Gold prices settled at $1324.59 an ounce on Friday, making a gain of 2.4% on the week and 4.1% over the month. Tensions between the U.S. and North Korea led investors to increase their safe-haven positions and tepid U.S. economic data weighed on the dollar for much of the month. Although the recent slowdown in wage growth and sluggish inflation cast doubts on whether the Federal Reserve will raise rates again this year, I think it is premature to discount a December rate hike based on a few reports.

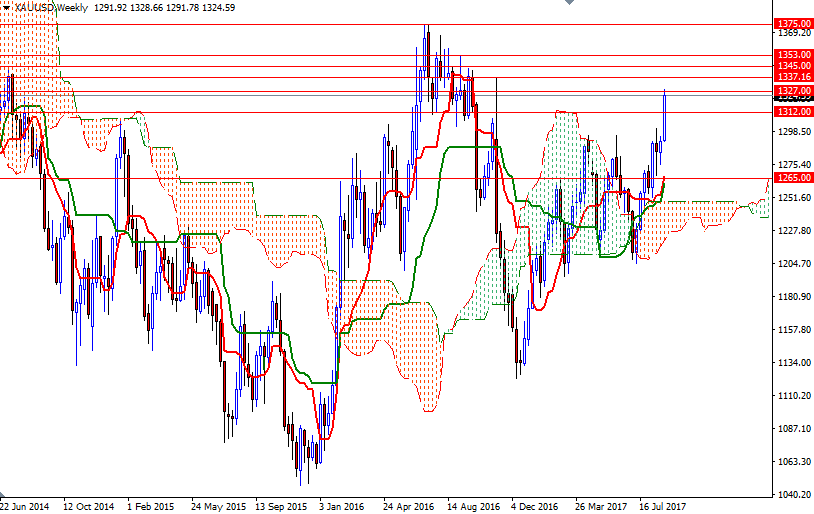

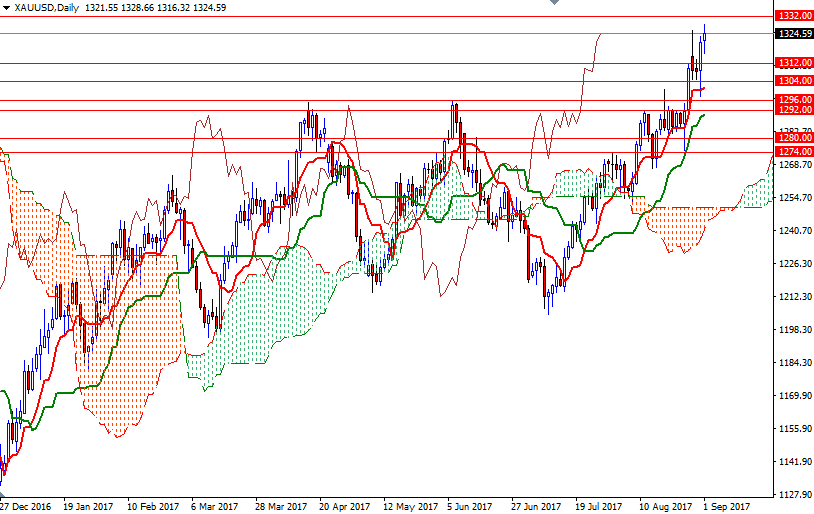

XAU/USD is trading above the Ichimoku clouds on all time frames (except the monthly chart). We have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), along with Chikou Span/Price crosses in the same direction. All these suggest that the bulls have the overall technical advantage.

If the market can get above the 1327 level, then it is likely that XAU/USD test the first strategic barrier at 1337. The bulls have convincingly push the market beyond there in order to challenge the bears waiting in the 1353/45 zone. A weekly close above this solid key resistance signals a run up to 1375. If the 1337 level remains intact and prices start to fall, the market could make a trip back down to 1296/2. On its way down support may be found at 1314/2 and 1304. A break down below 1296/2 opens up the risk of a move to 1280/74 before buyers step in.