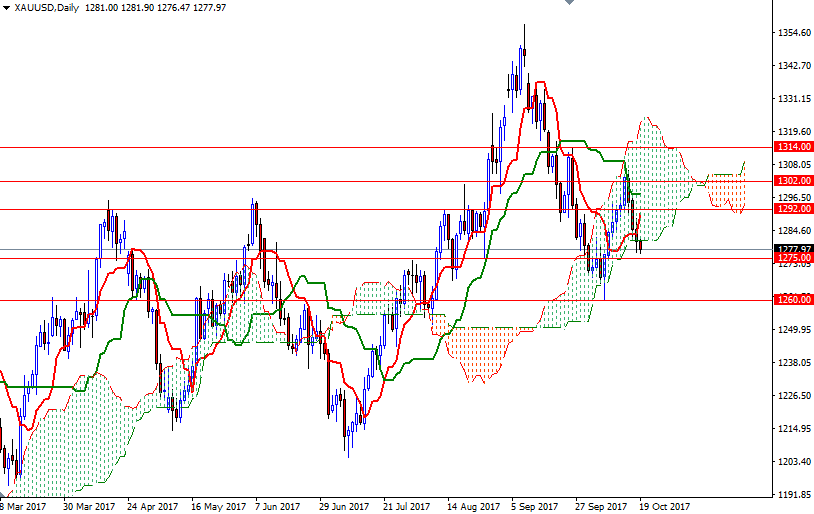

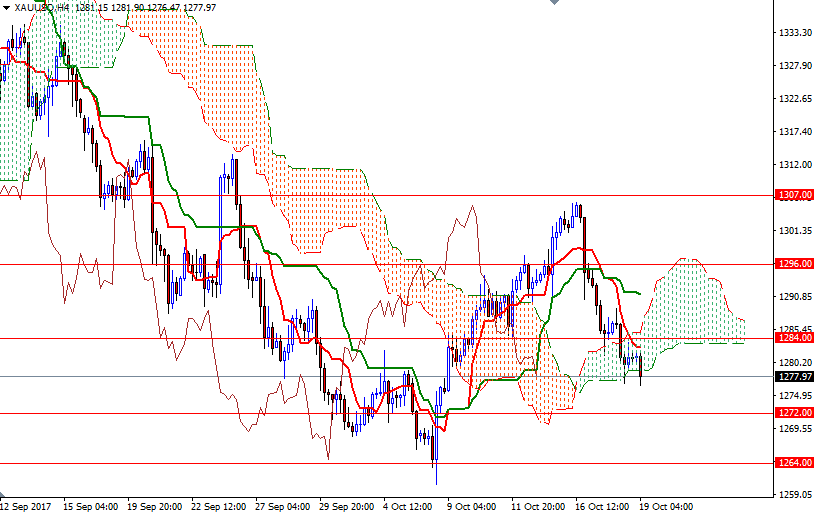

Gold prices dropped $4.22 an ounce on Wednesday, dragged down by a stronger dollar and U.S. equities closing at record highs. XAU/USD initially tried to pass through the $1289 level but found heavy resistance and headed back to the bottom of the Ichimoku cloud on the 4-hour chart. The bears have the short-term technical advantage, with the market trading below the Ichimoku clouds.

Prices continue to feel bearish pressure from the Ichimoku clouds and negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on the H1 and the M30 charts. Also note that the market is trading below the daily and 4-hourly clouds at the moment. If XAU/USD dives below 1275, then the 1272 level will be the next stop. A break down below 1272 could foreshadow a move to 1269/7.

However, if the support at around 1275 remains intact, expect a push up towards the 1284/2 area, where the bottom of the hourly cloud resides. The bulls have to lift prices above 1284 in order to march towards 1289/7. The top of the 4-hourly cloud stands at 1296 so breaching that barrier is essential for a stronger recovery.