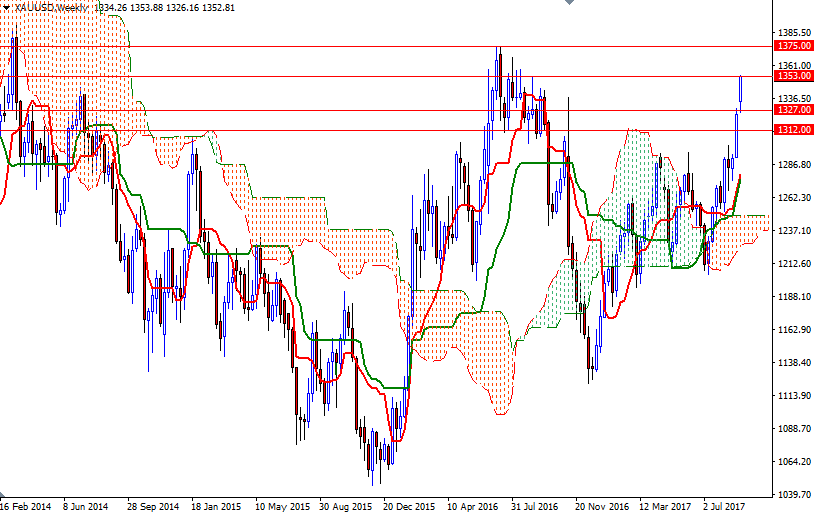

Gold prices ended Thursday’s session up $14.62 an ounce, helped by a slumping U.S. dollar. The greenback came under renewed pressure as the euro rallied after the European Central Bank raised its growth forecasts and indicated it was preparing to scale back its stimulus program. XAU/USD reached the $1353 area in Asia session today after the market broke through the resistance at $1345.

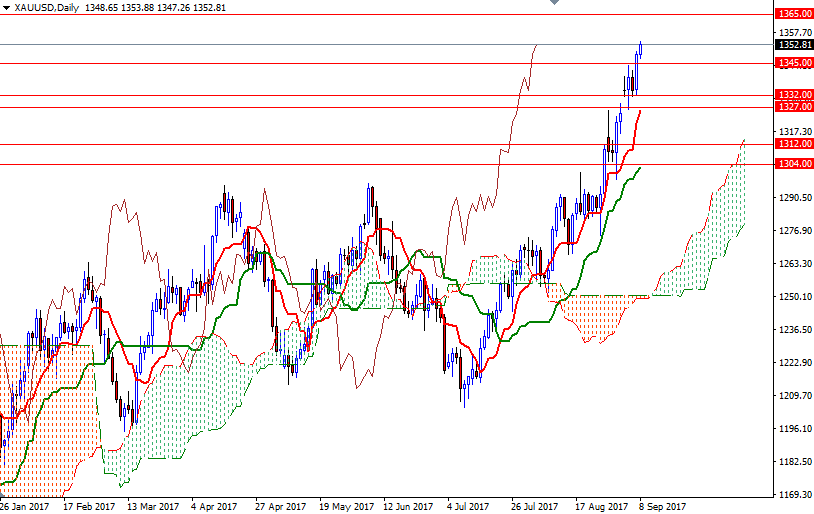

Prices continue to trade above the Ichimoku clouds and we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on all time frames. Adding to the bullish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which indicates a solid momentum. If the bulls can hold prices above 1353, their next stop will be 1358. Clearing this barrier is essential for a continuation towards the 1367/5 zone.

On the other hand, if the bulls fails to capture the strategic camp above us at 1358, then I wouldn’t rule out a pullback towards 1349/7. The bears have to drag XAU/USD below 1347 so that they can challenge 1345 and 1342. Closing below 1342 on a daily basis suggests a move down to 1336.50.