Gold prices ended Tuesday’s session down $5.34 as gains in equity markets dented the appeal of the safe-haven metal. Apparently, the risk-on attitude across global markets and the dollar’s recent appreciation will continue to influence the price of gold. In economic news yesterday, IHS Markit’s Composite PMI came in at 55.7, up from 54.8 in September.

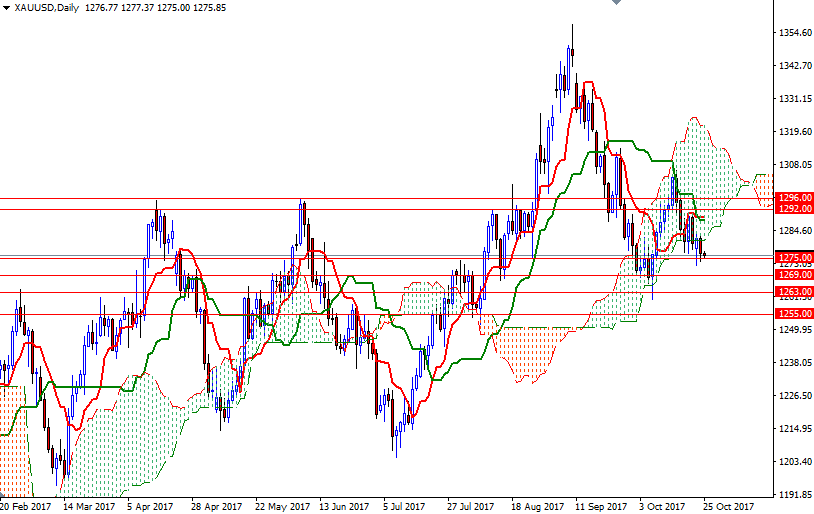

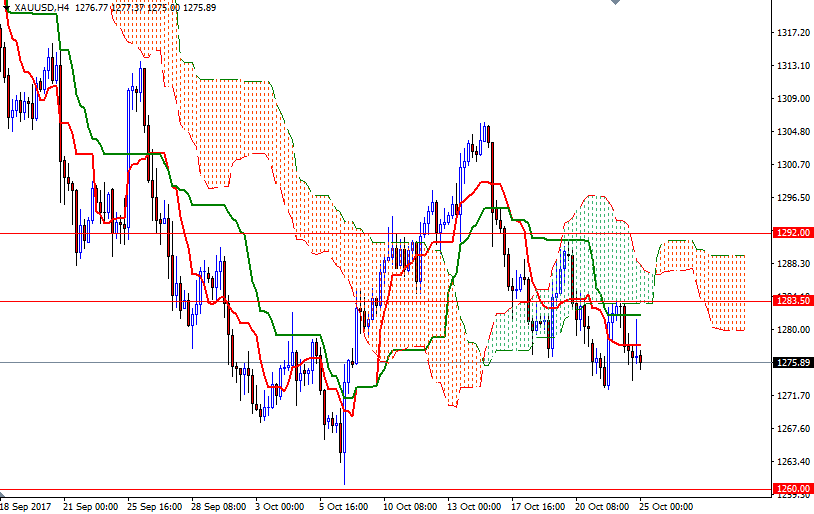

From a chart perspective, the bears still have the short-term technical advantage. XAU/USD is trading below the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both the H4 and the H1 charts.

The path of least resistance for gold appears lower but as I pointed out in my previous analysis, the bears have to clear the nearby support around 1275 to increase the selling pressure on the market. If XAU/USD dives below Monday’s low, the bears will be targeting 1269/7. A break down below 1267 could trigger further weakness and lead to a test of the 1263/0 area. To the upside, the initial resistance sits in 1283.50-1281.80. If the bulls successfully penetrate this barrier, 1288/7 and 1292 may be the next targets. The bulls will need to push prices above 1292 to gather momentum for 1296.