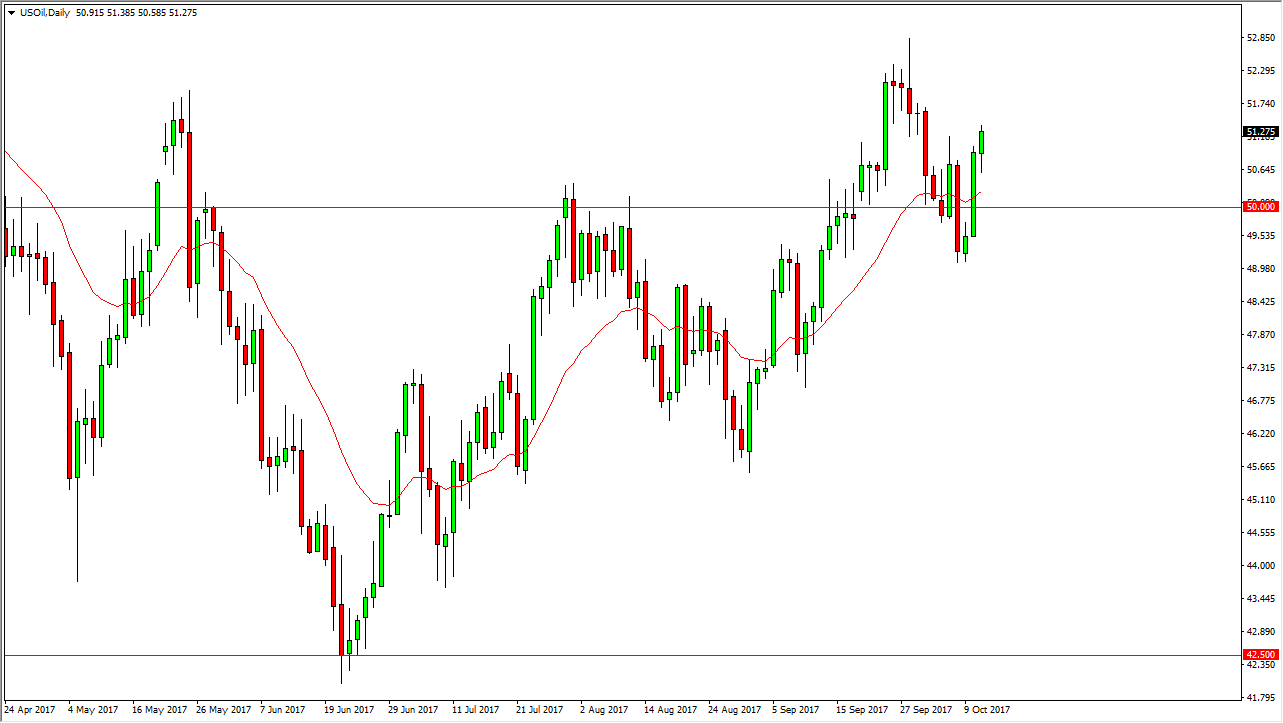

WTI Crude Oil

The WTI Crude Oil market initially fell on Wednesday, but found enough support underneath to turn things around and rally. We are now testing the top of the range for the last several sessions, and I think we may go looking towards the $52.50 level next. I think the $50 level underneath is support, and if we can stay above there, we will more than likely find plenty of buyers to get involved in the market as we continue to see Russians and Saudi Arabian ministers talk about cutting production. That of course puts a little bit of a floor in the market, and I think at this point the overall upward pressure should continue. However, if we were to break down below the $49 level, I think that we will continue to go lower at that point, as it would be a significant break of support.

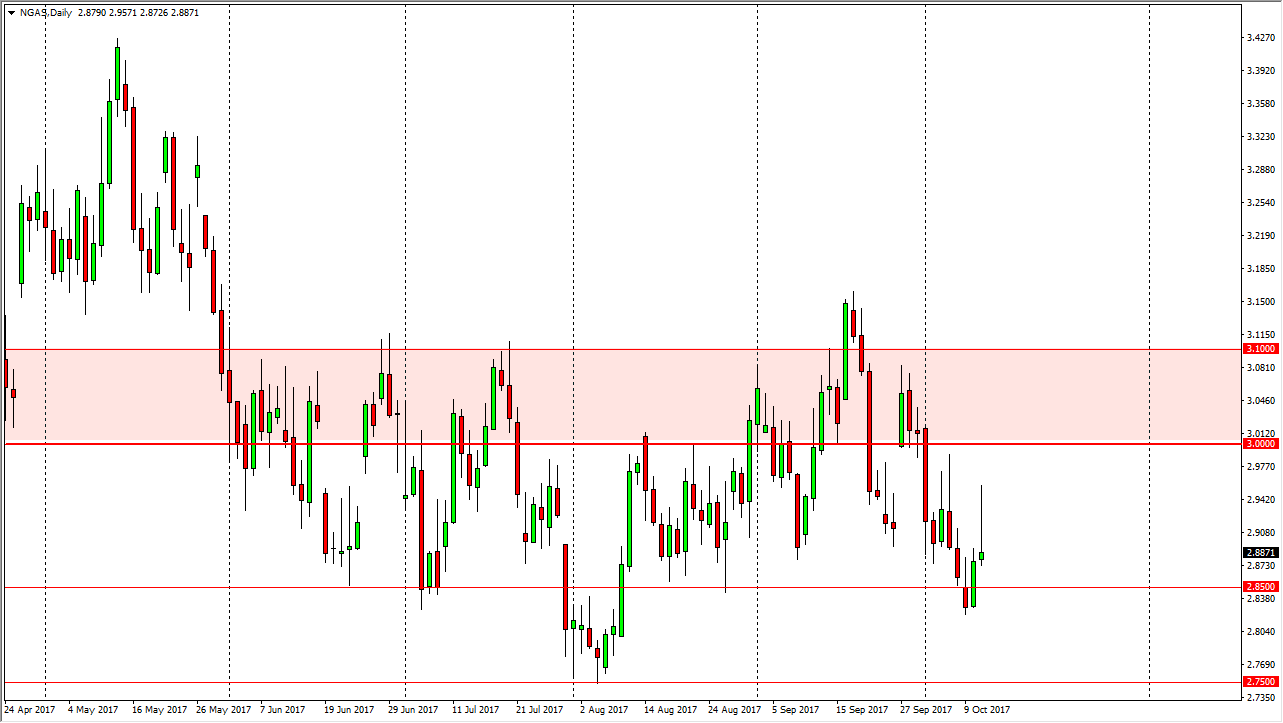

Natural Gas

Natural gas markets initially rally during the trading session on Wednesday, but broke down significantly and turned around to form a nasty looking shooting star. Because of this, the market looks likely to continue to sell off on rallies, if you are quick enough to catch the signs of weakness. I believe that the $3 level continues to be a massive ceiling in this market as the oversupply continues to plague the market. Remember, at $3, the American fracking companies find themselves profitable, and are more than willing to dump their massive over supplies of natural gas into the marketplace to avoid the losses that have been piling up for some time. Because of this, there will be a permanent foot on the throat of buyers in this market, and therefore I simply wait for an opportunity to short every time we rally.