Gold prices settled at $1279.33 an ounce on Friday, suffering a loss of 1.41% on the week and 3.19% over the month. XAU/USD has dropped nearly 5.75% since the market peaked at $1357.47, and the precious metal’s losses were mainly driven by expectations that the Federal Reserve will lift rates for a third time this year. Markets are pricing in a roughly 70% chance the Fed will raise borrowing costs in December, compared with less than 20% only about a month ago.

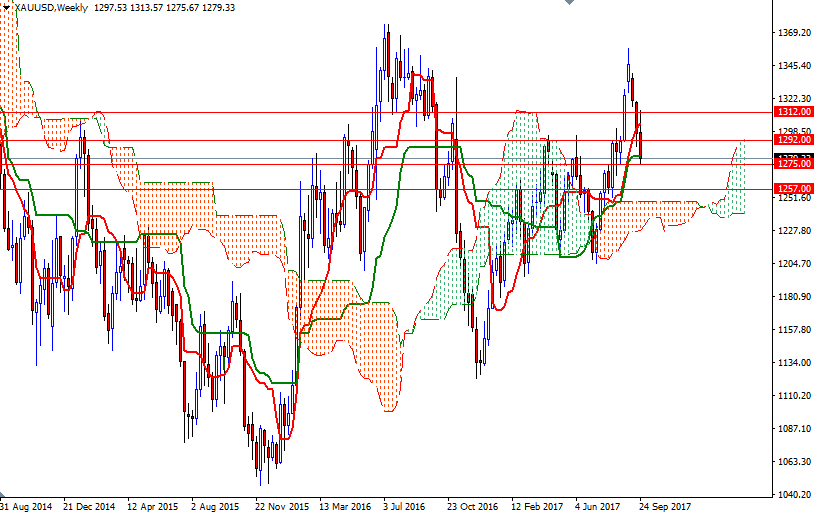

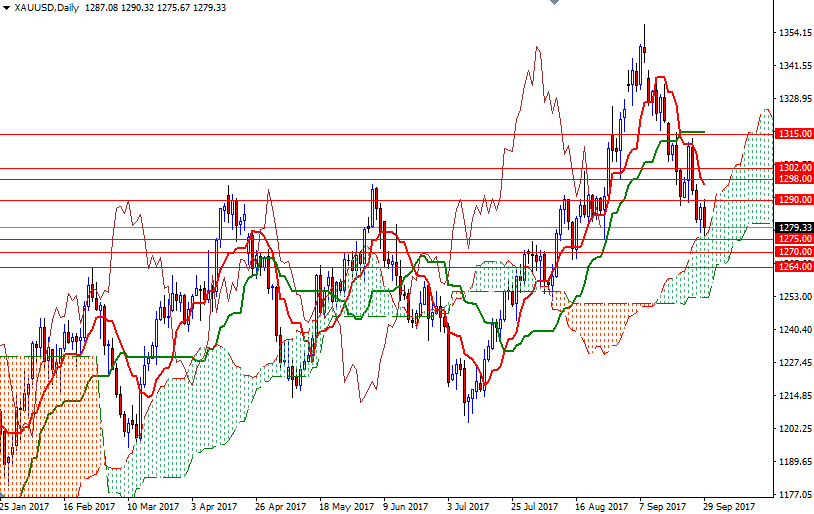

Last week’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 212594 contracts, from 236089 a week earlier. On the 4-hourly and the hourly charts, prices remain below the Ichimoku clouds. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on the daily and the 4-hourly charts, suggesting that the bears still have the near-term technical advantage.

XAU/USD has been under pressure since it broke down below the 1315/2. At this point, there is no sign of a reversal but beware that the market has reached the daily cloud. Technically, the Ichimoku clouds define an area of support or resistance depending on their location and in our case the daily cloud represents support. Therefore, a move towards the 4-hourly cloud may not be so surprising. In order to reach there, the bulls will need to break through 1292/0 first. Climbing above the 1302-1298 zone would be a positive sign; however, the bulls have to produce a weekly close above solid technical resistance in the 1315/2 zone, if they intend to take the reins. In that case, look for further upside with 1320 and 1326 as target. A break through there brings in 1334.40-1332. Down below, keep an eye on 1270 and 1264/3 (the 61.8% retracement based on the bullish run from 1204.76 to 1357.47). If gold prices dives below 1264, the market will be targeting 1257/4 and 1248. A successful break below 1248 would set XAU/USD up for a test of the support in the 1243.40-1240 zone.