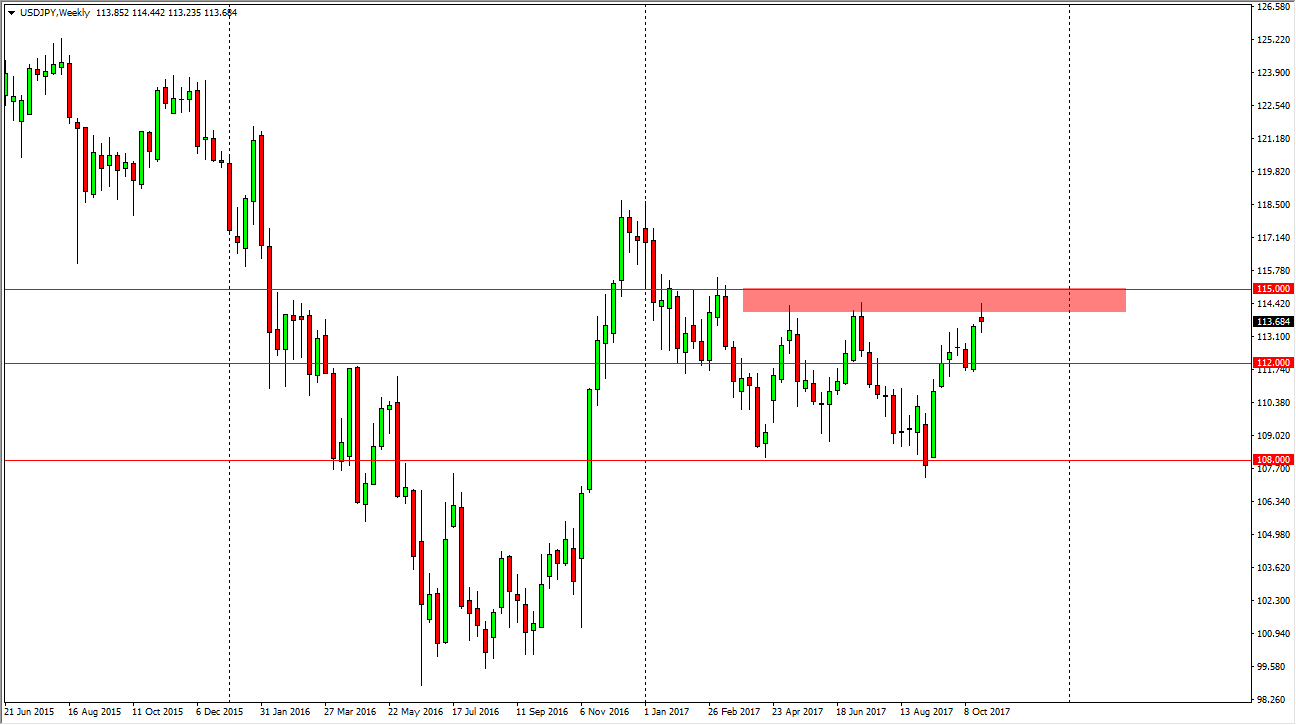

USD/JPY

The US dollar was very volatile during the week, reaching towards the 114.50 level before pulling back on Friday. Ultimately, this is a market that I think has a significant amount of resistance above, extending towards the 115 handle. It is not until we break above the 115 handle that I feel the market is free to go higher. In the meantime, I would not be surprised at all to see this market pull back, perhaps reaching towards support at the 113 level, and even more so at the 112 level.

