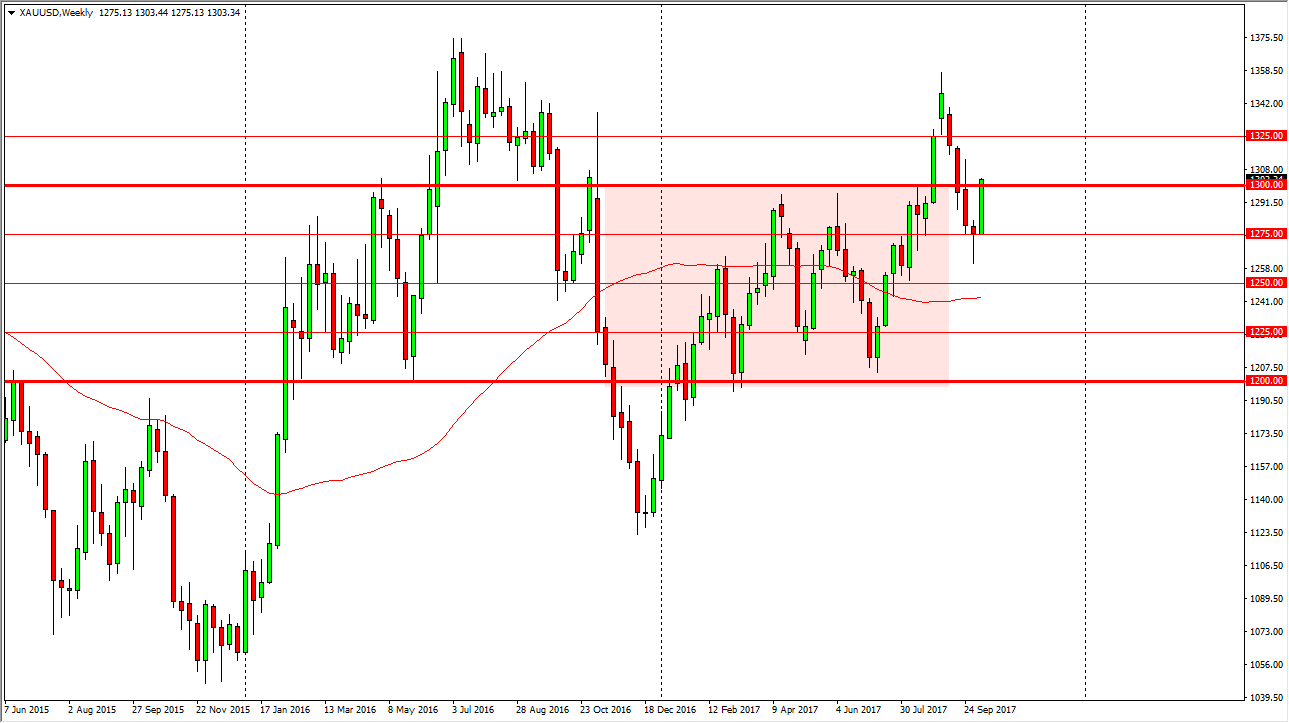

Gold

Gold markets rallied significantly during the week, breaking above the $1300 level. We had also clear the top of the hammer from the previous week, so now I believe we will continue the upward momentum and reach towards the $1325 level over the next couple of weeks. Dips will more than likely be looked at as value propositions.

