Gold edged higher on Tuesday, recovering a portion of the previous day’s losses, as the dollar pared gains. The precious metal was also supported by U.S. President Donald Trump’s comments on U.N. sanctions on North Korea. XAU/USD is trading at $1331.44 an ounce, slightly lower than the opening price of $1332.15.

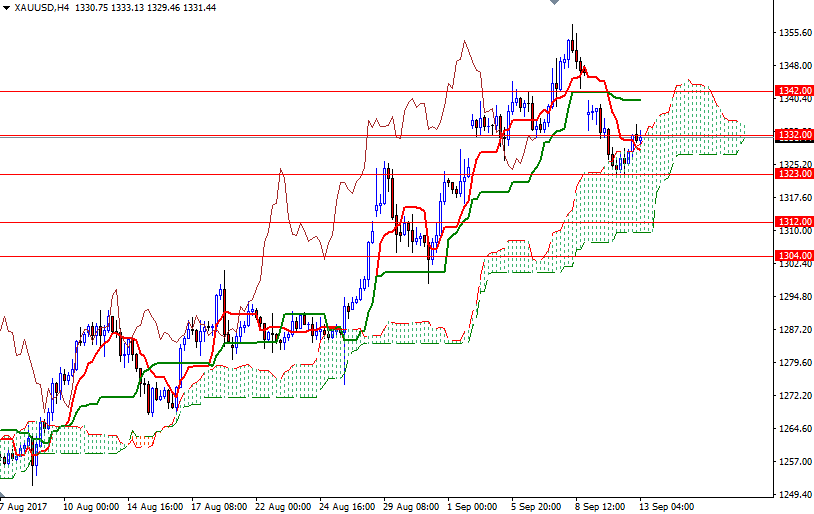

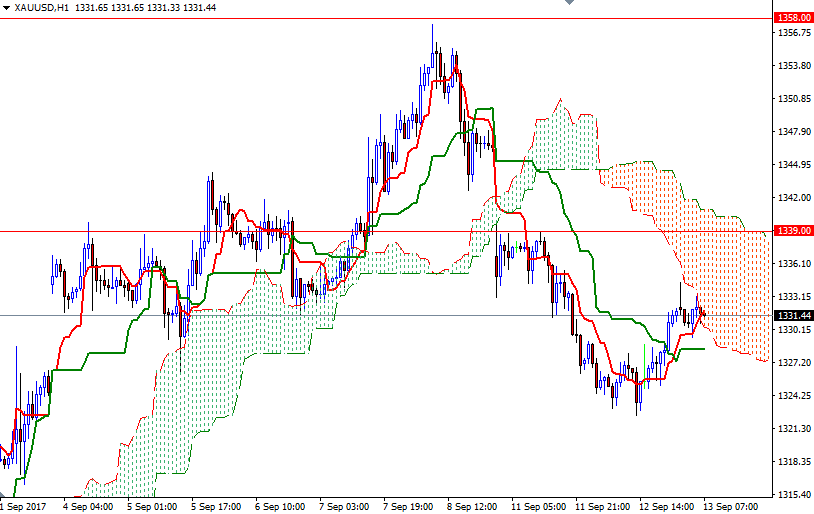

From a chart perspective, there are two things that catch my attention at first glance. XAU/USD is above the Ichimoku clouds on the weekly and the daily time frames and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. However, the short-term charts remains slightly bearish. The market is trading below the clouds on the H1 chart.

If the 4-hourly clouds continue to be supportive and prices can get back above 1332, keep an eye on the 1339/8 zone. The bulls have to capture that strategic camp in order to make an assault on the 1345/2. A daily close beyond 1345 is essential for a continuation towards 1358/3. On the other hand, if the market fails to penetrate the hourly cloud and drops through the support in the 1323/1 area, look for further downside with 1318-1316.50 and 1312 as targets. Breaking down below 1312 on a daily basis could trigger further weakness. In that case, the 1304/0 zone will probably be the next port of call.