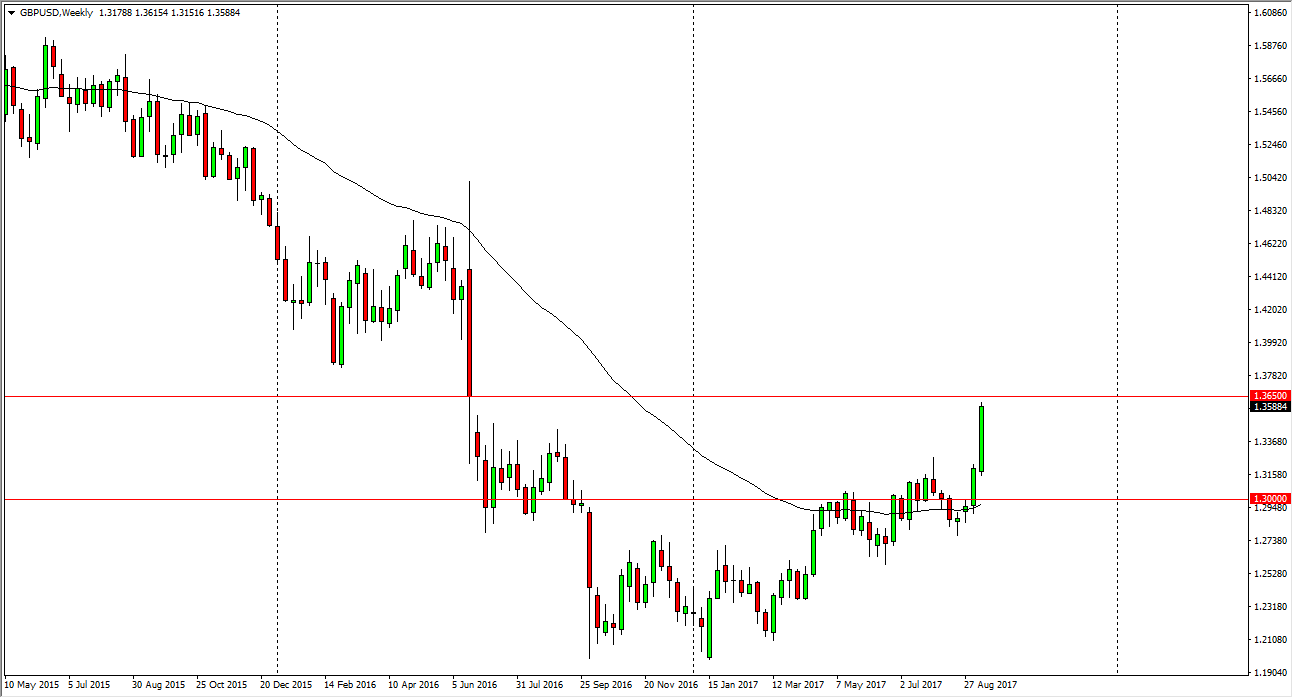

GBP/USD

The GBP/USD exploded after the Bank of England suggested that interest rates should climb relatively soon, and this made the Pound reach towards the gap from the Brexit. Because of this, I think that the market will probably pullback from this level, and go looking for support later in the week.

