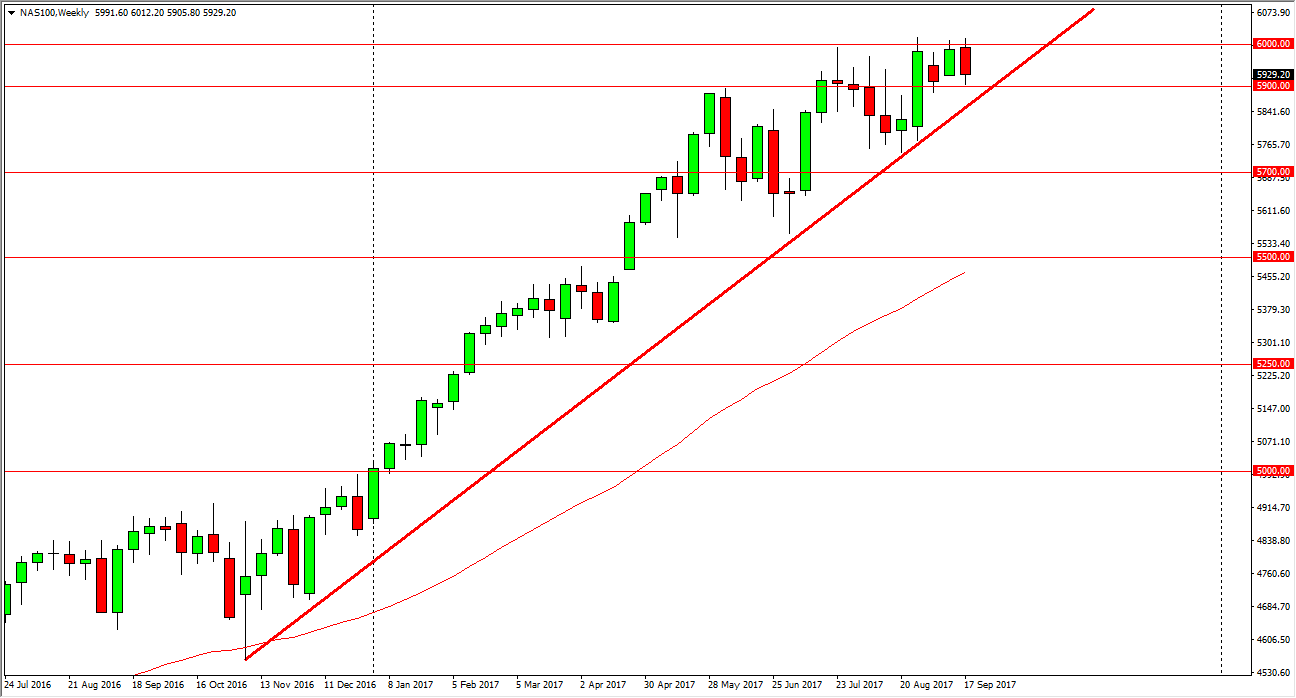

NASDAQ 100

The NASDAQ 100 has been in a strong uptrend for some time. The 5900 level has been offering significant support as of late, and the daily charts look like they are somewhat constructive. If we can stay above the 5900 level, I believe that this market will go looking for 6000 again this week, and could possibly even break above there and continue the longer-term uptrend.

