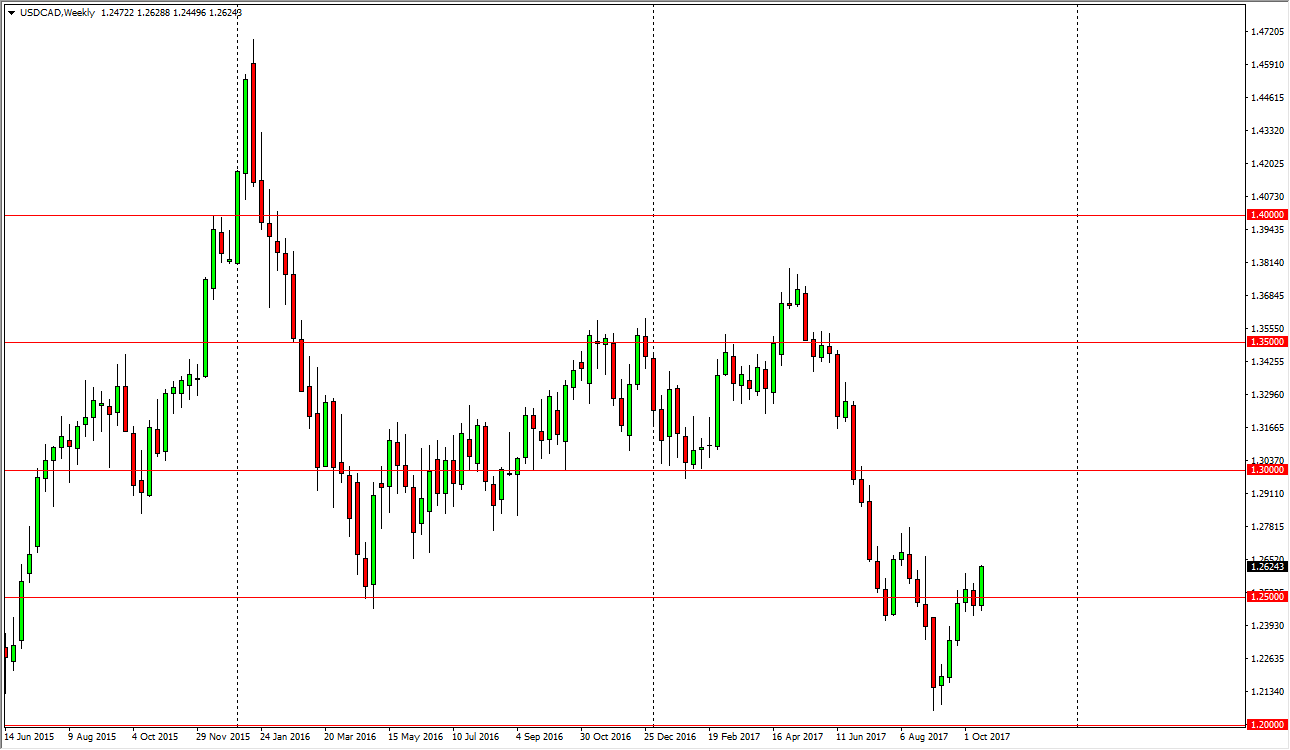

USD/CAD

The US dollar rallied significantly during the week, breaking above the resistance from a couple of weeks ago. Now that we are clear the 1.26 level, I think that the market will try to rally from here, perhaps towards the 1.28 level above. I see support at the 1.24 level, so if we can remain above that handle, I think that we go higher. If oil roles over, that will only exacerbate the move.

