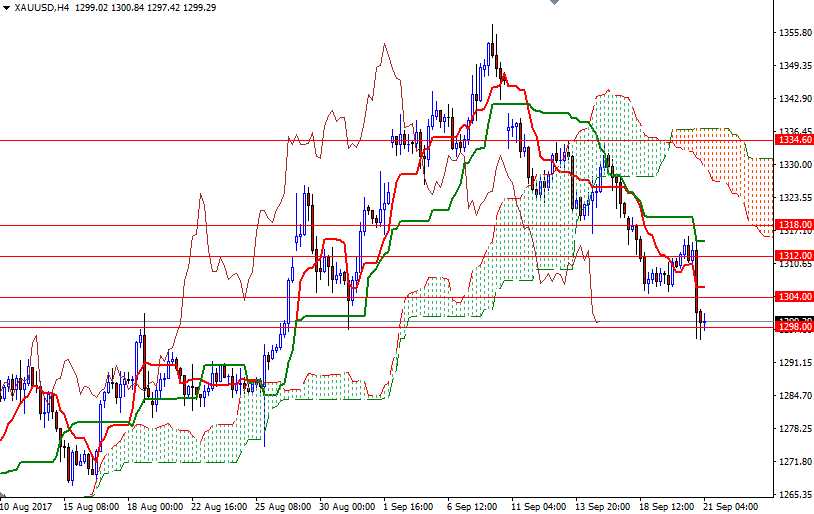

Gold prices dropped $10.01 on Wednesday as the prospect of a December rate hike by the Federal Reserve gave a lift to the U.S. dollar and weighed on the metal. The Federal Reserve left interest rates unchanged at its latest policy meeting but signaled it still expects one more increase by the end of the year. The central bank also announced that the gradual balance sheet reduction will start next month. XAU/USD headed towards the $1294-$1292 area after breaking down below $1304 put pressure on prices as expected.

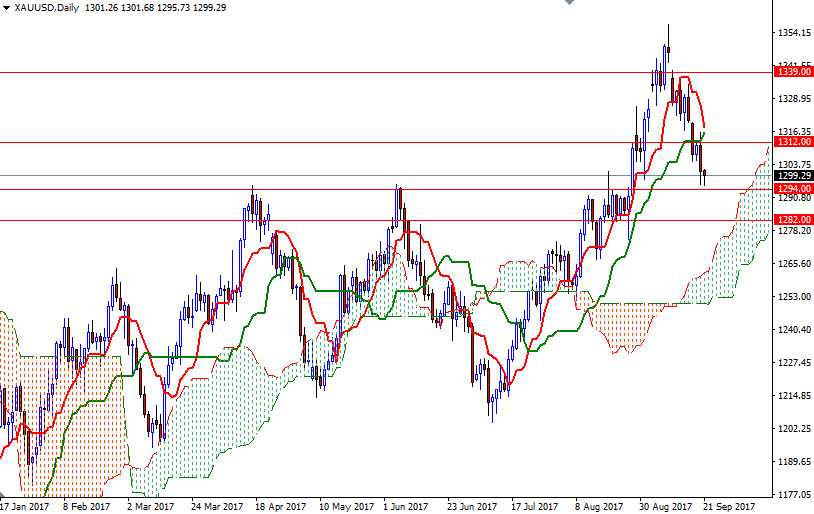

The short-term charts are still bearish, with the market trading below the Ichimoku clouds on the 4-hourly and the hourly charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned. The 1294/2 area had played an important role in the past and I expect that it could act as support in the near-term.

If this support remains intact, a bounce to 1306/4 wouldn't be so surprising. The bulls have to confidently lift prices above 1306 in order to challenge the next barrier in the 1312.60-1312 area. However, a successful break below 1292 could see a fall to 1282/0. The bears will need produce a daily close below 1280 if they intend to make an assault on the support in the 1275/3 zone.