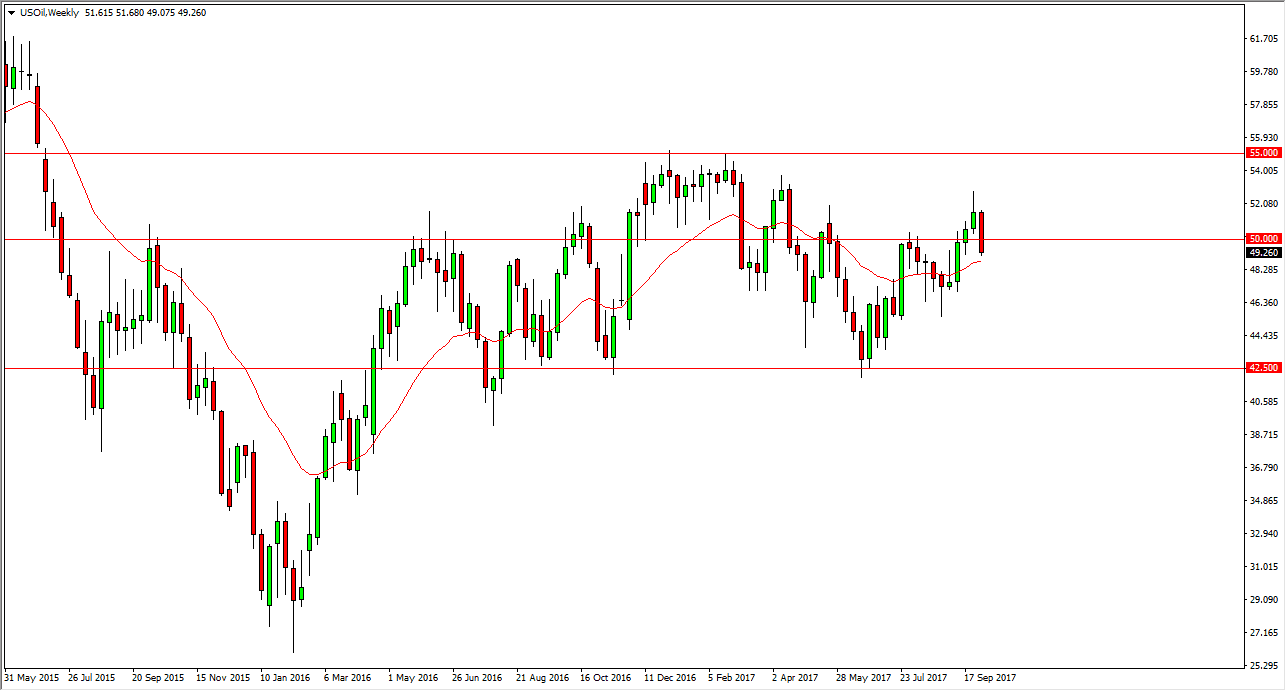

WTI Crude Oil

The WTI Crude Oil market had an extraordinarily bearish week, breaking below the $50 level, reaching towards the $49 level. If we can break down below there, the market should continue to go much lower, and I think that we could reach towards the $46 level after that. Rallies of this point will be treated with suspicion as it looks like we are getting ready to roll over.

