Gold prices ended Wednesday almost unchanged after a volatile session that saw prices swing between gains and losses as investors opted to remain on the sidelines ahead of the European Central Bank meeting. In the latest economic data, durable goods orders jumped 2.2%, while the prior print of 1.7% was revised higher to %2.0. Despite upbeat U.S. data, expectations that the ECB will announce the start of trimming its monthly asset purchases weigh on the greenback.

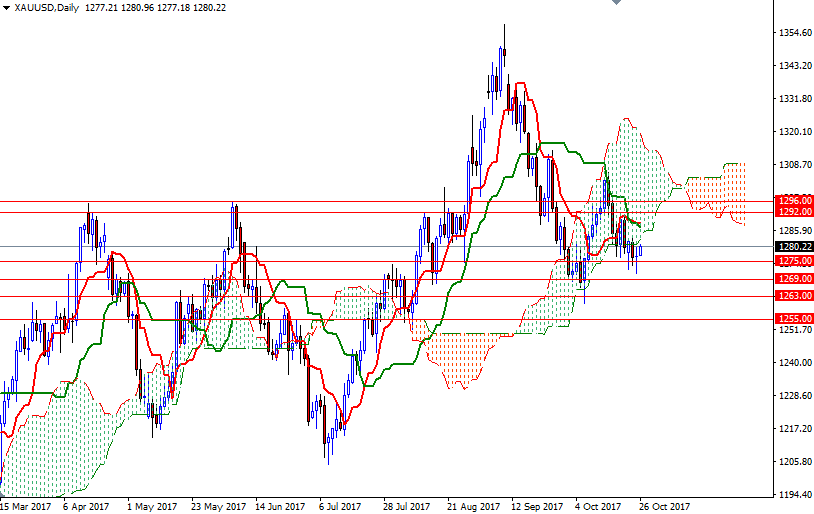

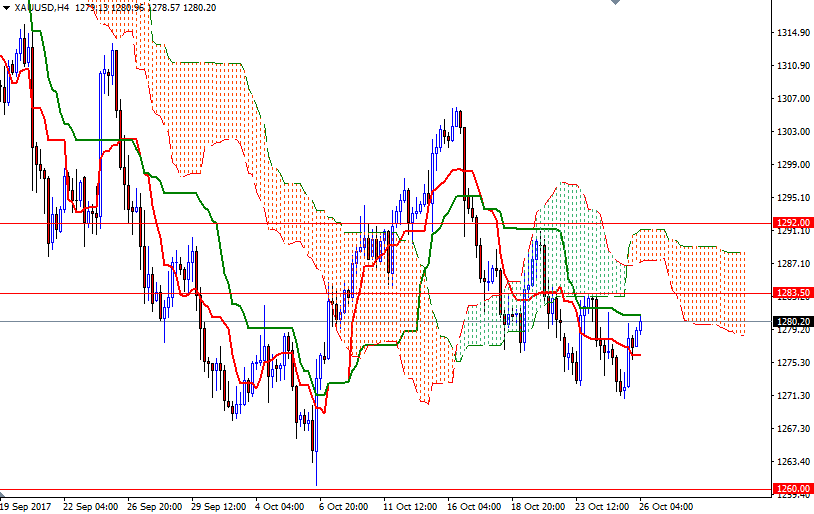

XAU/USD continues to feel bearish pressure from the daily and the 4-hourly Ichimoku clouds, however, prices still remain above the weekly cloud. The bears have tried to hold the market below the 1275 level but failed on each occasion. The market is currently trading above the clouds on the H1 chart and we a positive Tenkan-sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) cross.

The Kijun-Sen on the H4 chart sits at 1281 and the bulls have to lift prices beyond there to approach the next barrier in the 1285-1283.50 area. If XAU/USD breaks through, then look for further upside with 1287.70 and 1292 as the next targets. The clouds on the H1 and the M30 chart overlap in the 1276-1273 area. If this support is broken, it is likely that the 1269/7 zone will be the next stop. Closing below 1267 on a daily basis would open a path to 1263/0.