The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 1st October 2017

Last week, I saw the best possible trade for the coming week as long of the British Pound, and short of the U.S. Dollar. The result was negative, as the GBP/USD fell by 0.71%.

The Forex market over the past week has most into a U.S. Dollar counter-trend mode, along with mixed performances that do not make clear, obvious sense. The news has been dominated by the U.S. Federal Reserve’s more hawkish expression of its anticipated monetary policy tack, as expressed by Janet Yellen in a speech last week.

The news agenda this week will probably be dominated by key U.S. data including the Non-Farm Payrolls numbers on Friday.

Following the current picture, I see the highest probability trade this week as long of the Euro, and short of the Japanese Yen. The Euro is still in a long-term bullish trend against the U.S. Dollar, which in turn is in a long-term bullish trend against the Japanese Yen.

Fundamental Analysis & Market Sentiment

Sentiment is currently counter-trend, with considerable buying halting the bearish U.S. Dollar trend. The major event likely to dominate the market this week will be key U.S. data including the Non-Farm Payrolls numbers on Friday.

The market may be turning more bearish on the British Pound, as GDP data came in at a 4-year low last week followed by a relatively downbeat assessment from the Governor of the Bank of England. The Prime Minister’s political woes continue, as her own party seems completely unimpressed by her leadership as her party’s annual conference is about to begin.

Technical Analysis

U.S. Dollar Index

This pair printed a large bullish candlestick, although there is a sizable upper wick on the candle. This signifies further indecision and possibly a still deeper bullish retracement. The outlook is now slightly more bullish. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. The resistance level at 12012 has been rejected, holding almost to the pip. However, it is increasingly noticeable that there are not any visible weekly closes below about 11750, only lower wicks of candlesticks.

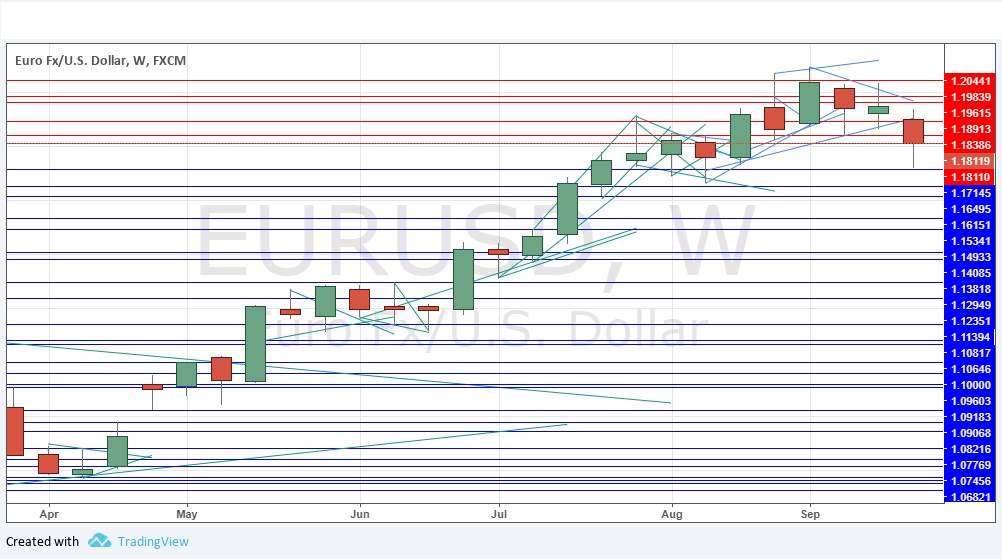

EUR/USD

Although it can be argued that this is not the most strongly trending of all the U.S. Dollar currency pairs, this week’s bearish candle has a large lower candlestick, indicating that the price may now be ready to resume some upwards movement, in line with the long-term bullish trend which is still technically in force. There are plenty of resistance levels above the current price, so the rise may be halting and not make it very far.

USD/JPY

This pair has now moved into a long-term bullish trend, with the Japanese Yen the weakest currency against the U.S. Dollar over the long-term. If the Dollar is going to reverse, it is likely to make itself felt most strongly here. However, it must be noted that the weekly candle is an indecisive doji which seems to be rejecting a long-term resistant trend line, as shown in the chart below. Sometimes this situation can produce a bullish surprise, so I stick with the trend and take a bullish bias here.

Conclusion

Bullish on the Euro; bearish on the Japanese Yen.