Gold prices rose $5.28 on Tuesday to settle at their highest levels in nearly a year as the weakness in the dollar and equities markets whetted investors’ appetite for the relative safety of the precious metal. Dovish comments from Fed officials, which bolstered views that the central bank could hold off hold off on rate hikes until next year, also underpinned gold. Fed governor Lael Brainard said “We should be cautious about tightening policy further until we are confident inflation is on track to achieve our target.”

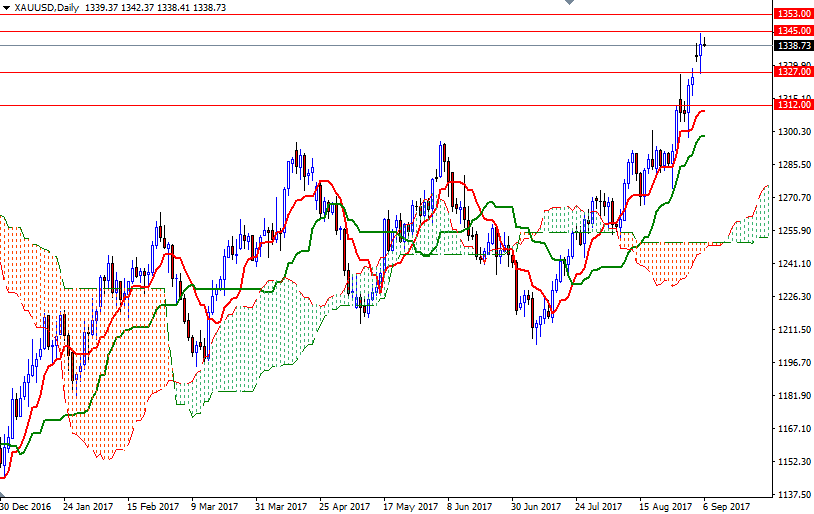

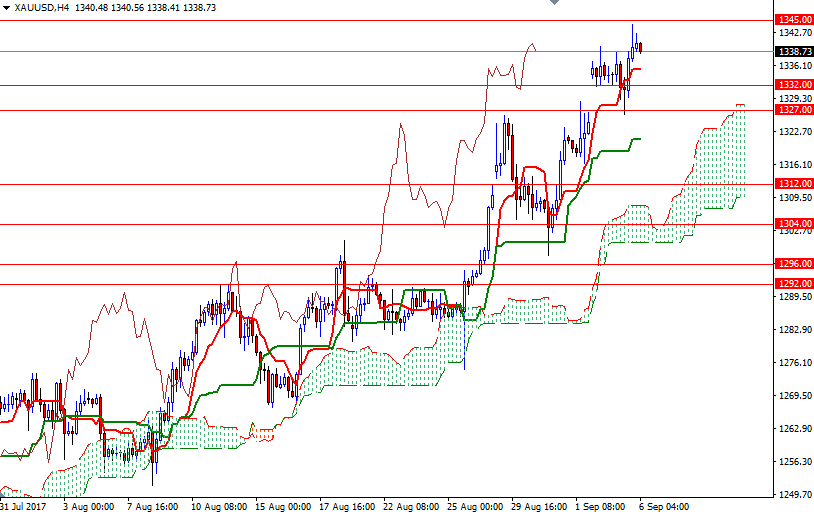

From a chart perspective, the bulls still have the overall technical advantage, with the market trading above the weekly and the daily Ichimoku clouds. We have positive aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line); plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. However, as I pointed out earlier in the week, there are tough barriers ahead (such as 1345 and 1353) so a range-bound movement prior to the ECB meeting wouldn’t be surprising.

A sustained break above 1353 implies that bulls will be aiming for the 1375 level, which is the next solid resistance on the charts. On its way up, expect to see some resistance in the 1367/5 area. Similarly, the bears have to drag prices below the support at 1327 in order to tackle 1324.50. If this support is broken, the 1318 level will be the next port of call.