Gold ended the week down 1.77%, giving up most of the previous week’s gains, as a rally in the U.S. dollar index weighed on the market and drew investors away from the precious metal. The American dollar got support from fresh economic data helped boost expectations for a U.S. Federal Reserve interest rate hike in December. The U.S. stock markets extended their gains on Friday after the U.S. Senate passed a budget blueprint. World stock markets haven’t been exhibiting much risk aversion so far.

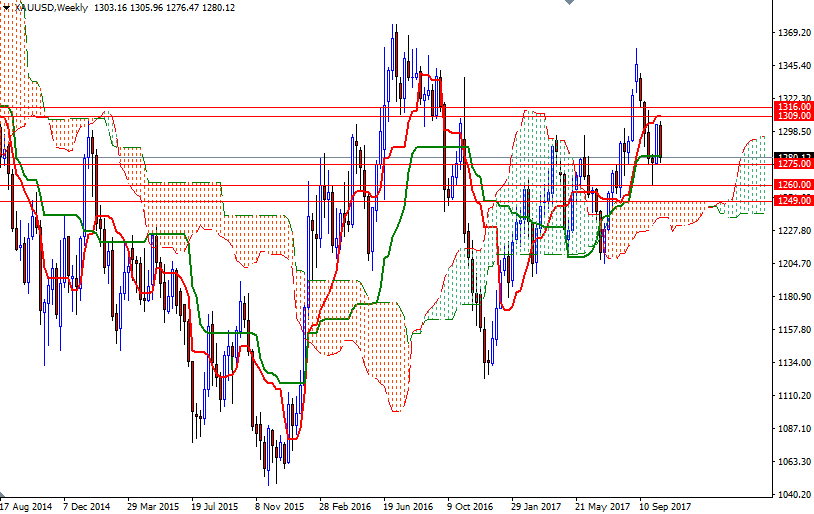

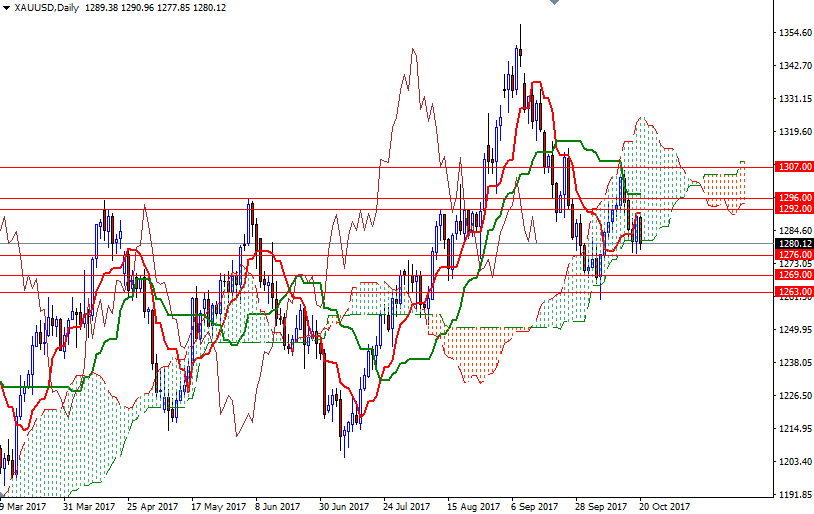

On the weekly chart, XAU/USD is trading above the Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned. However, the short-term outlook remains bearish, with the market trading below the Ichimoku clouds on the daily and the 4-hourly charts. In addition to that, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. To put it shortly, the upside potential will be limited until XAU/USD anchors somewhere beyond 1296 at least.

The bulls will have to capture this strategic camp so that they can test 1302/0 and 1309/7. Closing above 1309 on a daily basis implies that the market is going to challenge 1316/4. Similarly, there is a key support down below in the 1276/5 zone. If the downward pressure continues and 1276/5 is convincingly broken, the 1269/7 area will be the next port of call. Falling through 1267 could encourage sellers and increase the possibility of an attempt to visit 1263/0. A daily close below 1201 would open up the risk of a move to the weekly cloud.