Yesterday’s signals were not triggered, as none of the key levels were ever reached.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken from 8am New York time until 5pm Tokyo time, over the next 24-hour period only.

Be extremely cautious entering any trades before 7pm London time.

Short Trades

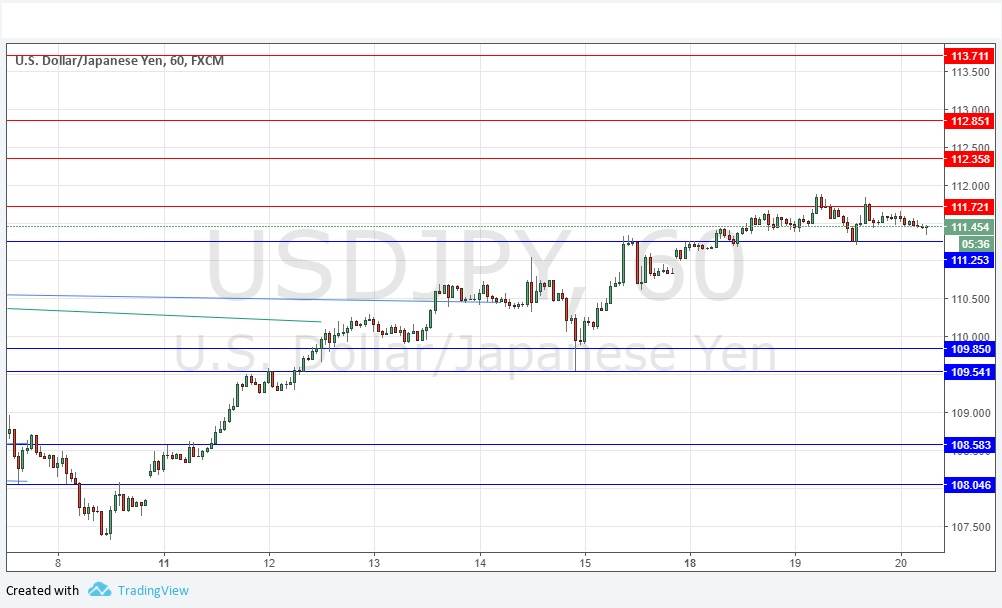

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 111.72, 112.36, 112.85, or 113.71.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trades

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 111.25, 109.85, or 109.54.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I forecasted yesterday that the advance may begin to halt now at 111.72. This is what happened, with the area just above the level acting as a high and capping the rise. The price has now made a bearish pull back, but has also printed new support close by at 111.25. The support is there, but it does not look very strong so be very careful in trying to take any long trade entry there.

I still see the resistance level at 112.36 as very strong and an attractive place to short any bearish reversal.

It is very likely that the FOMC release due later will produce a great deal of volatility in this pair, and could send the price spiking in any direction. Trading reversals at the limits of such spikes requires courage, but can be very profitable if taken shortly after major news releases such as this.

The pair is not in a trend, but is threatening to begin a new upwards trend. If the news is more hawkish for the Dollar than expected, I think the pair will see a meaningful rise here.

Regarding the USD, there will be a release of the FOMC Statement, Projections, and Federal Funds Rate at 7pm London time, followed by the usual press conference. There will also be a release of Crude Oil Inventories earlier at 3:30pm. Concerning the JPY, the Bank of Japan will be releasing their Monetary Policy Rate and Statement late in the Asian session, which will also be followed by a Press Conference.