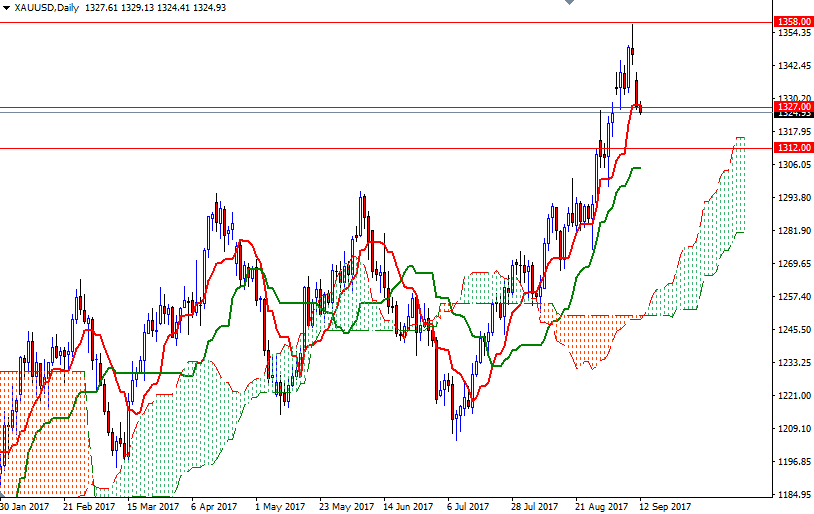

Gold prices ended Monday’s session down $9.25 as investors continued to cash in profits from a recent rally that pushed the market to the highest level in a year. The reduced anxiety in the marketplace and the rallying world stock markets have put downside price pressure on the safe-haven gold market. XAU/USD is trading at $1324.93, lower than the opening price of $1327.61.

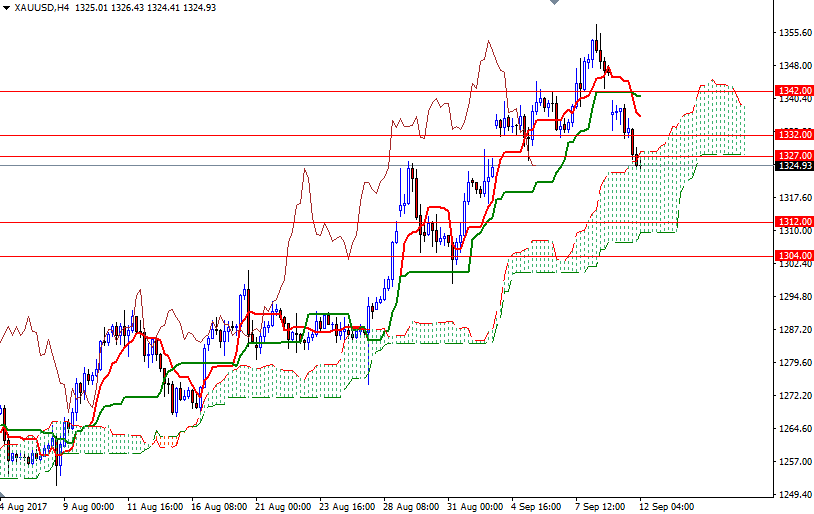

The short-term outlook turned negative as yesterday’s downside gap dragged prices below the Ichimoku clouds on the H1 chart. XAU/USD is currently trading below the clouds on the M30 and the H1 time frames; plus we have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line). However, the 4-hourly cloud occupies a large ground and should act as a support.

If prices recover and climb back above the 1332 level, which also happens to be the top of the cloud on the M30 chart, the market may head towards the 1339/8 zone. The bottom of the hourly cloud sits in that area so the bulls will need push the market beyond there to make a run for 1342. To the downside, keep an eye on the intra-day support in 1323/1. If this support is broken, the market will be targeting 1318-1316.50. A breakdown below 1316.50 paves the way for a test of 1312.