at 1270. A daily close below 1270 suggests that the market will be targeting 1264.

At this point, the bulls will have to push prices back above 1288 if they don’t intend throw the towel. In that case, they could have a chance to challenge 1295. Beyond that the 1298 level, the bottom of the 4-hourly cloud, stands out. If this the bulls overcome this barrier, the 1302 level will be the next target.