Gold ended the week down $4.76 at $1273.46 an ounce, hurt by a stronger dollar. XAU/USD traded as low as $1264.17, the lowest level in three weeks, after a report showed the U.S. economy grew more than expected in the third quarter but found support in the vicinity and headed towards the $1276-$1275 area. This week sees a deluge of key U.S. economic data, including the monthly non-farm payrolls report, factory orders and manufacturing and services PMIs. The main event for U.S. markets this week is likely to be the two-day Federal Open Market Committee meeting beginning on Tuesday. President Donald Trump is expected to announce his choice for the next leader of the Federal Reserve sometime this week.

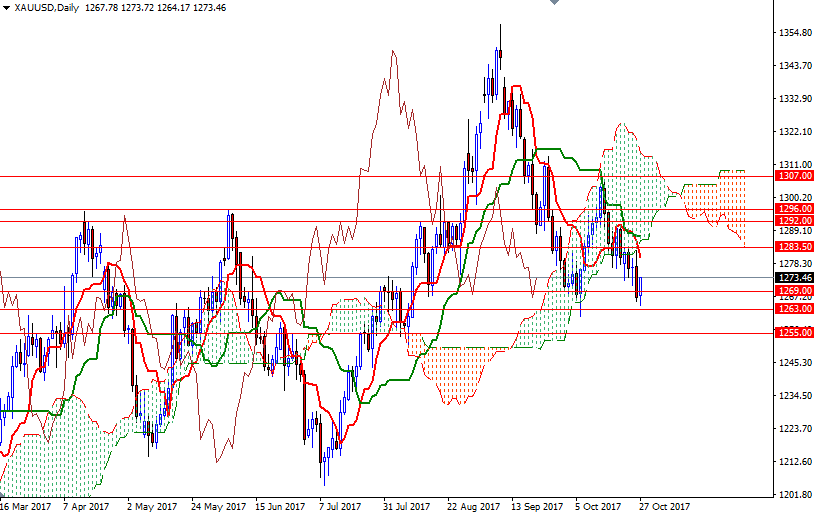

The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 191385 contracts, from 200724 a week earlier. Trading below the Ichimoku cloud (on the daily and the 4-hourly charts) indicates that XAU/USD is likely to continue to suffer from the bearish short-term outlook. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both time frames also support this theory.

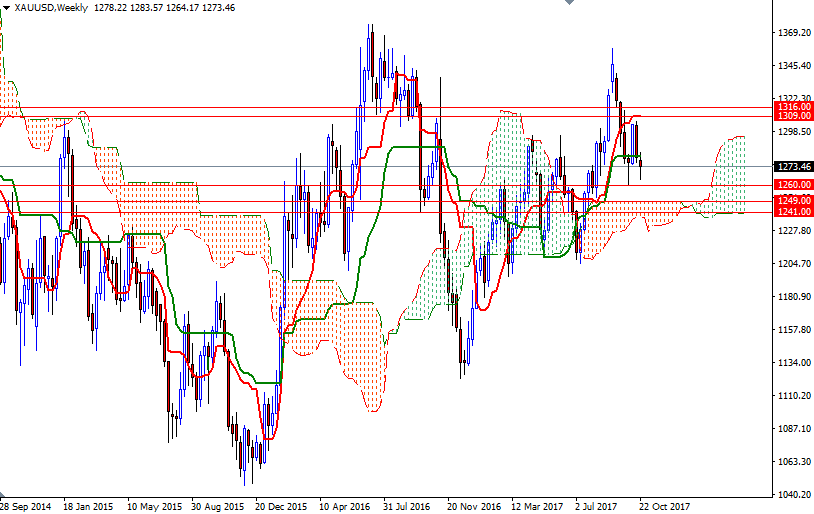

However, note that the market is still above the weekly cloud and in order to reach there the bears have to successfully drag prices below the 1263/0 zone. In that case, look for further downside with 1255 and 1249/7 as the next targets. A daily close below 1247 implies that the market is getting ready to visit the support in 1241/39. To the upside, the initial resistance sits in 1276/5 and the bulls have to clear this barrier so that they can find a chance to make an assault on 1283.50-1280. A break through there brings in 1292/0 (the top of the 4-hourly cloud). Beyond that, the 1297/6 area stands out as a strategic resistance. Closing above 1297 on a daily basis suggests that the market will be aiming for 1302.