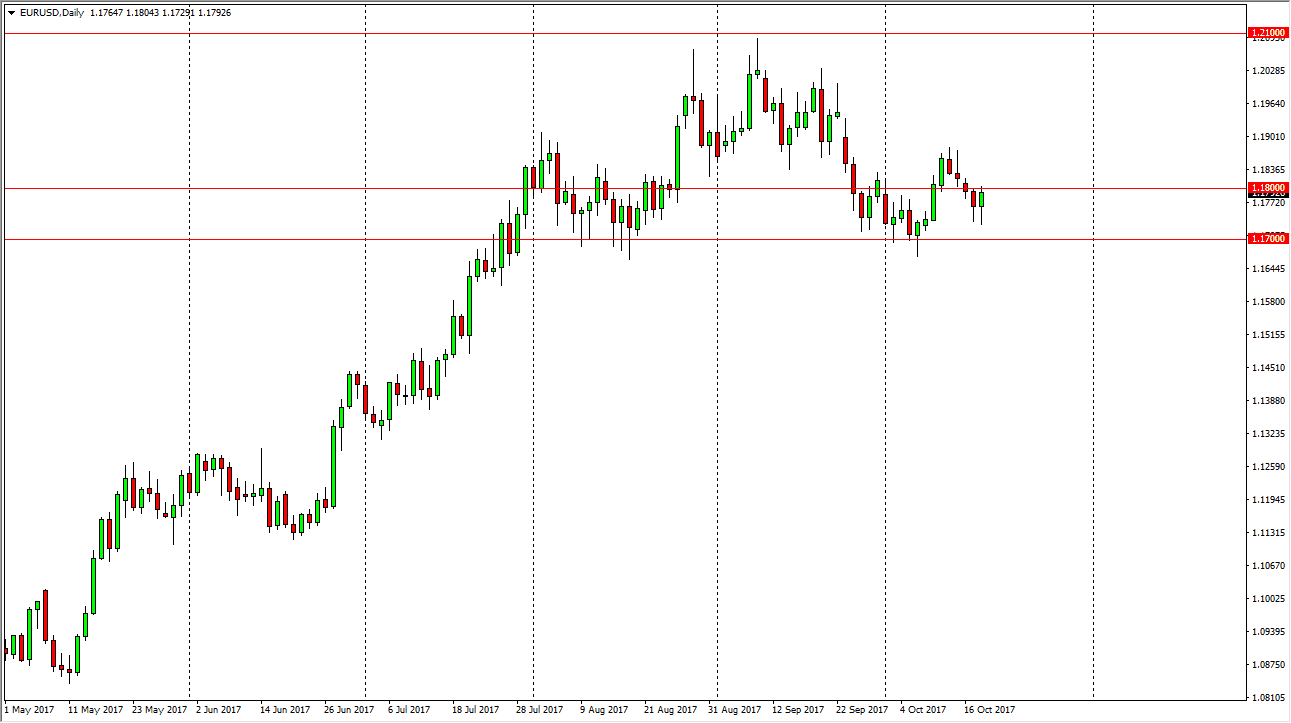

EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, but found enough support to turn around and form a hammer. The hammer sits just below the 1.18 level, and a break above that level not only breaks the hammer from the Wednesday session, but it breaks above the hammer from the Tuesday session as well. I think at that point we go looking towards the 1.19 level, and then eventually the 1.20 handle above. Longer-term, I still expect to see this market break towards the 1.25 handle, but I’m also cognizant of the 1.17 level below being massive support. If we were to break down below there, you could make an argument for head and shoulders pattern being completed. That could send the market down the 1.13, but right now I suspect there’s probably more pressure to the upside than the down.

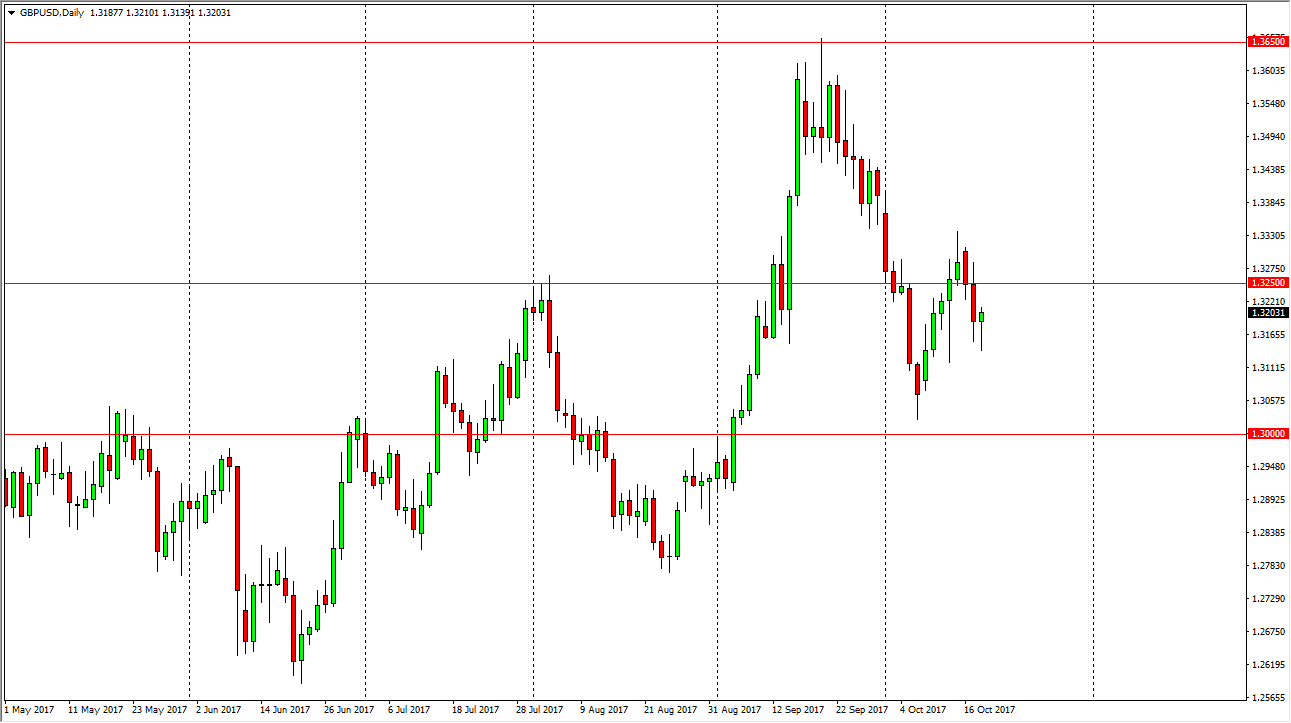

GBP/USD

The British pound also fell during the day but also like the EUR decided to turn around and form a hammer. I think we’re going to go higher from here, testing the 1.3250 level from here, and then eventually the 1.33 level. A clearance of that level sends this market to the 1.3650 level longer term. I believe the British pound will continue to strengthen, mainly because the Bank of England looks almost a foregone conclusion for interest rate hikes. The 1.30 level underneath continues to be the floor in the market, and as long as we can stay above that level, I’m a buyer on dips. We should continue to see quite a bit of volatility though, because quite frankly most of what’s driving the British pound right now a speculation on news headlines.