Gold prices rose $7.72 on Friday, recouping earlier losses, and settled at $1276.15 an ounce as traders assessed the likelihood of a December rate hike in the wake of a mixed employment report. Better risk appetite in the marketplace, as well as a strengthening greenback the past four weeks, have been bearish elements for the yellow metal. Major world stock markets were mostly up last week, following the lead of U.S. stock indexes, and the U.S. dollar index reached the highest level in 10 weeks.

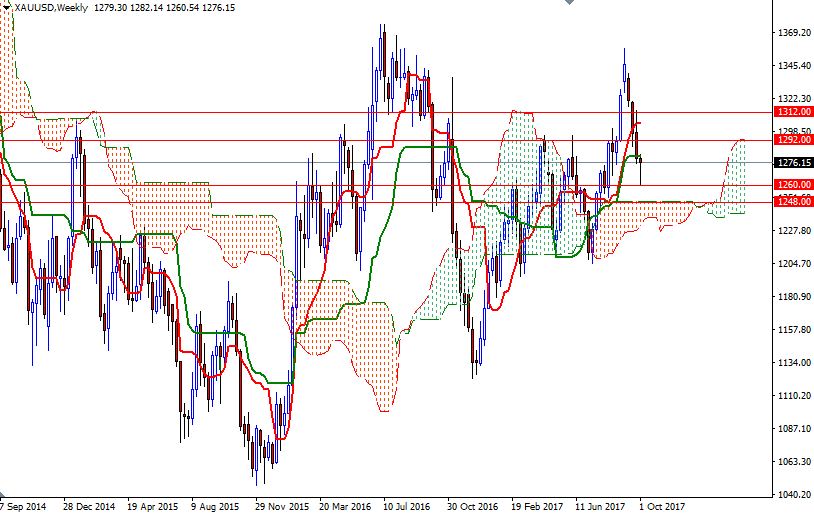

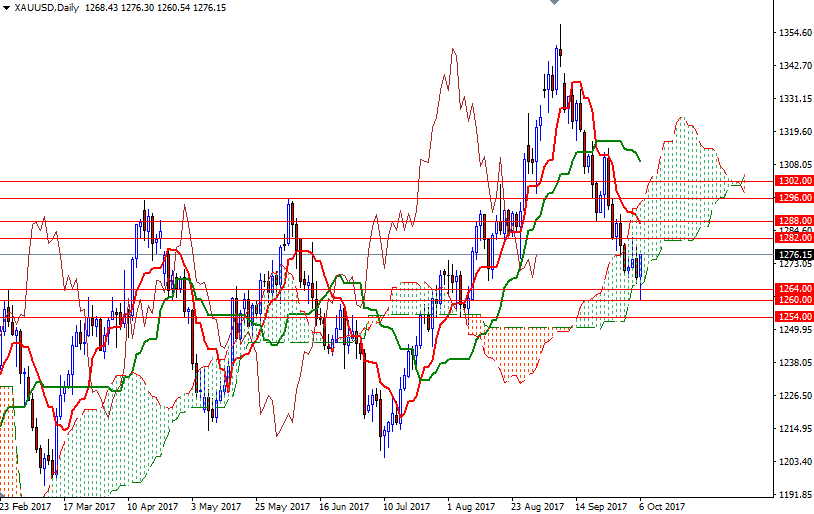

XAU/USD traded as high as $1276.30 after employment data showed that the U.S. labor market shed 33000 jobs in September. Data also revealed that average hourly wages increased 0.5% and the unemployment rate dropped to 4.2% from 4.4%. Market expectations are high that the U.S. central bank will hike rates again in December but investors doubt that the Fed will raise borrowing costs three more times next year. From a chart perspective, trading below the Ichimoku clouds on the 4-hour chart implies that the bears have the short-term technical advantage. However, the long lower shadow of Friday’s candle, along with the fact that prices are still above the weekly cloud, suggests we shouldn’t rule out a rebound in gold.

If the bulls can convincingly push prices above 1282/1, look for further upside with 1288 and 1292 as next targets. Closing above the top of the 4-hourly cloud would be a sign of bullish recovery and open a path to the next barrier in the 1302-1296 area. The bears, on the other hand, will have to produce a close below the 1260 level in order to put more pressure on the market and test the support at 1254. Below 1254, the 1248 level, the top of the weekly cloud, stands out as a key technical level. If this support is broken, then the market will be aiming for 1243/0.