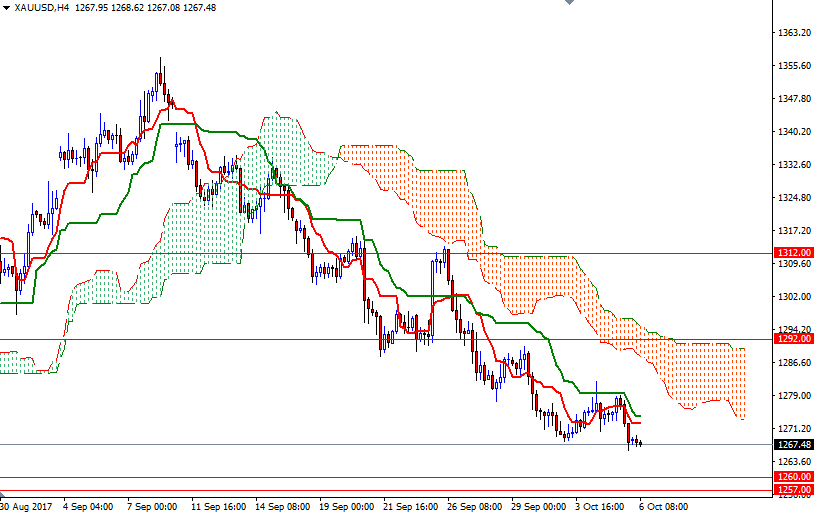

Gold prices dropped $6.81 on Thursday as the dollar appreciated ahead of key U.S. jobs data. XAU/USD initially tried to break out to the upside but the anticipated resistance at the $1277.50 level kicked in and capped the market. Consequently, the market fell through $1272-$1270 and tested the support at $1267.

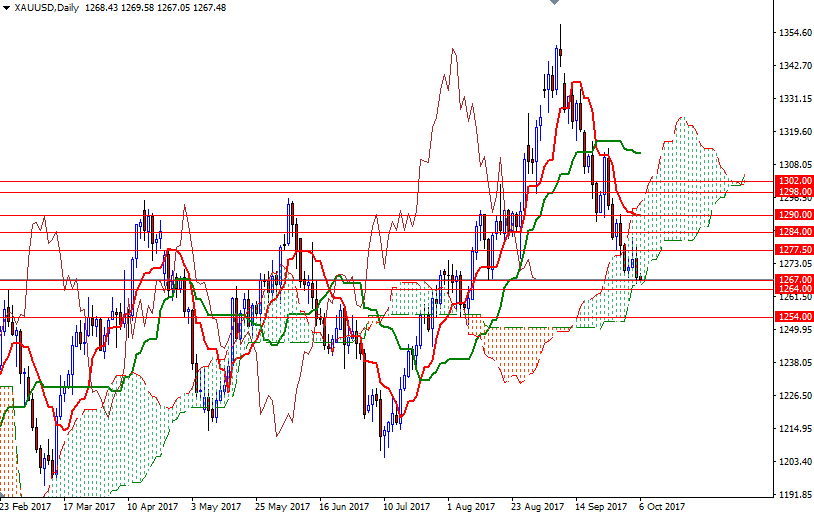

The market continues to feel bearish pressure from negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) lines on the daily and the 4-hourly charts but the bulls are trying to hold market above the 1267 level. A break down below 1267 opens up the risk of a move to 1264. If this support is broken, then the 1260 level will be the next stop.

To the upside, keep an eye on 1277.50 and 1279. The bulls will have to lift prices above 1279 in order to test the next barrier in the 1284/2 zone. If the market successfully breaks through 1284/2, the 1292/0 area will probably be the next port of call.