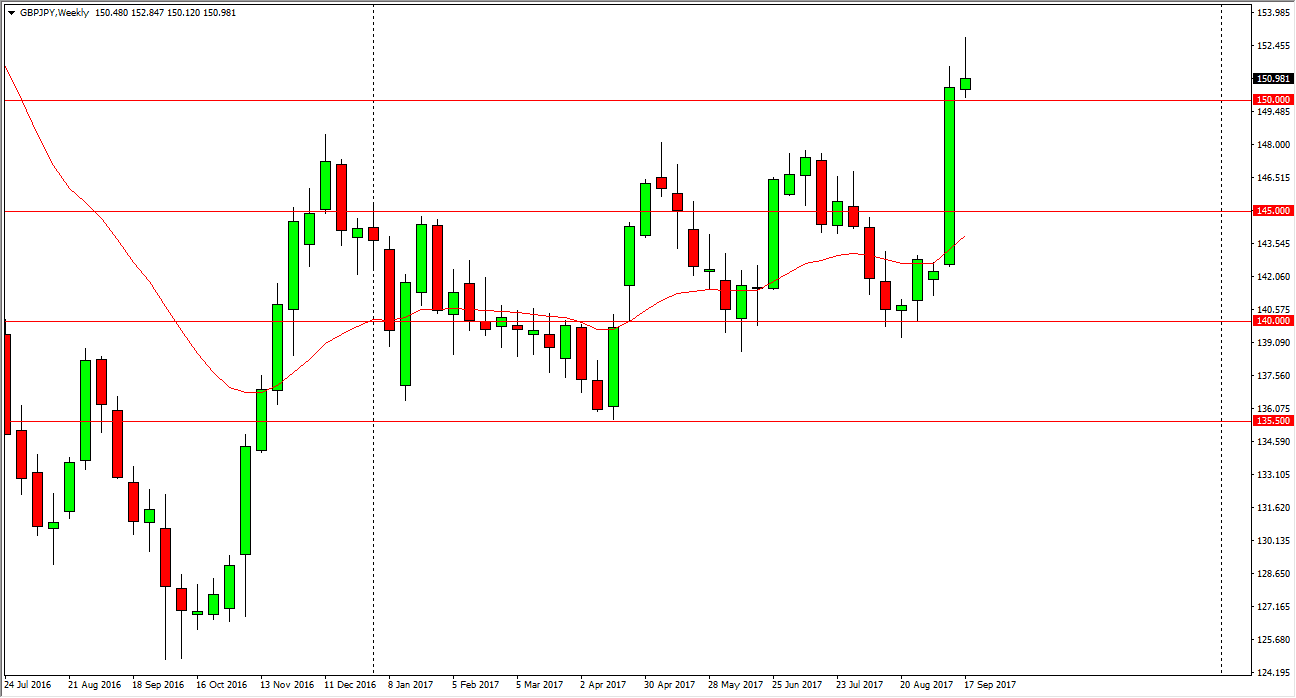

GBP/JPY

The British pound spent most of the week rallying against the Japanese yen, but turned around at the 152.50 level. When it up forming a very nasty looking shooting star, and while it is a negative sign, I think that if we can stay above the 150 handle, things should be okay. I also think that there is plenty of support near the 148 level, so even if we do break down below the 150 handle, I think it is simply an opportunity to pick up this pair at lower levels as we try to build up momentum.