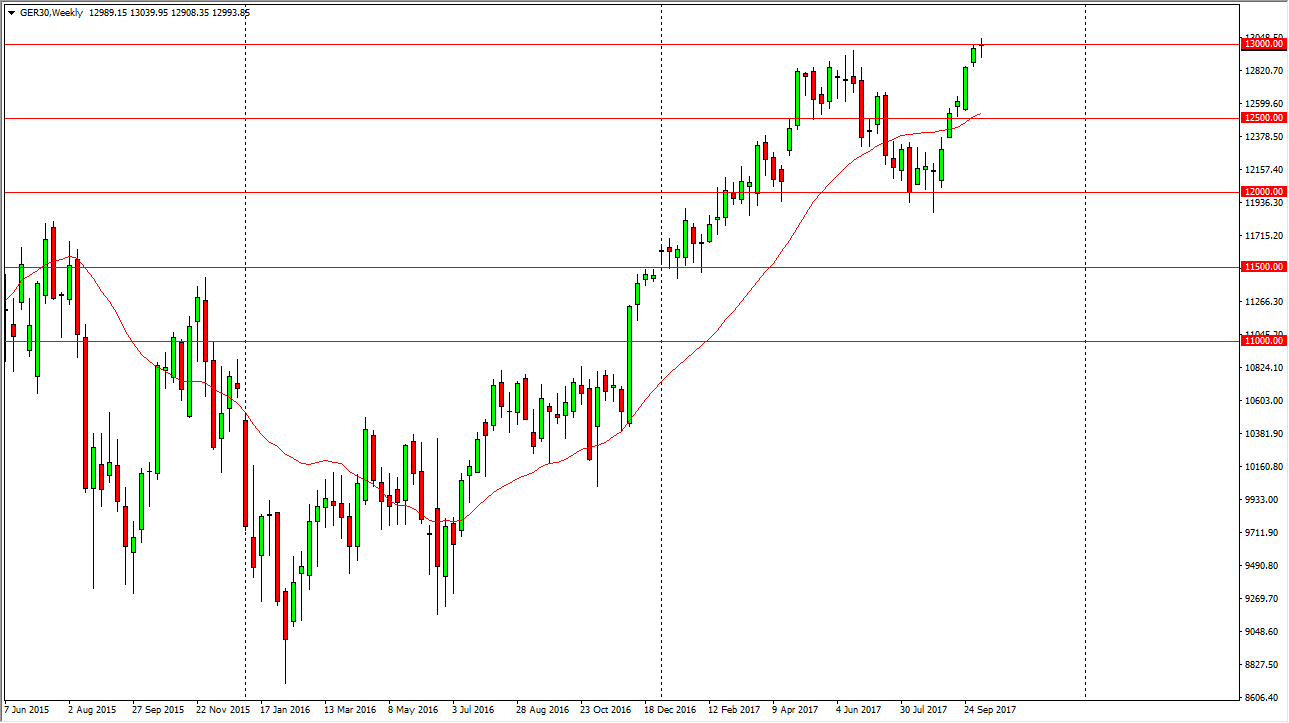

DAX

The German index initially fell during the week, but ended up forming a bit of a hammer. The hammer sits right at the top of the uptrend, and the vital €13,000 level. If we can break above the top of the candle that should send this market into its next leg higher. Alternately, a breakdown below the bottom of the hammer would be a negative sign, perhaps having the market look for support closer to the €12,750 level.

