XAU/USD swung between gains and losses after opening with a gap up and ended the day with minor losses. Gold has been supported by tensions on the Korean Peninsula and the recent volatility in world stock markets. Asian equities and the U.S. dollar index are slightly lower on Tuesday. The U.S. economic calendar is relatively light this week but it is full of Fed speakers.

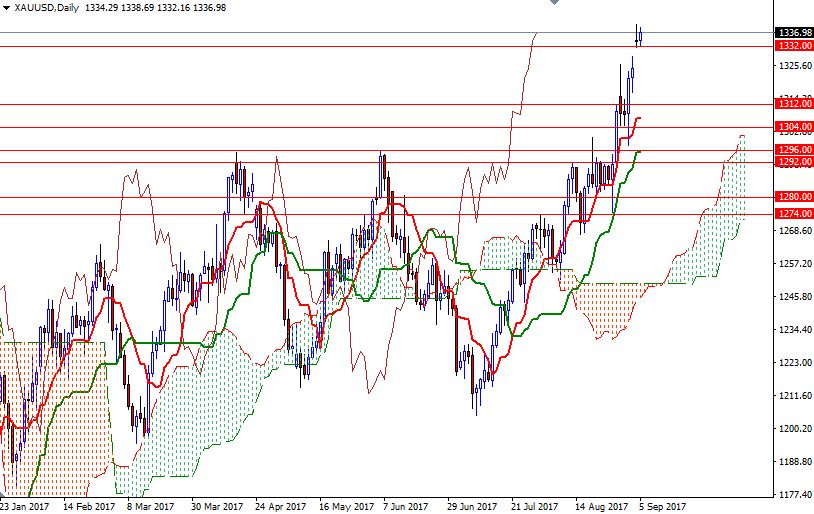

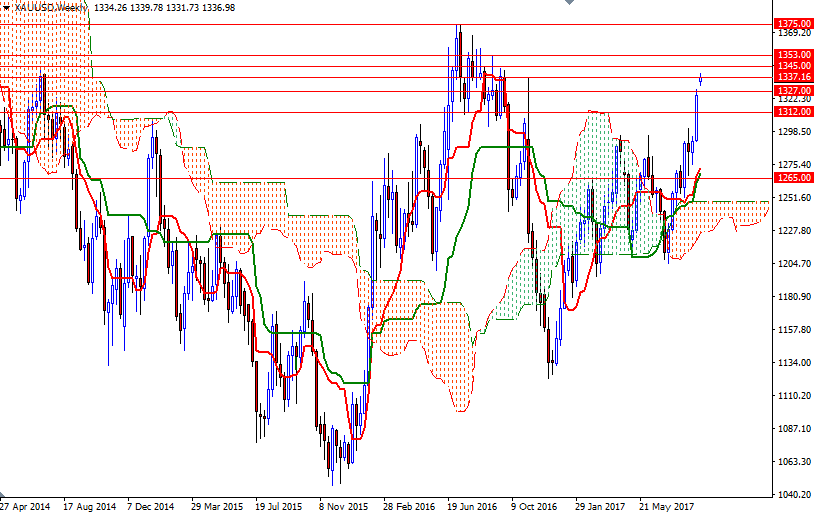

From a chart perspective, the medium-term trend continues to favor the upside. The market is above the weekly and the daily Ichimoku clouds and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, note that XAU/USD is currently trading within yesterday's range.

If the support at 1332 remains intact and the bulls confidently take out yesterday's high, then the next stop will be 1345-1343.50. Beyond there, the 1353 level stands out as a solid technical resistance and the bulls will have to produce a daily close above there in order to set sail for 1375. If the market falls through 1332, keep an eye on the 1328/7 area. A break down below there implies that the bears will be targeting 1324.50 and 1318. Closing below 1318 on a daily basis could foreshadow a move to 1312.