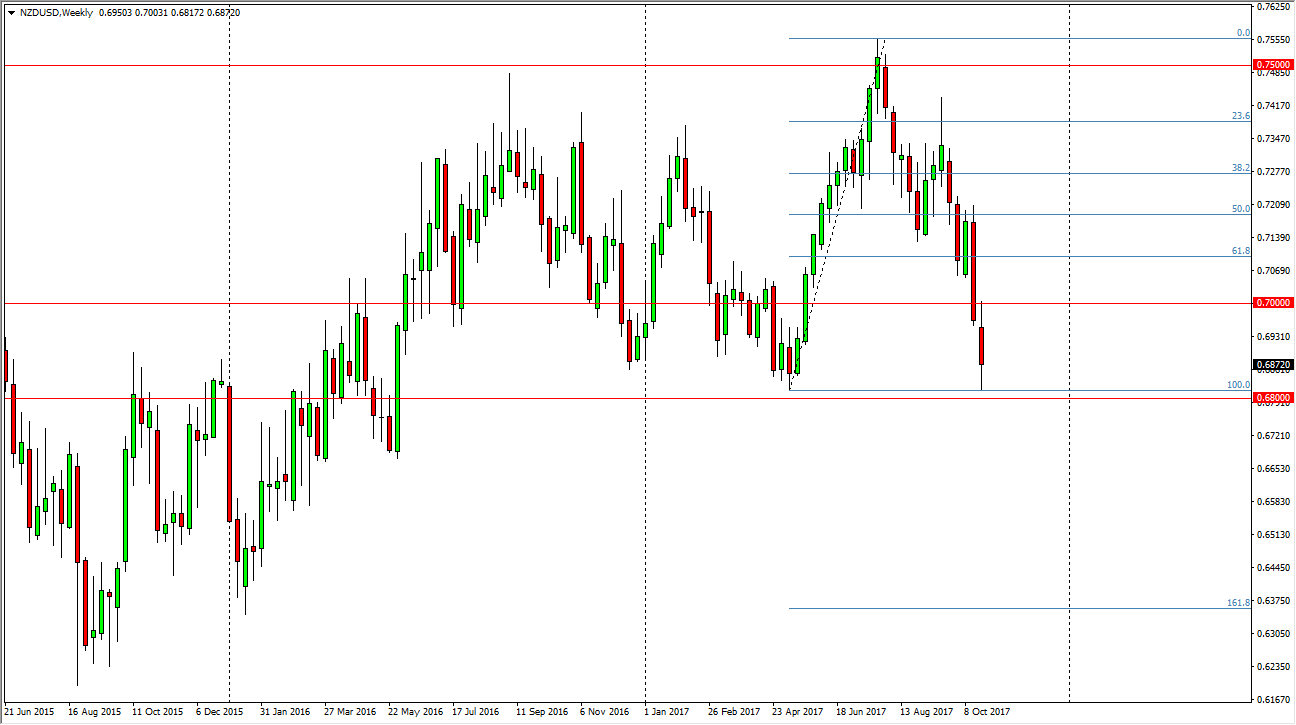

NZD/USD

The New Zealand dollar has been back and forth during the last week, and I think we are now trying to form some type of consolidated area. The 0.70 level above will be resistive, just as the 0.68 level below will be supportive. And less something changes, it would not surprise me at all to see this market go back and forth in consolidation over the next couple of weeks. However, once we break out of this range, I am willing to follow the market, regardless of the direction.

