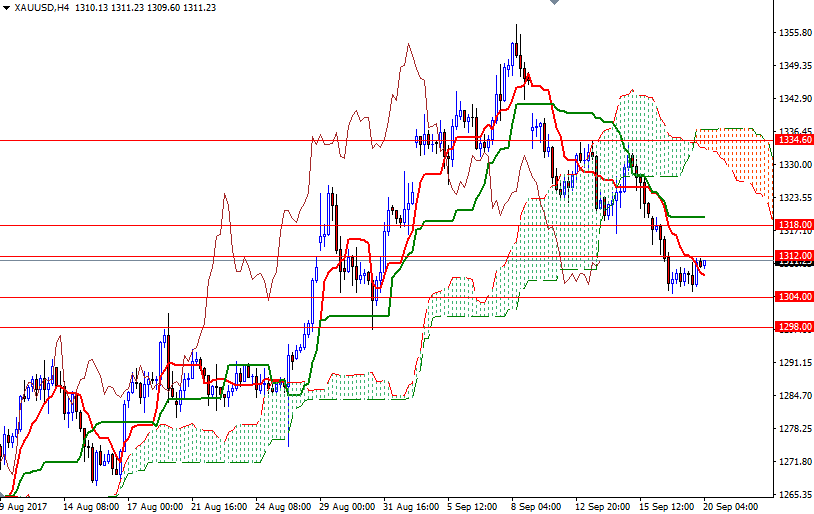

Gold prices ended Tuesday’s session with slight gains as the dollar weakened ahead of the Federal Open Market Committee meeting. XAU/USD has become stuck in a relatively tight range. The market has gone nowhere in Asia today and the London session is likely to trade between 1318 and 1304.

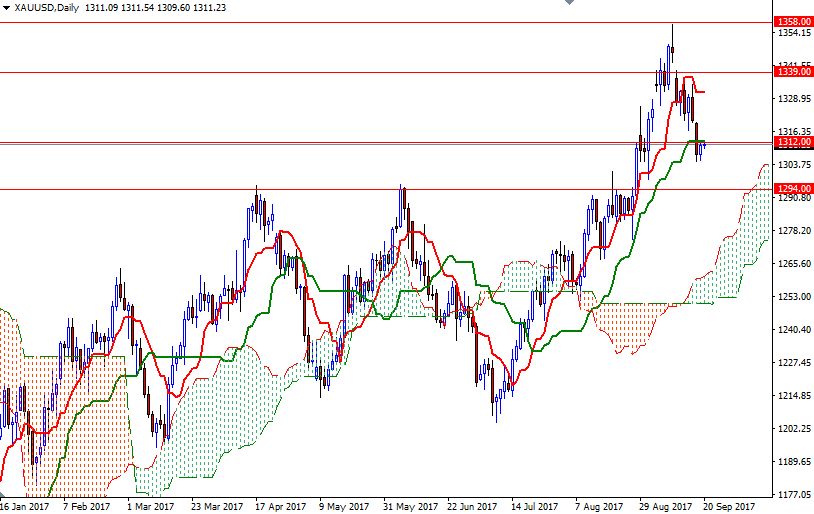

From a technical perspective, trading above the Ichimoku clouds (on both the weekly and the daily charts) indicates that the bulls have the medium-term technical advantage. Positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines as well as the Chikou span (closing price plotted 26 periods behind, brown line), which resides above the clouds, support this theory. The short-term charts, on the other hand, suggest that the risk of a fall to the 1294/2 zone, a former resistance, still exists.

To the upside, keep an eye on the 1312.60-1312 area, the confluence of a horizontal resistance and the daily Kijun-sen. Beyond there, the 1320/18 zone stands out as a crucial barrier. The top of the Ichimoku cloud on the H1 chart also sits in this area so a clean break out above 1320 signals an extension to 1326/4.