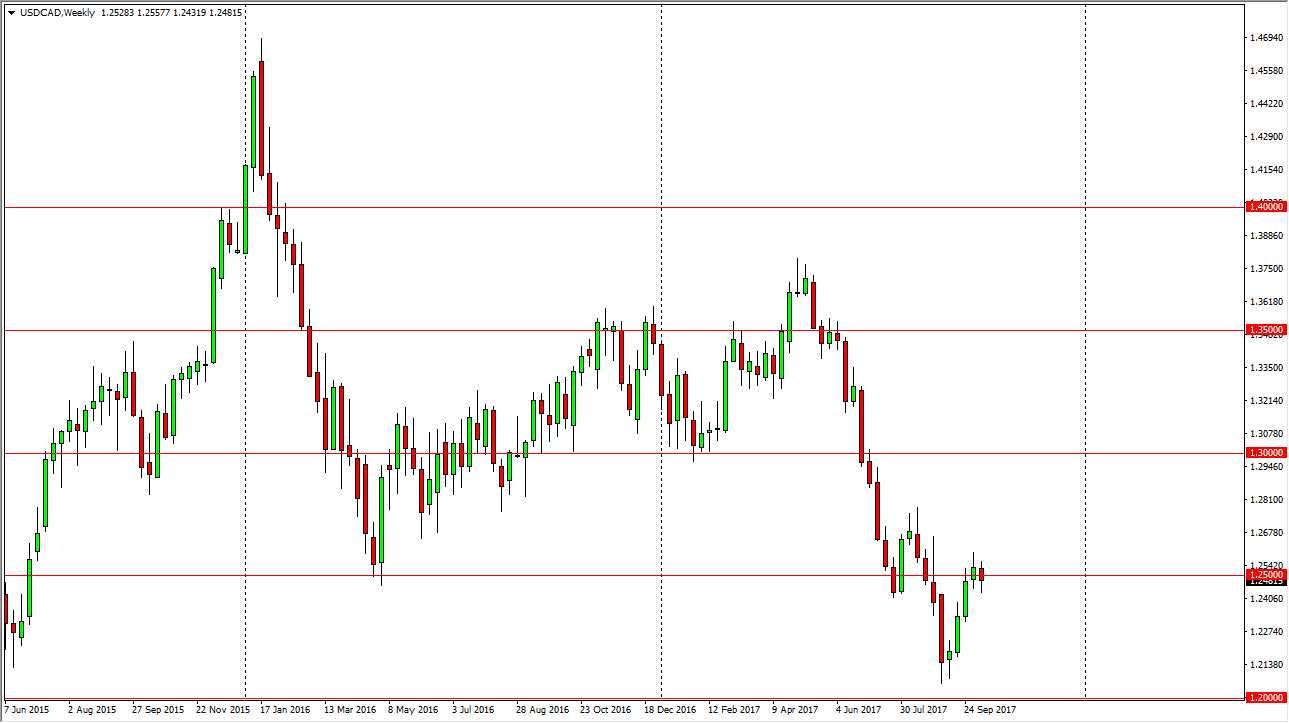

USD/CAD

The US dollar fell a bit during the week, but continues to hang about the 1.25 level. I think that although oil markets are starting to rally, the upside for those markets is somewhat limited, and it looks as if we can break above the top of the previous weeks range, we could go to the 1.28 level, then perhaps the 1.30 level after that. If we break down below the bottom of the week, and more specifically the 1.24 handle, then we go looking towards 1.21.

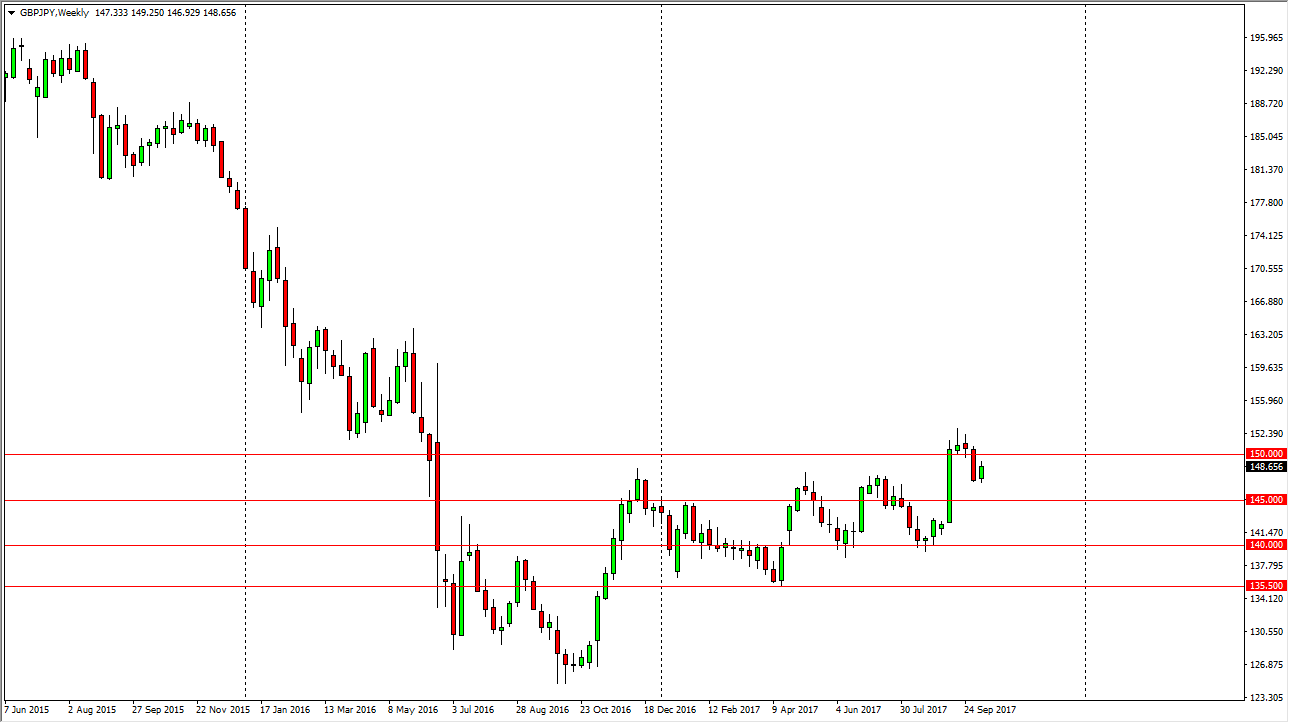

GBP/JPY

The British pound rallied a bit during the week, but still remains below the vital 150 handle. I suspect that any rally towards that area will run into a significant resistance, so short-term buying may be possible, but a breakout is unlikely. Longer-term, I think it happens but it’s just not gonna happen this week.