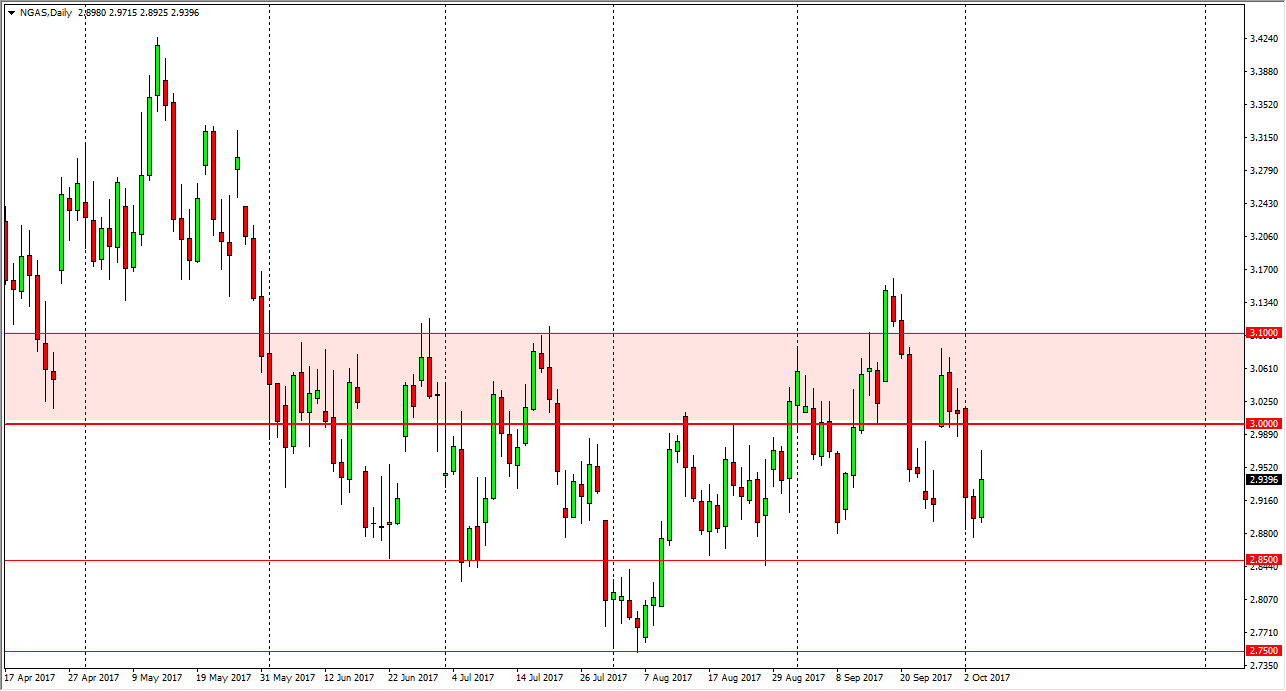

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Wednesday but was turned around at the $50.75 level. There was so much in the way of bearish pressure that we turned around and broke below the $50 level to form a shooting star. The shooting star suggests that we are going to continue going lower, and that we may test the vital $49 support level. I think at this point, the crude oil markets look like they are ready to sell off again. However, this is an area that there is a lot of noise based around, so I would expect very choppy conditions. If we were to break above the $51 level, then I think we go back towards the highs. Otherwise, a breakdown below the $3 handle, the market could fall apart.

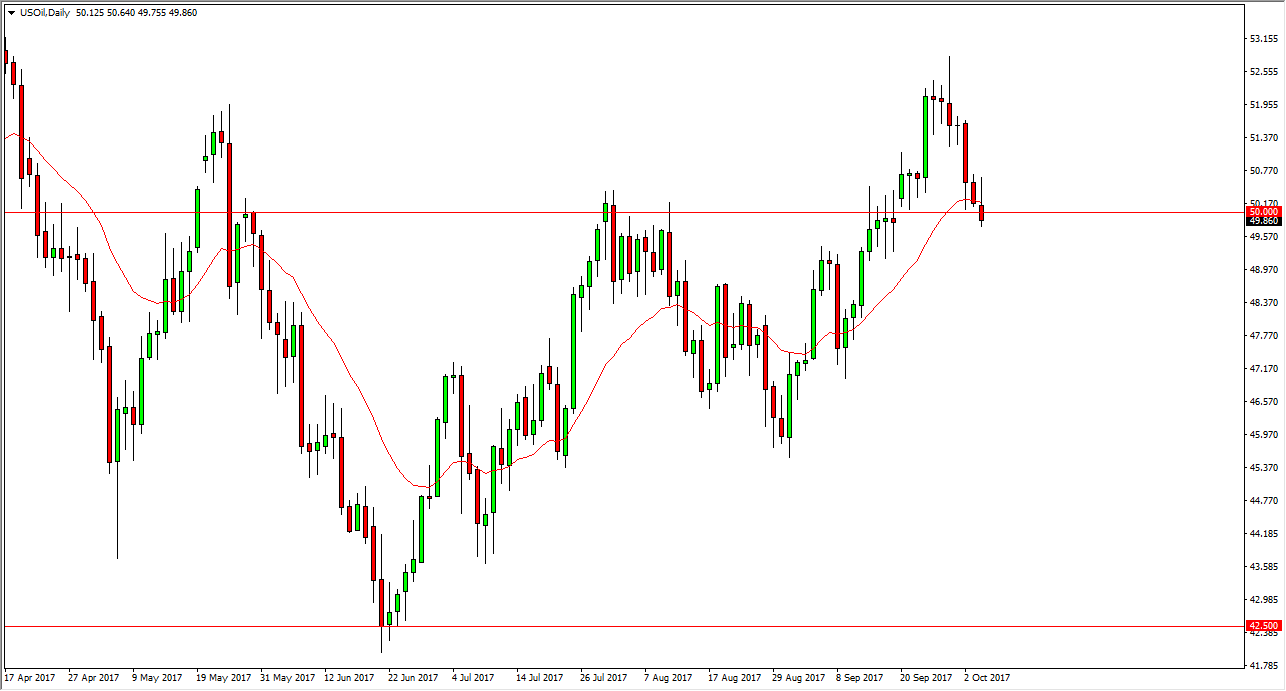

Natural Gas

Natural gas markets rallied during the day on Wednesday, as we continue to see extraordinarily volatile conditions. I believe that given enough time we will see the markets break down again, and I think that the oversupply continues to be a major issue. Quite frankly, this is a market that continues to offer selling opportunities, as there is a massive amount of supply above the $3 level. However, it’s also very volatile market, so being patient and waiting for rallies will probably pay off better than any other type of trading that I can think of. I believe that the $2.85 level underneath is massive support, and therefore will be difficult to break down below. However, if we do I think we will probably go looking towards the $2.75 level after that. Overall, buying natural gas is almost impossible to do as there is such a massive supply overhang in the markets.