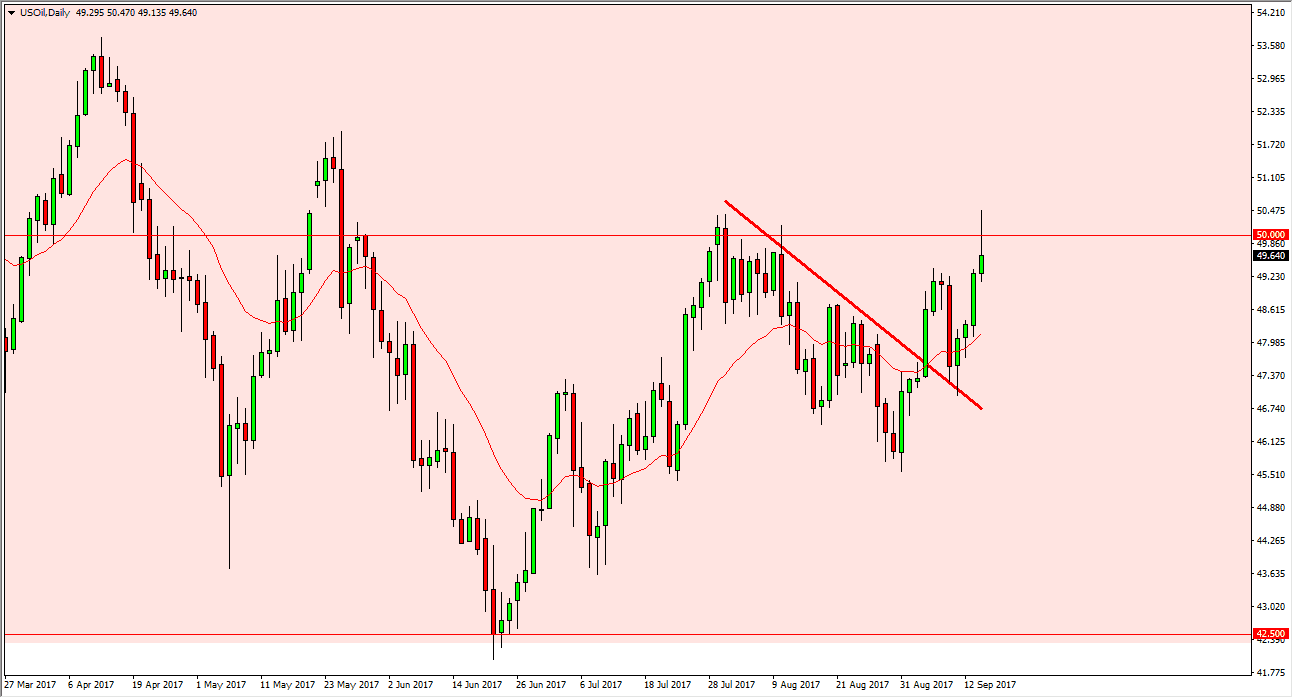

WTI Crude Oil

The WTI Crude Oil market initially rally during the day on Thursday, but found the $50 level to be resistive enough to turn things around and form a shooting star. If we can break down below the bottom of the range for the day, I think that the market then goes down to the $47 level. Alternately, if we can break above the top of the shooting star, that would be a very bullish sign, sending this market towards the $51.75 level above. I think we will see a certain amount of volatility, but it makes sense that the $50 level has offered resistance. Ultimately, I think that the market should continue to be volatile as it is moving on several different issues at the same time. I believe longer-term, the markets are still going to be bearish as oversupply of crude oil continues to be an issue.

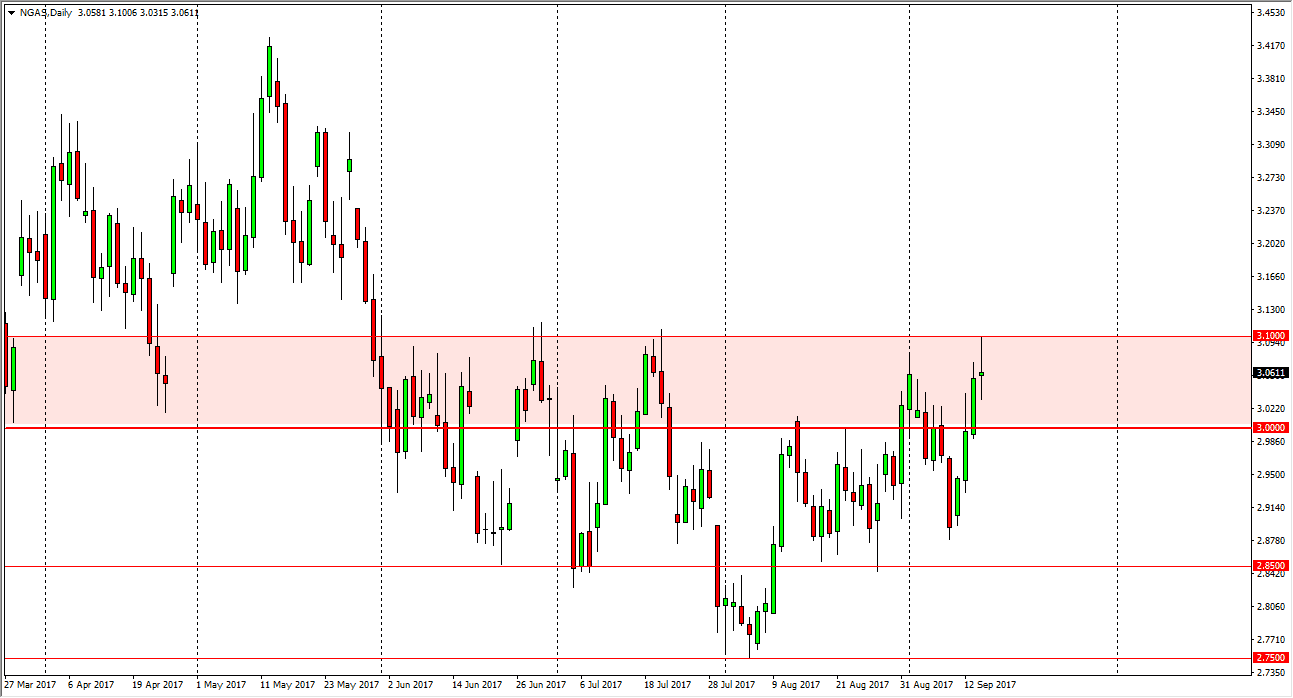

Natural Gas

Natural gas markets touched the $3.10 level, but turned around to form a massive shooting star. It looks as if the resistance barrier is continuing to hold, and therefore I have no interest in buying this market unless of course we can break above the $3.10 level on a daily close. Until then, rallies are still to be sold but it’s obviously a market that has a tremendous amount of pressure underneath it. If we can break below the $3 level, the market will more than likely go down to the $2.90 level. All things being equal, it’s likely that we will see volatility, as natural gas markets are being highly influenced by seasonality and the effects of hurricane hits in the southeastern part of the United States. Ultimately, the end of the day will tell us quite a bit.