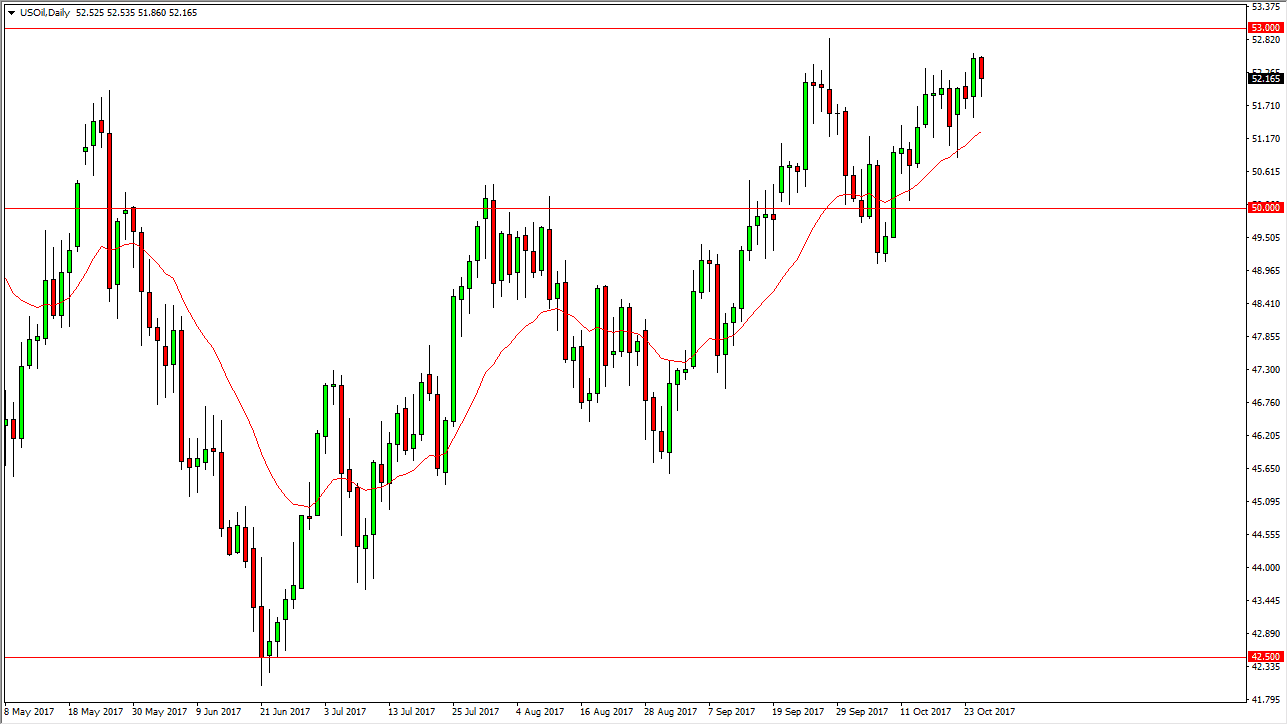

WTI Crude Oil

The WTI Crude Oil market fell during most of the session on Wednesday, reaching down towards the $52 level underneath. The $53 level above is resistance, and I think we need to break above there to pick up significant momentum, and continue the uptrend. When you look at this chart, it’s obvious that a move above $53 would be a very bullish sign. A break above there is a good opportunity to build a larger position and aim for the $55 level above which would be significantly resistive based upon the large, round, psychological aspect of the number. I think if we break down below the $51 level, that would be very negative, and send this market to the $50 level next. I think we should continue to see a lot of volatility, but it looks as if the buyers are becoming aggressive.

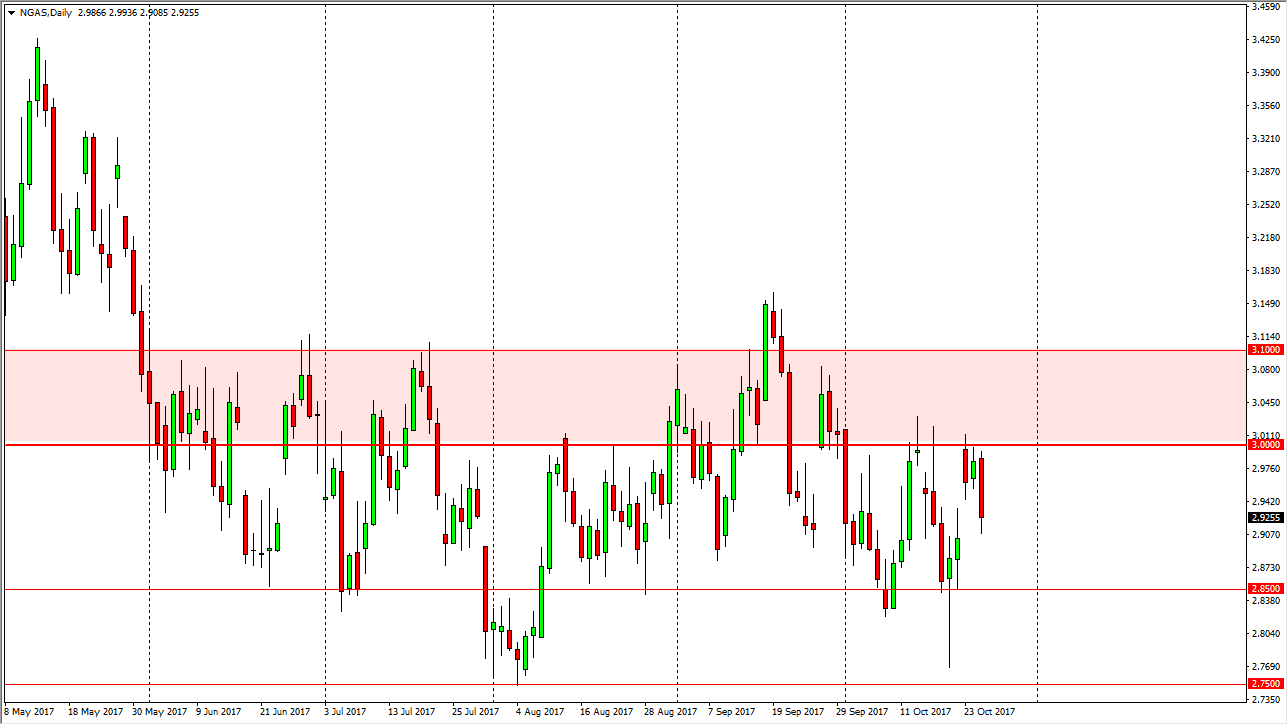

Natural Gas

The natural gas markets broke down during the session on Wednesday, as the $3.00 level continues to signify a massive amount of supply in the market as the US fracking companies continue to flood the market as the companies become profitable at that level. Because of this, I think we will continue to see selling every time we get close to that area, and that’s exactly what I’m waiting on. I think that now that we have filled the gap from a couple of sessions ago, the market will probably bounce, looking for sellers above. The $2.85 level underneath should continue to be support, and I believe that if we break down below there, the market should then go to the $2.75 level. Volatility continues, so therefore I think that you should get selling opportunities quite frequently.