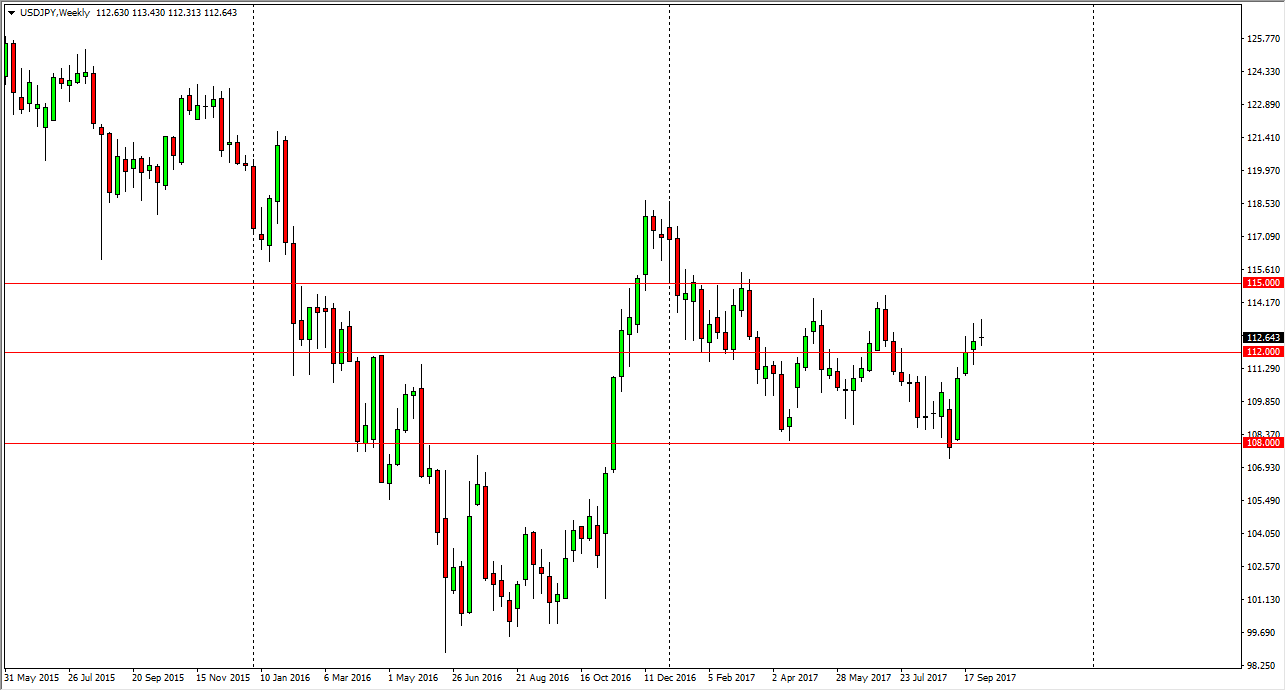

USD/JPY

The US dollar rallied initially against the Japanese yen, but turned around to show signs of exhaustion. By forming the shooting star, it looks as if we’re going to try to reach 112, where I would expect see this support come back into play. If we can break down below there, I think that the 111 level under there is massively supportive. I think were to get a short-term pullback, but eventually I think that it’s only a matter of time before the buyers return.

