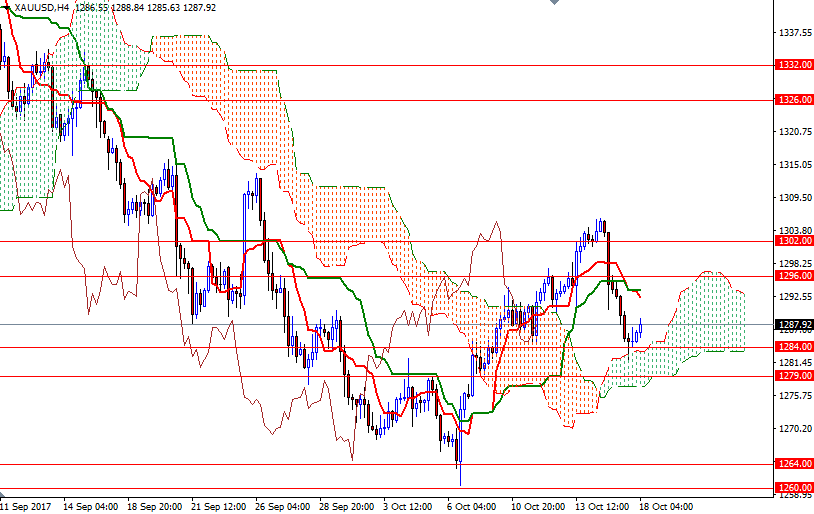

Gold prices fell $10.22 an ounce on Tuesday, extending their losses to a second straight session, as strength in the U.S. dollar eroded the appeal of the precious metal. Technical selling pressure was also behind gold’s decline yesterday. Dropping through the $1292-$1289 support triggered a fresh round of selling and dragged prices to the Ichimoku cloud on the 4-hour chart as forecasted. XAU/USD is currently trading at $1287.92, higher than the opening price of $1285.02.

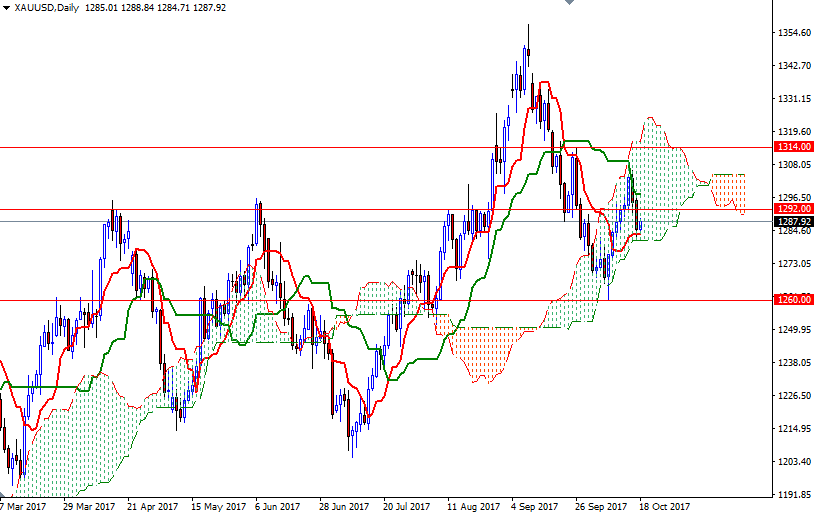

The area occupied by the 4-hourly cloud has been supportive so far. The bottom of the daily cloud is also right below so it will continue to play an important role. We have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both charts; however, the bears will have to pull prices below the 4-hourly cloud in order to increase selling pressure. If that is the case, look for further downside with 1275 and 1272 as next targets.

The Ichimoku clouds on the H1 and the M30 charts overlap in the 1289-1296 area. If XAU/USD penetrates this barrier, then the market will be aiming for 1302/0. A break through there would attract new buyers and bring in 1309/7.