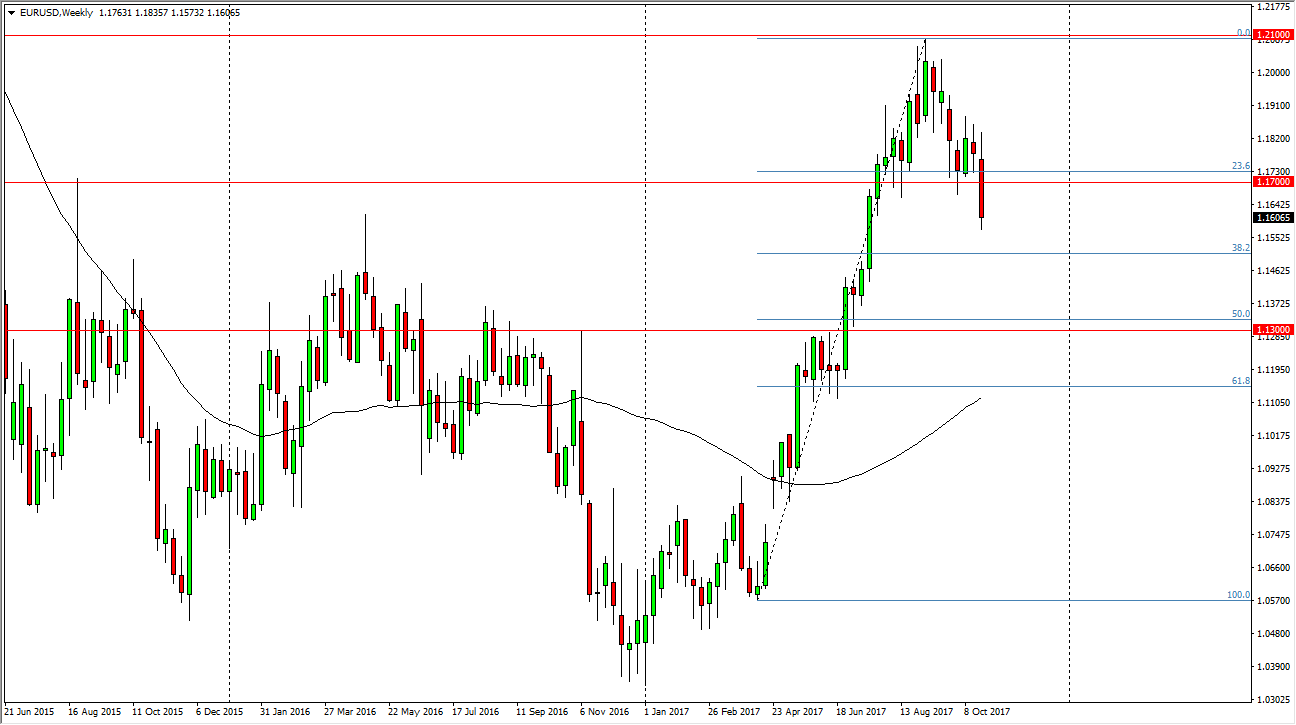

EUR/USD

The EUR/USD pair initially started the week positive, but Mario Draghi was very dovish when he gave his press conference on Thursday, and we have since broken down below vital support. On the daily chart, we have broken down below the neckline of the head and shoulders pattern, and that of course is negative. So, I think of the next couple of weeks we will have a pullback but when you look at the longer-term charts, quite frankly this pullback is necessary. I think short-term bearish pressure has control of the market, but given enough time I expect to see buyers return, closer to the 1.13 handle.

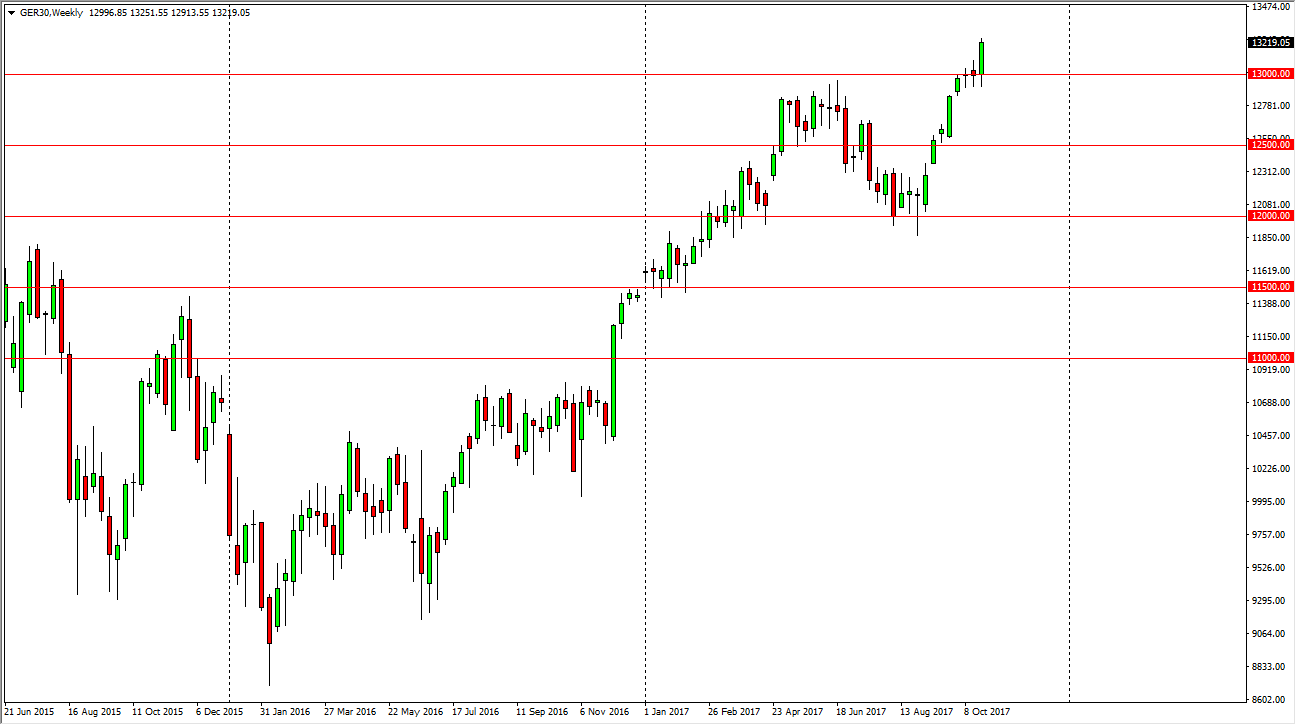

DAX

The German index initially fell during the week, but with the EUR/USD pair sliding, it suggests that Germans are going to be able to sell their exports at lower price. That being the case, the market looks likely to go higher, and that a pullback should be a buying opportunity, especially if the €13,000 level offers support. I think that the market will eventually reach towards the €13,500 handle, and I suspect that although choppy, the buyers will return repeatedly.