Gold prices settled at $1346.48 an ounce on Friday, rising nearly 1% over the course of the week, as safe-haven demand continued to lure investors into the market. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 245298 contracts, from 231047 a week earlier. It seems that a shortfall of inflation from the Fed’s 2% target and concerns over economic slowdown caused by hurricanes in the U.S will continue to weigh on the greenback.

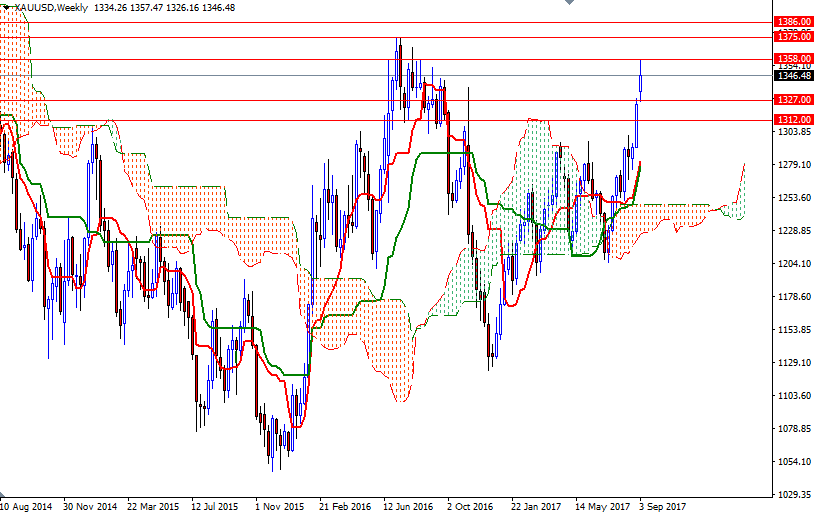

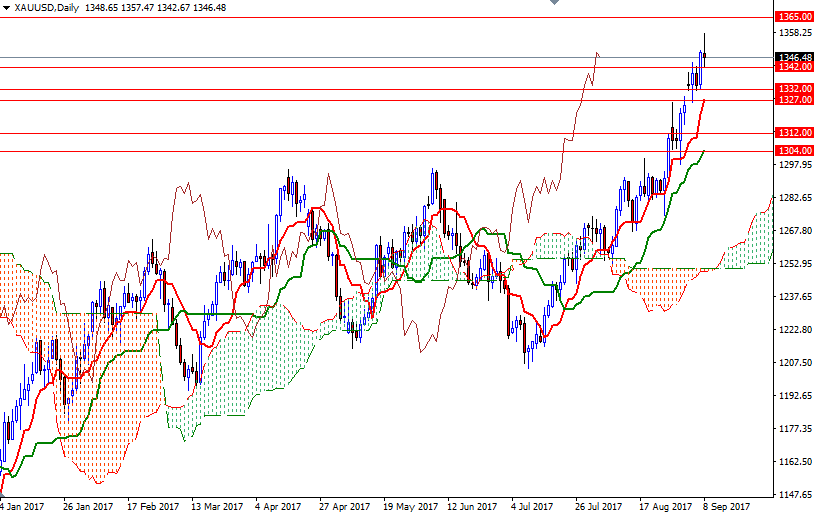

From a chart perspective, trading above Ichimoku clouds (the weekly and the daily charts) suggests that gold is likely to maintain bullish trend over the medium term, a case I have been repeating for weeks. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line). Despite this positive picture, the failure to pass through the 1358/3 area suggests that XAU/USD is likely to feel some extra pressure from profit taking in the near term.

Down below, the 1245/2 area stands out as the initial support, and the bears will need to drag prices below the hourly Ihcimoku clouds in order to gather momentum for 1332 and 1327/6. If XAU/USD closes below 1326, at least on a daily basis, look for further downside with 1318 and 1312 as next targets. However, if the bulls overcome the resistance in 1358/3, we could possibly see the bulls make a run for 1367/5. The bulls have to produce a daily close above solid technical resistance in the 1378/5 zone so that they can tackle 1388/4.