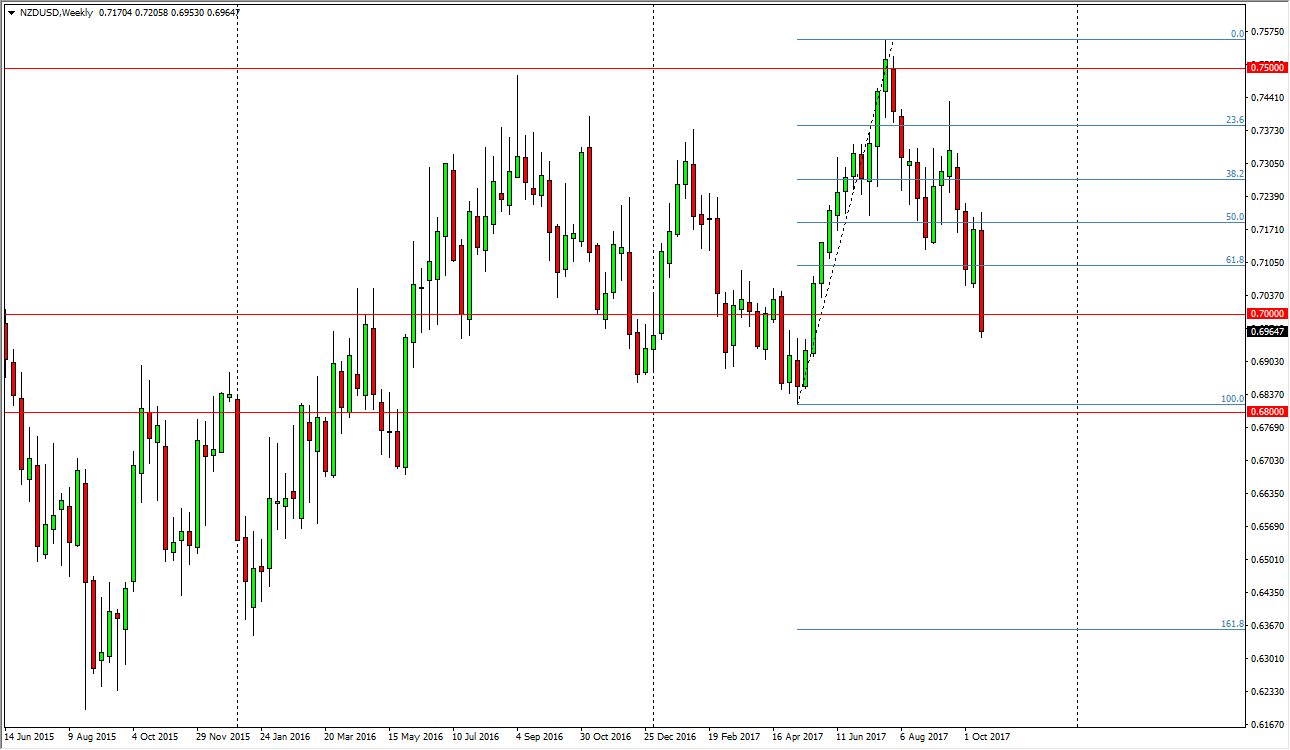

NZD/USD

The New Zealand dollar initially tried to rally during the week, and then collapsed. We broke down below the 0.70 level, showing signs of significant weakness. This would have been due to the new prime minister being certified, as traders fear expansive spending by Labour. Ultimately, I think that the market is going to go looking to retrace the entire move that sent us towards the high, meaning that we should then go down to the 0.68 level below.

