Last Thursday’s signals were not triggered, as there was no bearish price action at $5778.93.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades must be taken earlier than 5pm New York time today.

Long Trades

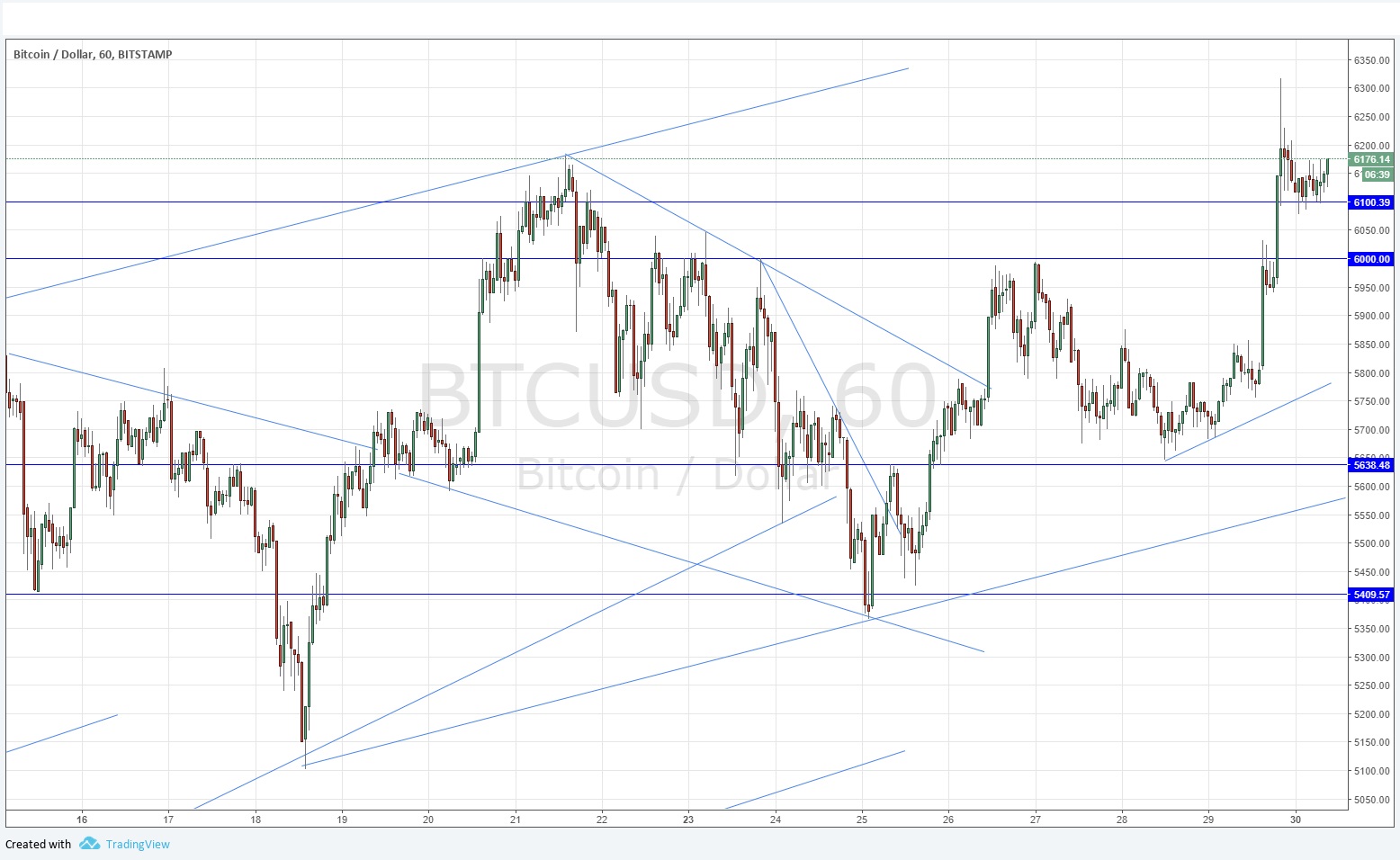

Go long after a bullish price action reversal on the H1 time frame following the next touch of $6139.00, or $6000.00.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

The price initially failed to break up past the big round number of $6000.00 at the end of last week, but over the weekend has gone on to rise strongly and make a new all-time high. New all-time highs are significant, especially, when they happen to new, exciting assets in the market which are subject to a high level of interest from speculators. Bitcoin certainly fits this description, so there is every sign that we are in a strong bullish trend on all time frames, and that we are going to get higher prices still over both the long and short term.

As the picture is so strongly bullish, I would not look for a short trade anywhere now, but it can be noted technically that the area around $6350.00 would see the confluence of a couple of trend lines which could be drawn to provide some resistance, so it should be a logical area at which to take at least partial profit on any successful long trade.

There is nothing due today regarding the USD.