Gold prices rose for a second straight session and settled at $1276.15 an ounce, supported by a weaker U.S. dollar index and a slide in U.S. equities. The American dollar inched lower as investors turned cautious ahead of a Federal Reserve meeting and a slew of U.S. economic data releases this week. The Fed is not expected to take any actions this week but traders still see a high probability of a rate hike in December at 84%.

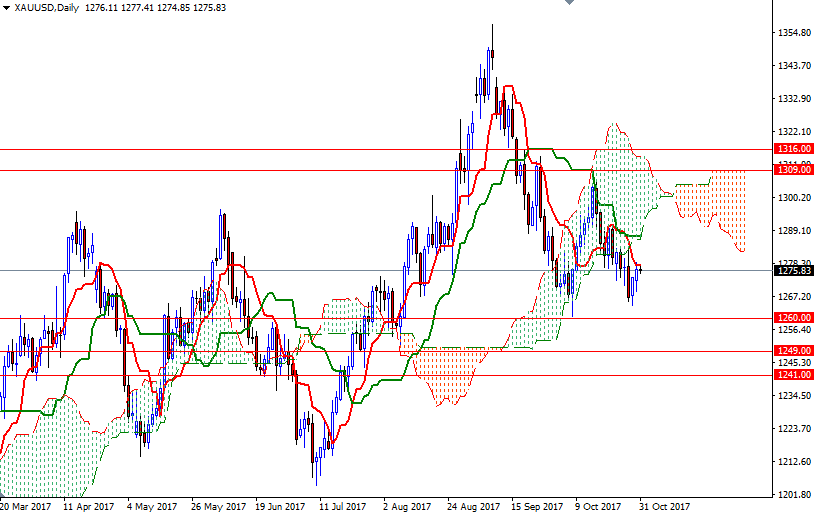

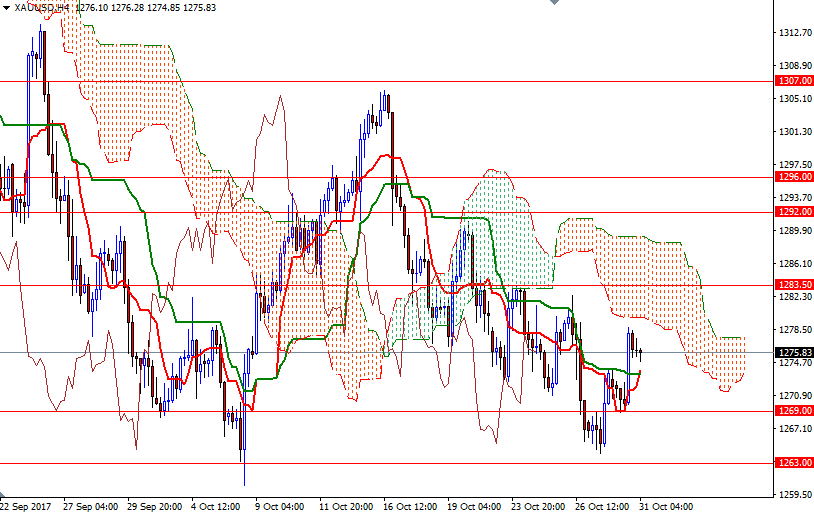

XAU/USD is trading below the Ichimoku clouds on the daily and the 4-hourly charts, indicating that the bears have the overall short-term technical advantage. However, we have a weak bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross on the 4-hour chart, and prices are above the clouds on the H1 time frame. With that in mind, XAU/USD is likely to trade sideways in the near term.

To the downside, the bears will need to pull prices below the intra-day support in 1273/2 to test 1269/7. A break down below 1267 could see a fall to 1263/0. If the market is able to stay above the hourly cloud, expect a move towards the 4-hourly cloud. In that case, 1278 (the daily Tenkan-sen) and 1280 (the bottom of the 4-hourly cloud) may be visited. Penetrating this barrier could foreshadow a move to 1283.50.