Gold prices ended lower on Wednesday as the majority of market participants opted to remain on the sidelines ahead of the European Central Bank meeting. XAU/USD is hovering just above the 1332 support level in early Asia session. Aside from the ECB meeting, traders will look to Fed speakers for their assessment of economic conditions.

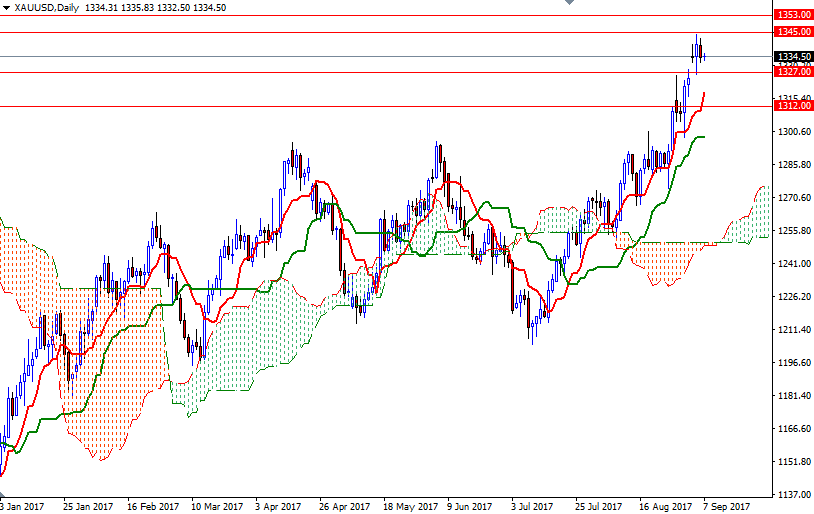

The key levels remain the same as the market is stuck within the trading range of the past three days. So far gold prices have been continuously held in check by the key 1345 barrier, and down below we have the Ichimoku cloud on the H1 chart acting as a support. Although we have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the H1 chart, the area between the 1332 and the 1327 levels is occupied the Ichimoku cloud so the bears will need to pull prices below there to test 1324.50. If XAU/USD drops through 1324.50, the market will be targeting 1318.

To the upside, the initial resistance sits in 1341/1, followed by 1345. The bulls have to lift prices above the 1345 level to gather momentum for 1353, which is the first solid technical resistance. A break through there could trigger a push up to the 1367/5 area.