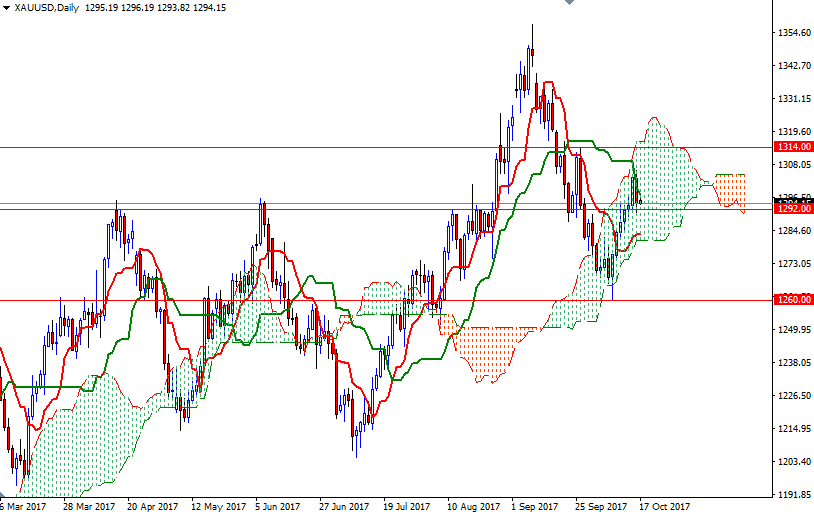

Gold prices moved lower on Monday as the dollar clawed back some of its recent losses. In economic news, the Federal Reserve Bank of New York reported that manufacturing activity in the region jumped to 30.2 from 24.4 a month earlier. The XAU/USD pair is currently trading at $1294.15, slightly lower than the opening price of $1295.19. Gold has rebounded nearly 2.7% since hitting a two-month low of $1260.51 on October 6.

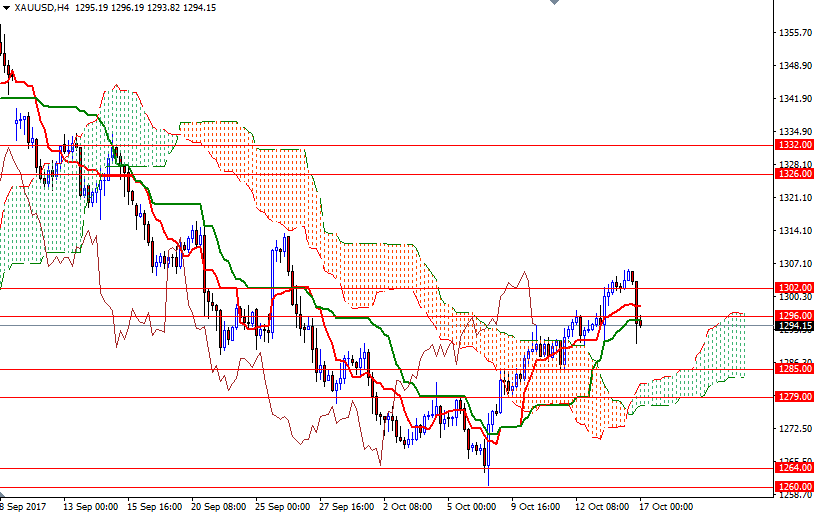

XAU/USD was unable to hold above the strategic $1302-$1300 area and as a result, prices headed back to $1292-$1289 as anticipated. Although the market found support in this area, it might be in danger unless prices get back above the $1296 level. The market is trading below the Ichimoku clouds on the H1 and the M30 charts. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on both charts.

If the 1292/89 support is broken, the market will probably continue to retreat towards the 4-hourly cloud. In that case, the 1285/4 area could be the next stop. The bears have to drag prices below 1284 to make an assault on 1279. The first upside barrier comes in around 1296 and that is followed by 1309/7. Closing beyond this resistance on a daily basis would signal a push up to 1316/4.