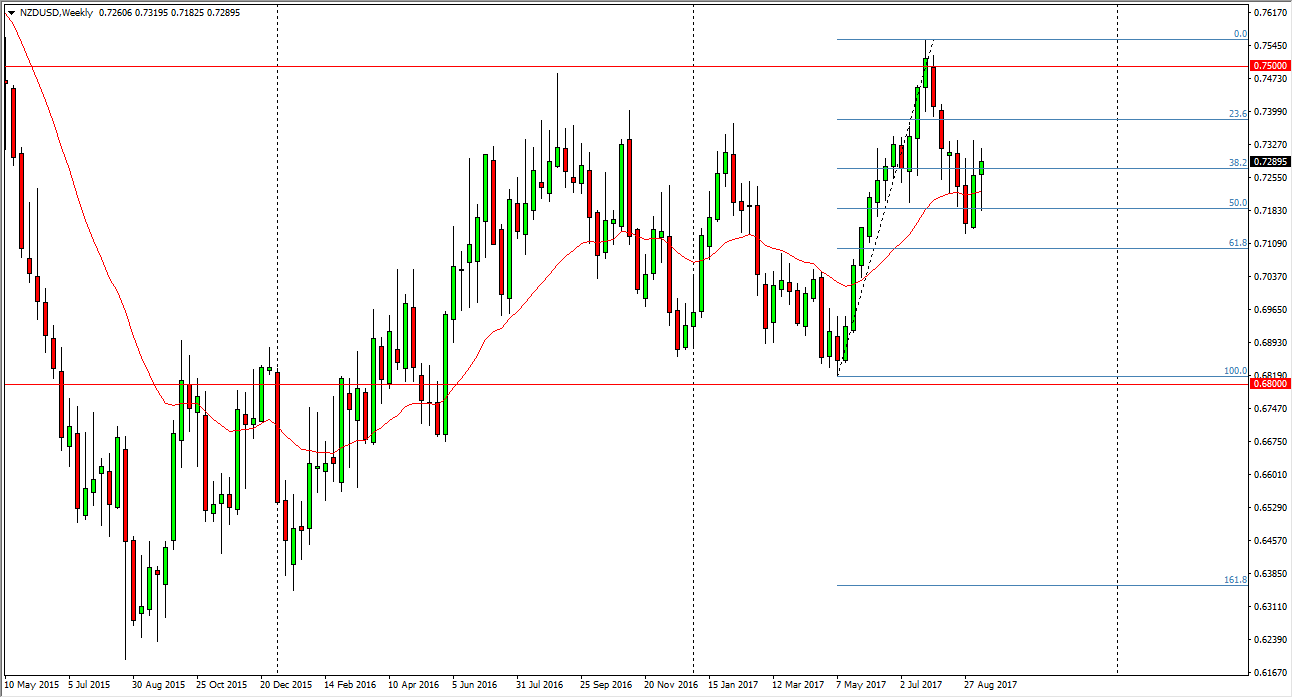

NZD/USD

The NZD/USD pair initially fell during the week, testing the 50% Fibonacci retracement level. The market looks as if we could see continued bullish pressure going forward, and I think we are going to go looking for the 0.75 level eventually. However, this week could be choppy.