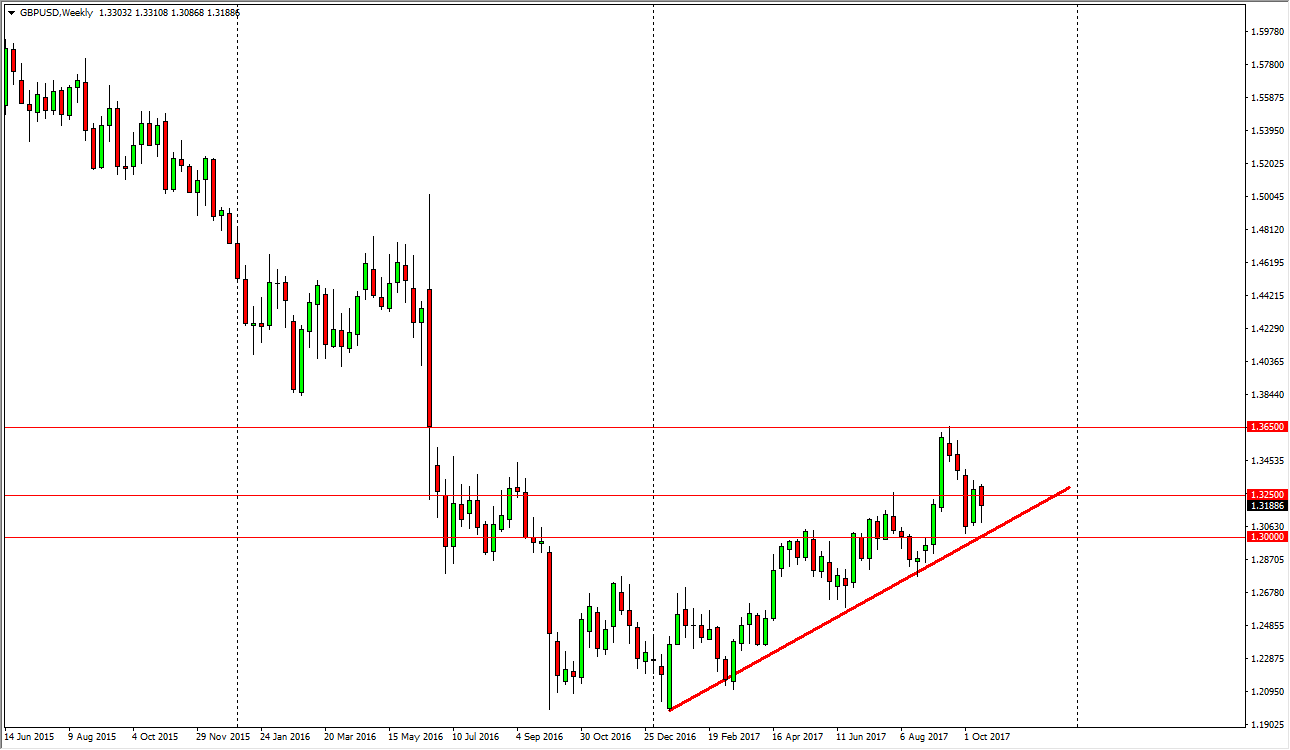

GBP/USD

The British pound fell significantly during the week, but found enough support underneath to turn around and form a hammer. The market looks well supported due to the trendline below, and I think that we are going to continue to see a lot of support near the 1.30 level. Ultimately, we should then break above the top of the hammer, and send this market looking towards the 1.3650 level above. Ultimately, this is a market that continues to see a lot of choppiness, so longer-term traders will probably continue to buy dips, but it is going to be noisy.

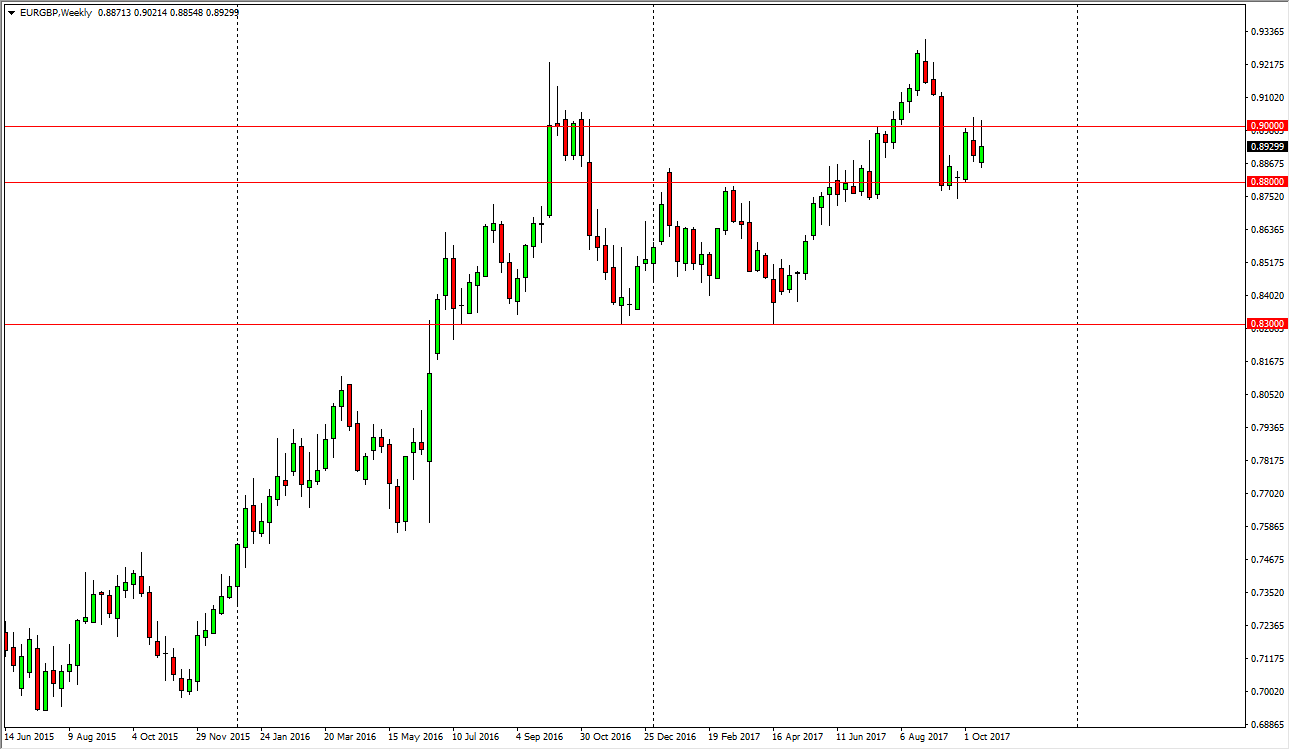

EUR/GBP

The EUR/GBP pair continues to be very noisy, and during the previous 2 weeks have formed hammers. The hammers suggesting that the 0.90 level will be very difficult to overcome, but I also recognize that there’s a lot of support in the 0.88 level. This market is almost completely driven by headlines coming out of both Brussels and London right now, so I think that it is going to continue to be very noisy. However, if we break down below the 0.88 level, the market should continue to go much lower. Alternately, if we break above the 0.90 level, that would be an extraordinarily bullish move.