By: DailyForex

Gold prices ended Tuesday’s session down $5.84, weighed down by the strength in the greenback. Gold has recently come under pressure from growing expectations that the U.S. Federal Reserve will lift interest rates once more by the end of the year. It “would be imprudent to keep monetary policy on hold until inflation is back to 2%,” Fed Chair Janet Yellen said yesterday.

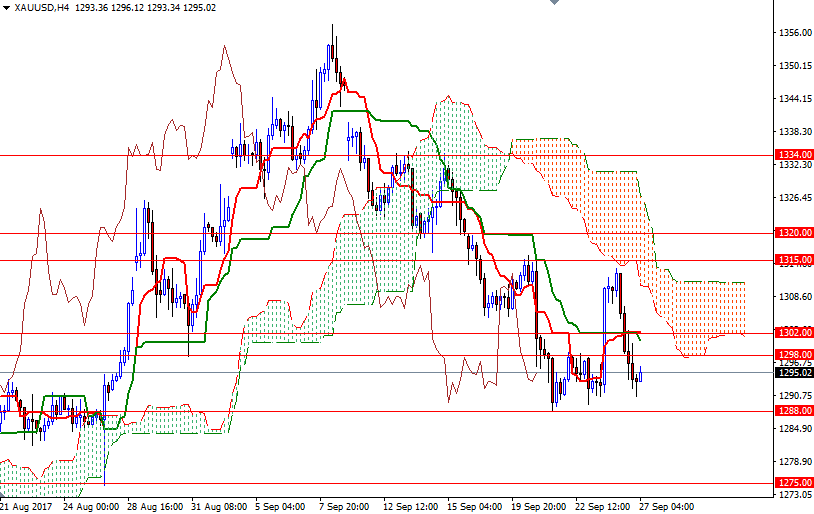

Market participants are looking ahead to Thursday’s GDP data. The key levels remain unchanged as the market continues to consolidate between 1315/2 and 1292/88. Although the medium-term outlook is still bullish, the short-term charts give the bears a slight advantage. Also note that the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are flat on both the daily and the 4-hourly time frames.

XAU/USD has to push its way through the 1315/2 resistance zone in order to gather momentum for 1320. A break through there would be a positive sign and help the bulls tackle the subsequent targets at 1326/4 and 1344.40-1332. However, if prices drop below 1288, the market will probably head towards the daily cloud. In that case, look for further downside with 1284 and 1282/0 as next targets. Closing below 1280 implies that the bears are aiming for 1275.