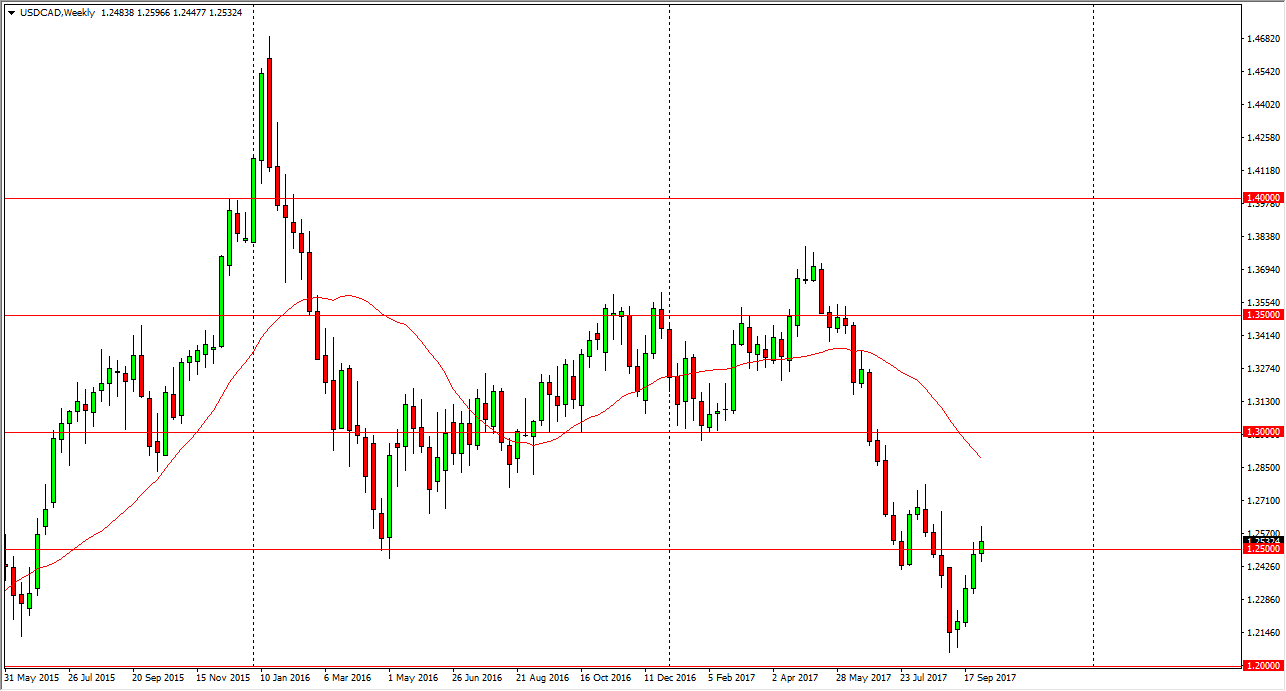

USD/CAD

The US dollar rallied a bit during the week, breaking above the 1.25 level. In fact, one point we even reached above the 1.26 level, so it’s likely that the buyers may come back in, and with oil markets rolling over, we could see the market go higher. Also, we recently had a significant traded in the bond markets fearing the Canadians, and I think that starting to unwind. I expect bullish pressure, but it might be choppy.

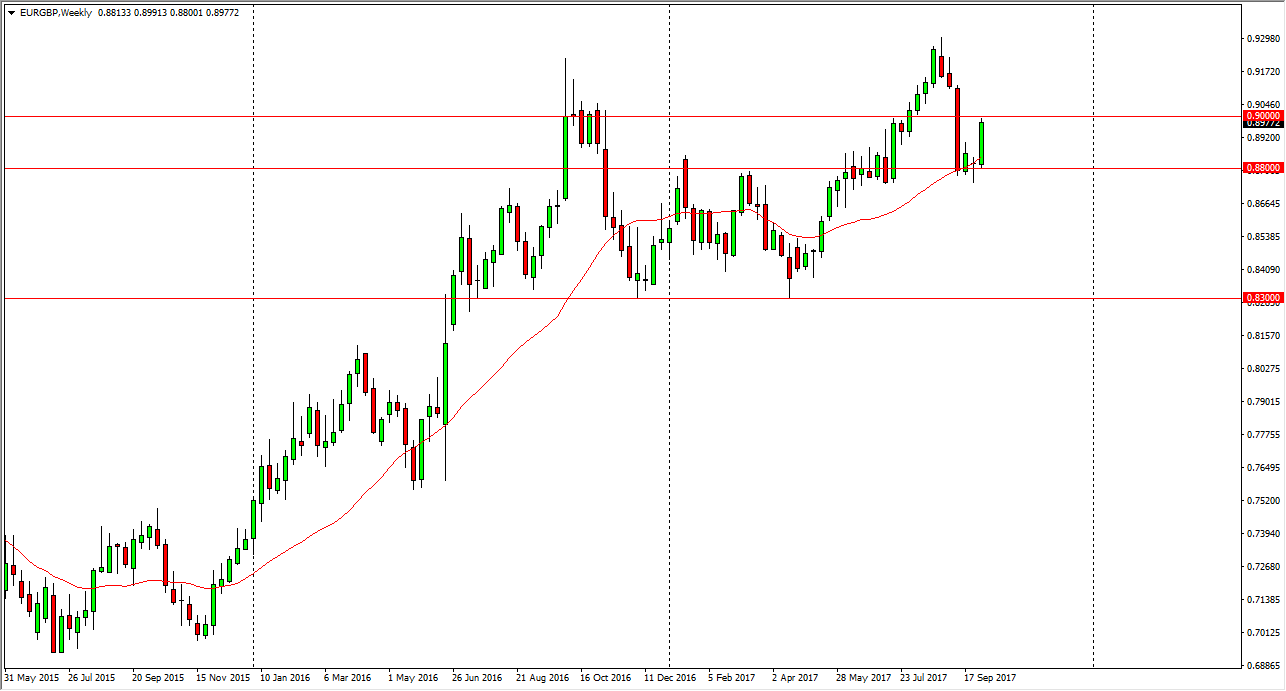

EUR/GBP

The EUR/GBP pair broke higher during the week, clearing the top of the hammer from the previous week. The 0.88 level offered support, and it looks likely that were going to continue to rally now that we have tested the 0.90 level. If we can break above there, the market should continue to go higher, perhaps reaching towards the 0.93 level after that. Short-term pullback should be buying opportunities.