Gold prices rose slightly on Tuesday after dropping to a seven-week low earlier in the day. The U.S. dollar edged lower as investors took a cautious stance ahead of jobs data, which will be released on Friday. Market participants will also be monitoring speeches by Federal Reserve officials this week for clues about the future of the central bank’s monetary policy

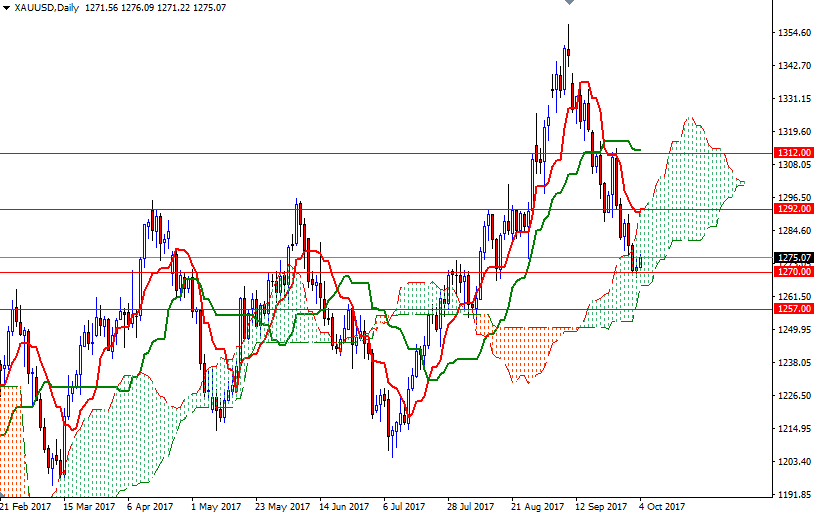

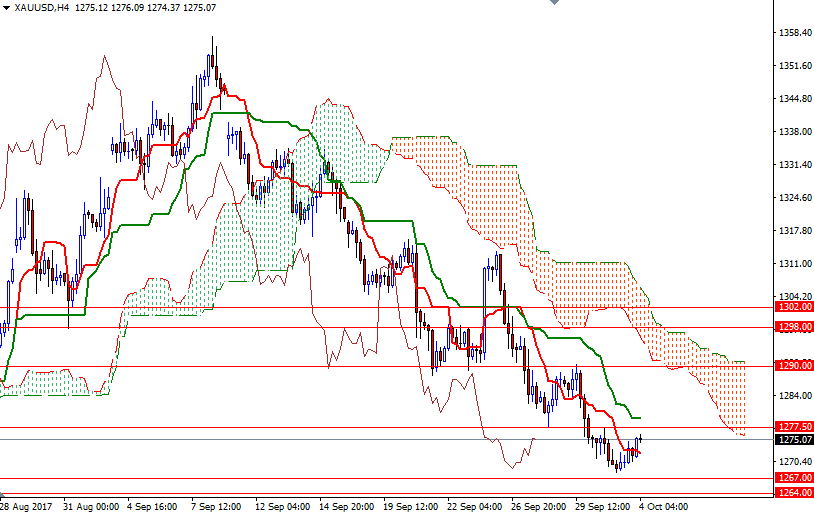

The short-term charts are still bearish, with the market trading below the Ichimoku clouds on the H4 chart. However, note that XAU/USD is residing within the borders of the daily cloud, which acts as support at the moment. With that in mind, we can probably expect a ranging/consolidation pattern over the next few days.

The bulls have clear nearby resistances such as 1277.50 and 1280.20 to gather momentum for 1284. Beyond 1284, the 1292/0 area, where the top of the daily cloud and the bottom of the 4-hourly cloud converge, stands out as the initial solid resistance. If the market fails to climb above 1280.20, keep an eye on the support in 1272/0. If this support is broken, the market will be targeting 1267. A breakdown below 1267 paves the way for a test of 1264.