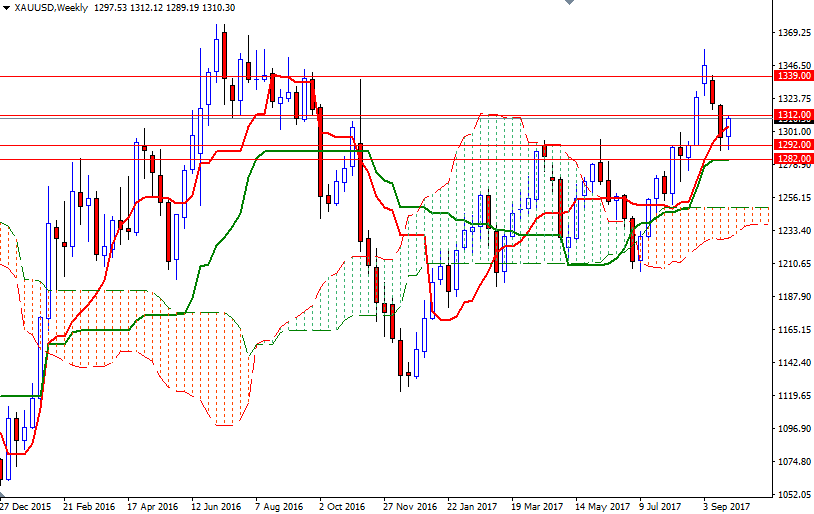

Gold prices rose $12.97 an ounce on Monday as rising tensions between North Korea and the United States prompted investors to seek shelter in safe-haven assets. XAU/USD was able to cleanly break through the resistance in the $1302-$1298 area after North Korea’s foreign minister Ri Yong Ho called President Donald Trump’s latest comments a declaration of war. Recently, the market has been fixated on the Federal Reserve as well. The prospect of a December rate hike dragged prices down to $1288 level last week.

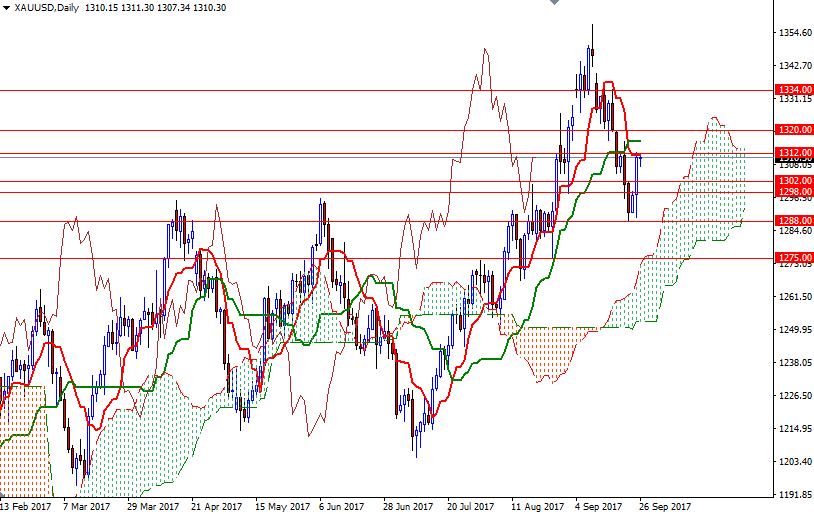

Yesterday’s price action pushed prices above the Ichimoku cloud on the hourly chart but it seems that the market is stalling near the 1312 level. The bottom of the 4-hourly cloud sits not too far from there at 1315, so the bulls have to pass through that barrier to gather momentum for a test of 1320. A break up above 1320 could foreshadow a move up to 1326.

To the downside, the initial support stands at 1304.80, followed by 1302-1300.65. The bears need to pull prices back below 1300.65 to tackle the support in 1298/7. If the market dives below 1297, then the 1293/2 area will probably be the next stop.