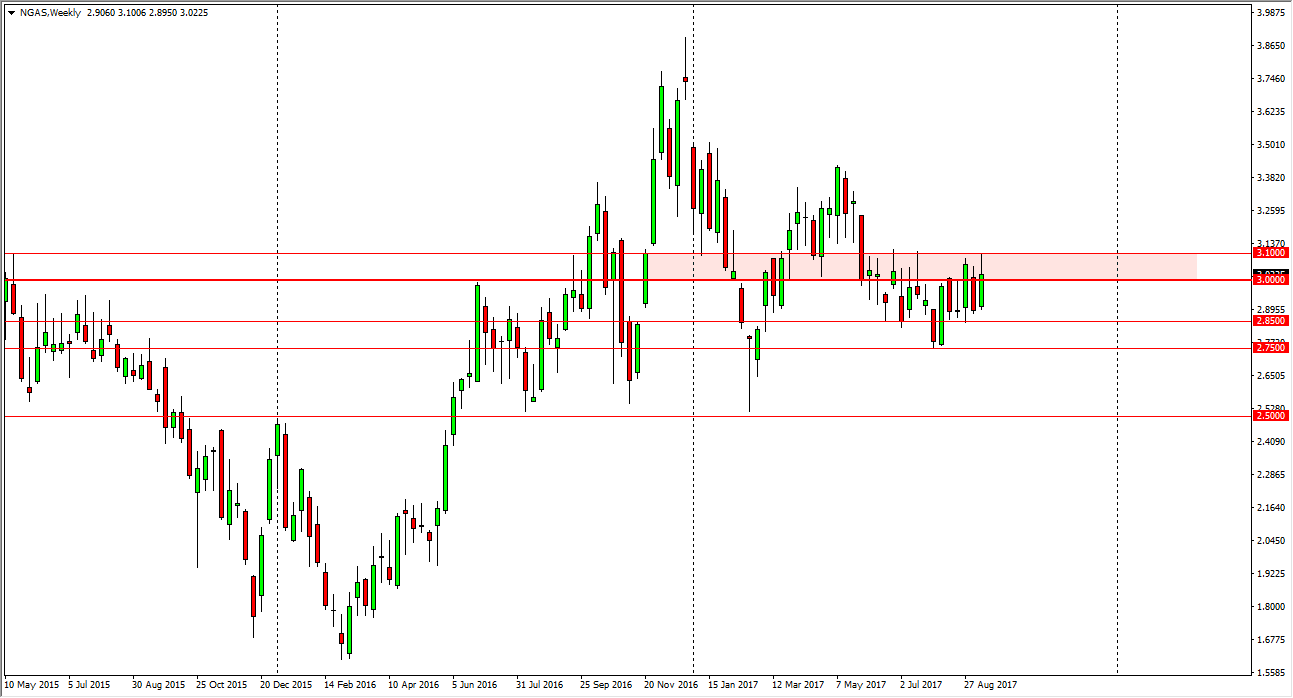

Natural Gas

Natural gas markets been very choppy on the short-term charts, but when you look at the weekly chart, you can clearly see that there is a significant amount of resistance between the $3 and $3.10 level. Because of this, I think that we will probably see some type of bullish pressure during the week, but more than likely the sellers will step in below $3.10 as it is so resistive.

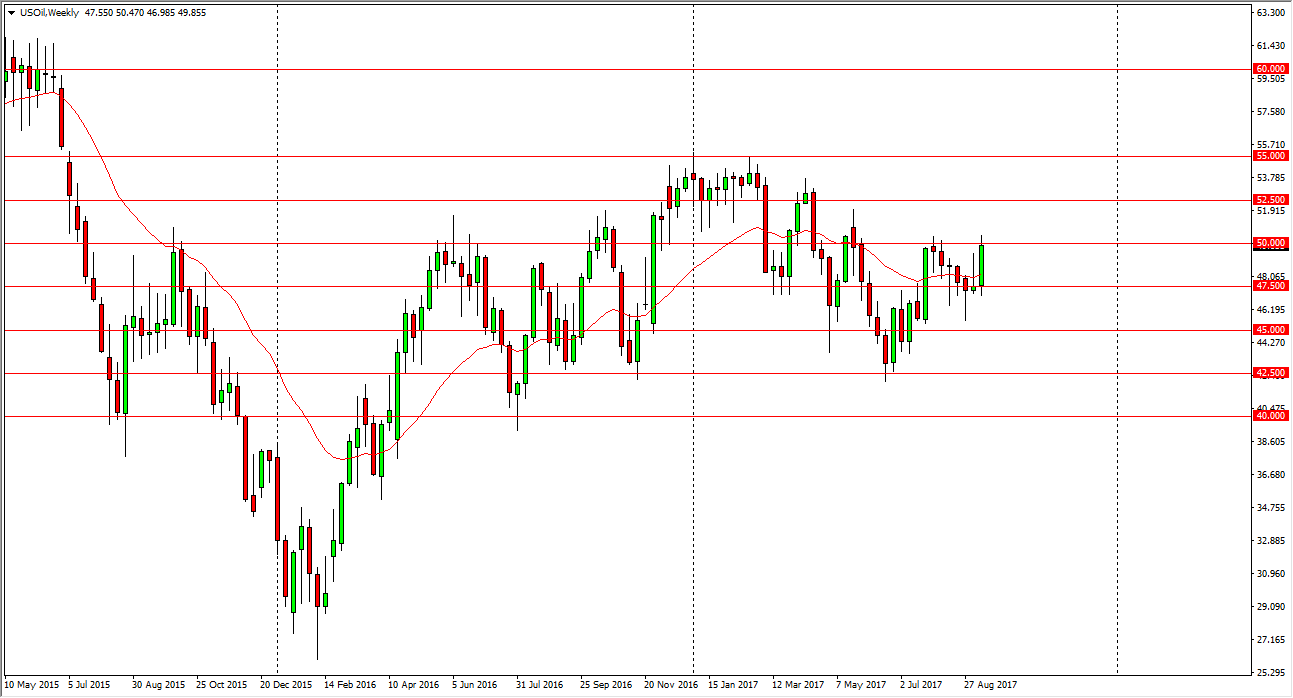

WTI Crude Oil

The WTI Crude Oil market rallied during the week, slicing through the top of the shooting star from the previous week. We have tested the $50 level, and I think if we can break above the top of the range for the week, crude oil will continue to go higher, perhaps reaching towards the $52.50 level.