Gold prices ended Monday’s session down $11.98 as investors awaited the outcome of the Federal Reserve’s two-day policy meeting. The continued strength in U.S. equities and a breach of a key support in the $1318-$1316.50 area also weighed on the precious metal. As a result, XAU/USD fell all the way back to $1304.

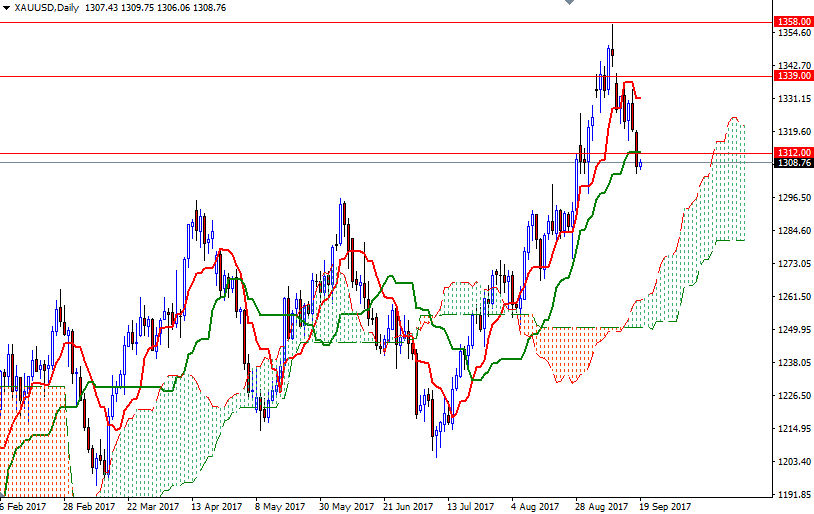

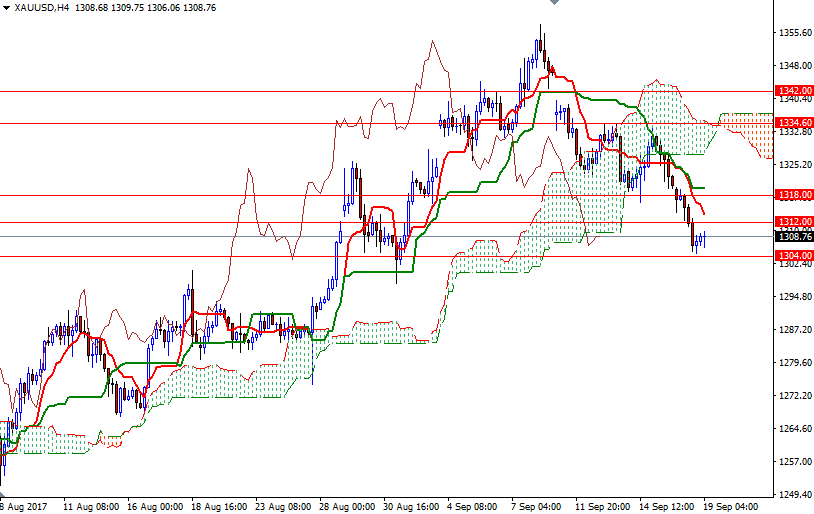

Traders are keen to see the Fed’s plans to shrink the size of its balance sheet this year. The U.S. central bank will publish updated economic projections on Wednesday, and Chair Yellen is scheduled to give a post-meeting press conference. The short-term charts are still bearish, with the market trading below the Ichimoku clouds on the 4-hourly and the hourly charts. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on both charts.

The bulls have to lift prices above 1312 so that they can revisit the 1321.40-1318 area where the top of the hourly cloud sits. If this resistance is broken, XAU/USD may test 1329/7 next. A successful break below 1304, on the other hand, could see a fall to 1300-1298. Closing below the 1298 level, which represents the 38.2% retracement of the bullish run from 1204.76 to 1357.47, opens up the risk of a move towards 1294/2.