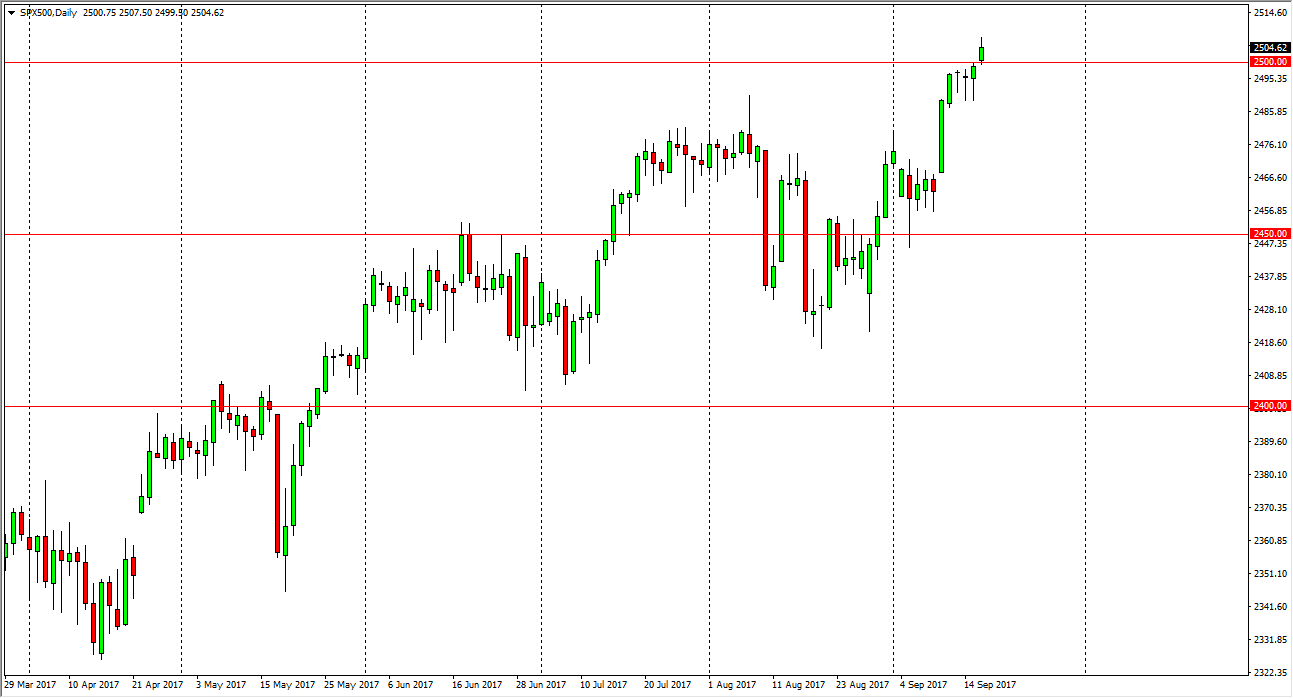

S&P 500

The S&P 500 has broken above the 2500 level, which has been a psychological resistance barrier that the market has been pressuring for several days now. Now that we are above this level, I think that the market is probably going to continue to find buyers on pullbacks, as it should offer value in a market that has been very bullish. I think there is a “floor” at the 2450 level underneath, and if we can stay above that level, we are still in an uptrend. I currently believe that “buying on the dips” continues to be the best way to trade this market, as there are simply no signs of bearish pressure of any circumstance going forward, and although we may get a couple of rough days from time to time, eventually the buyers return.

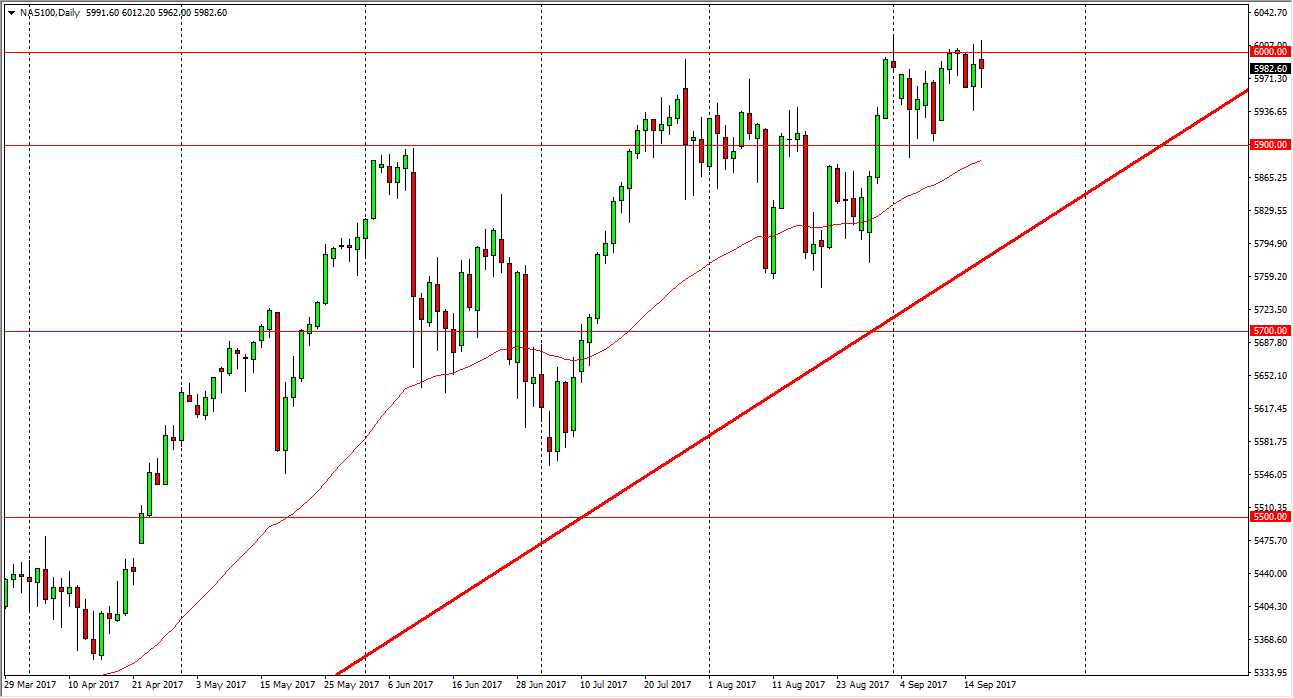

NASDAQ 100

The NASDAQ 100 didn’t have is easier to go on Monday though, as the 6000 level continues to be massive resistance. If we can close above that level on a daily candle, I think that the buyers will come in and push this market to the upside. All things being equal, when you look at this chart, you can see that there is an ascending triangle forming just below the 6000 handle, so I think that the buyers are likely to come back into this market every time it dips. If we can clear the top of the candle from the Monday session on a close, that would be a strong sign that could have people going long again. I believe that selling is all but impossible, especially considering that there is a weekly trend line just below. Given enough time, I anticipate that this market will go looking towards the 6100 level.