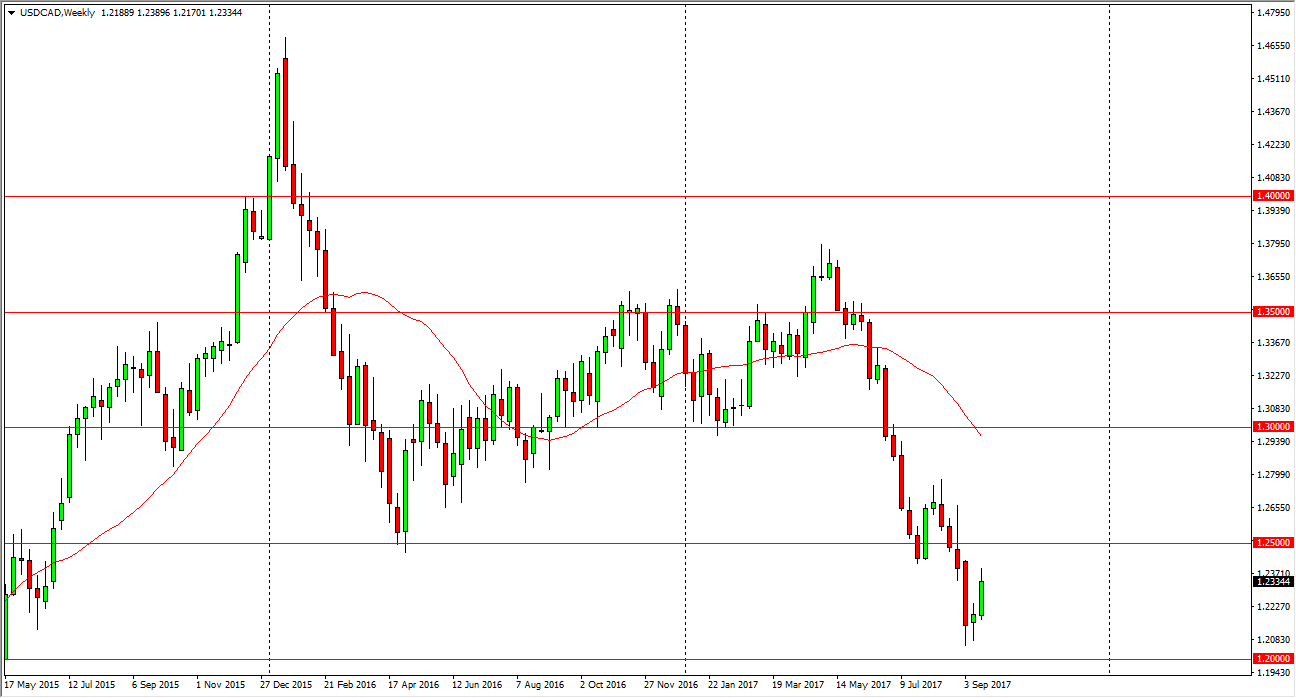

USD/CAD

The US dollar rallied against the Canadian dollar during most of the week, but we are testing an uptrend line in this general vicinity from the weekly chart. It is because of this that I am not concerned about buying this pair until we break clear of the 1.2650 level. In the meantime, any signs of weakness in the general vicinity could be an opportunity to start selling again as the Canadian dollar continues to strengthen.

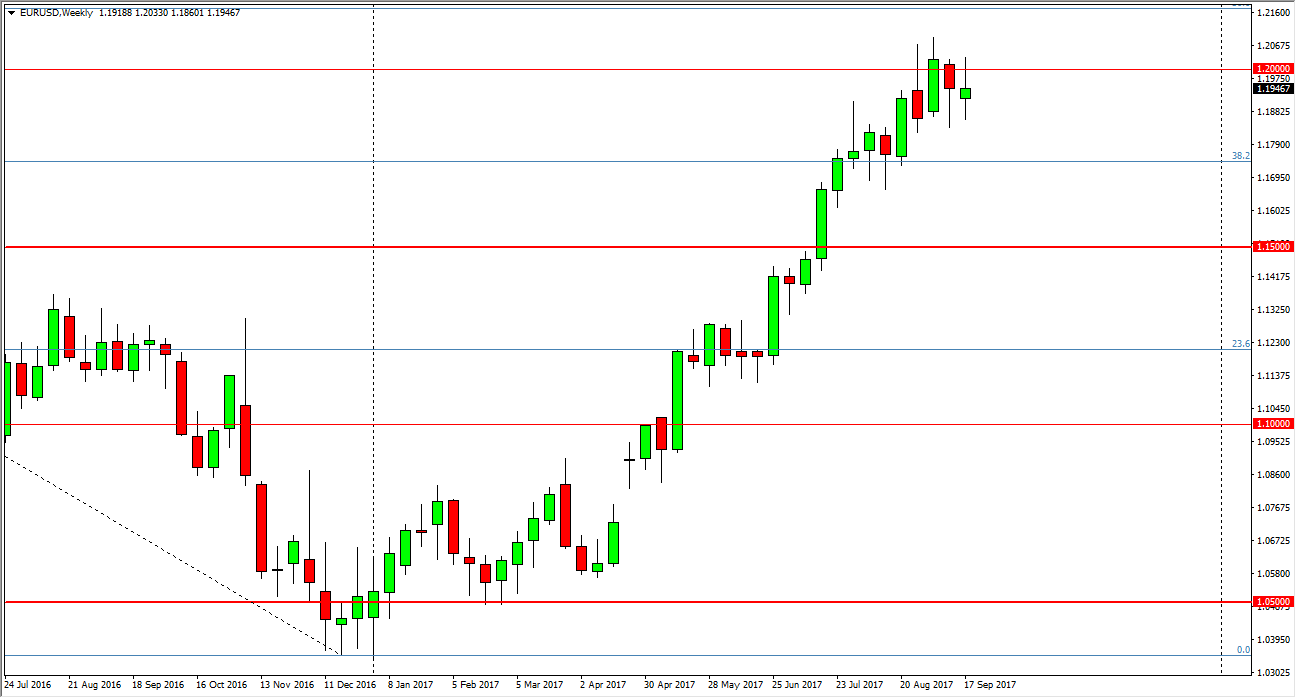

EUR/USD

The EUR/USD pair tried to rally during most of the week, but got turned around at the 1.20 level again. I think that this we could be a bit soft for this pair, as there could be a bit of a bit for the US dollar. However, I think this is simply an opportunity to pick up this pair at lower levels, with particular interest being shown at the 1.18 region.