Gold prices ended Wednesday’s session up $2.91 an ounce, supported by a weaker U.S. dollar index. On the economic data front, the ISM’s manufacturing purchasing managers index came in better than expected with a print of 59.8 and the ADP Research Institute said private sector added 135000 jobs last month

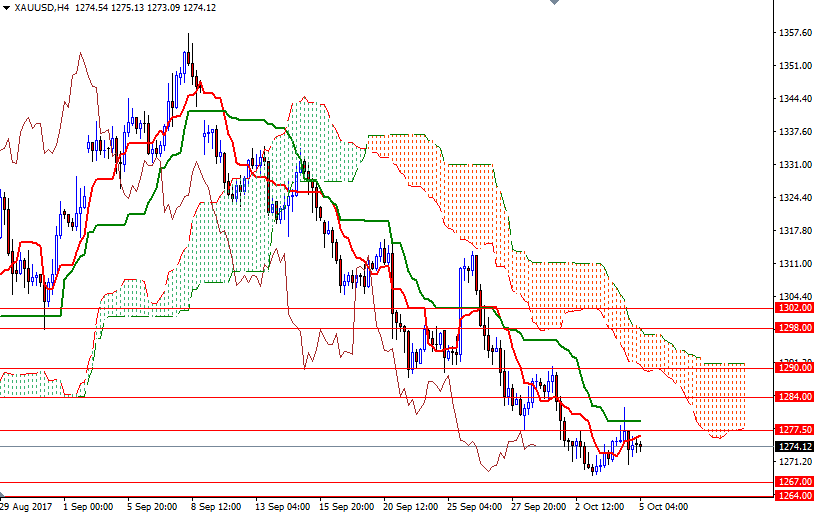

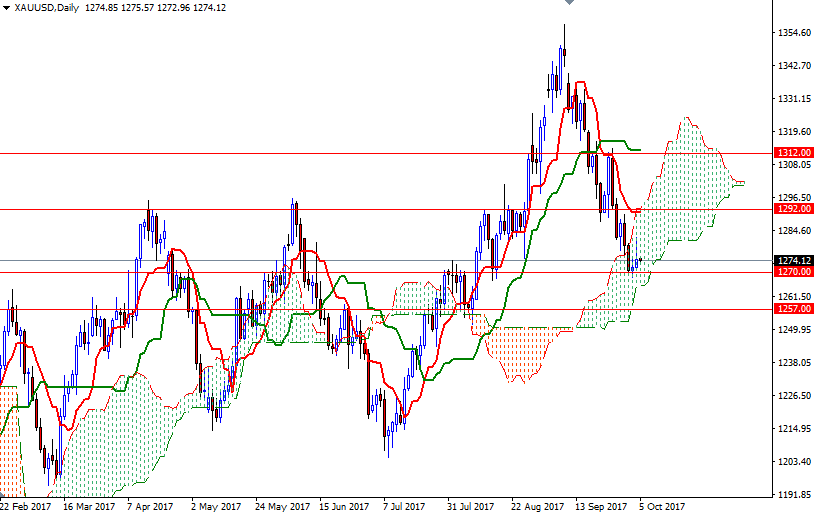

XAU/USD is trading below the Ichimoku clouds on the 4-hour chart. We have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) on both the daily and the 4-hourly charts, along with Chikou Span/Price crosses in the same direction. These suggest that the bulls still have the near-term technical advantage. However, keep in mind that prices are within the borders of the daily cloud; plus, the Tenkan-sen and the Kijun-sen are flat. The market may remain range-bound ahead of the Labor Department’s employment report.

To the upside, the initial resistance stands at 1277.50, followed by 1284/2. If XAU/USD climbs above 1284, prices will probably head to 1292/0, the bottom of the 4-hourly cloud. A break down below 1272/0 on the other hand, could see a fall to 1267. The bears have to drag the market below 1267 in order to make an assault on 1264.