By: DailyForex

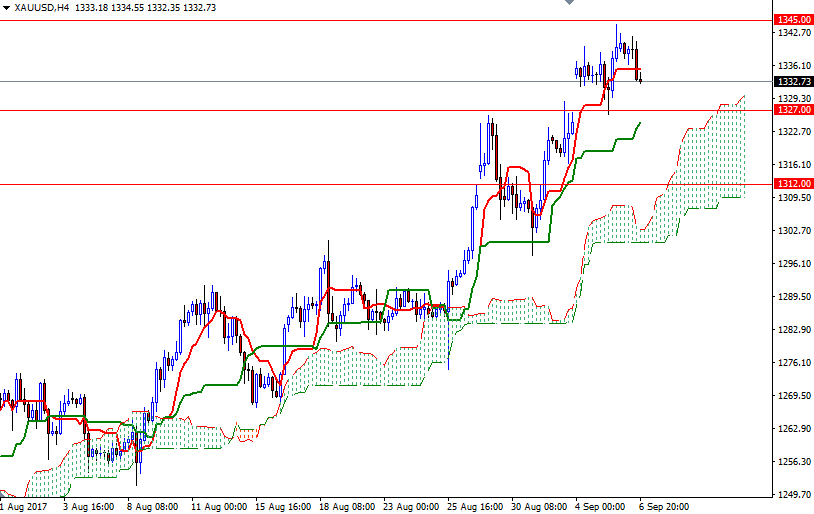

Gold prices fell in U.S. trading on Wednesday, giving back all of the gains made in the previous session. The safe-haven metal is feeling some downside price pressure as U.S. stock indexes edged higher on corrective bounces from recent selling activity. XAU/USD is currently testing the support at the 1332 level but the RSI on the H4 chart highlights the risk of a move towards the 1327 level.

The Ichimoku cloud on the H1 chart occupies the area roughly between the 1332 and the 1327 levels so it should be supportive. If the bears can take out yesterday’s low of 1326.16, then prices will tend to retreat to the 4-hourly cloud. In that case, I think we will visit 1324.50.

If the hourly cloud holds, we may see an upwards move to the interim resistance in 1342/1. The bulls have to pass through there so that they can challenge the first strategic barrier at 1345. A break up above 1345 implies that the bulls are getting ready to tackle the 1353 level.