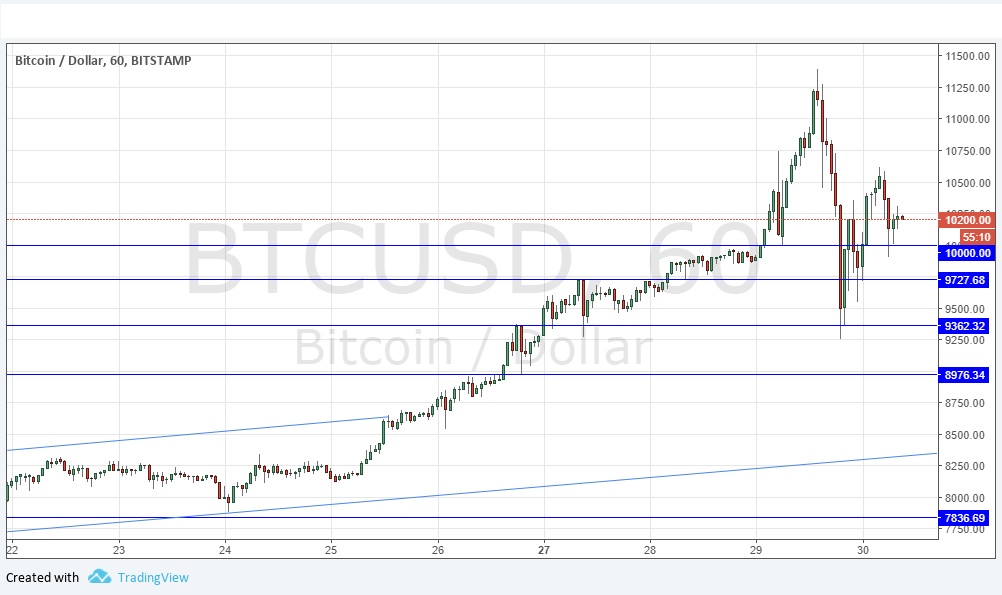

Yesterday’s signals were not triggered, as although there was bullish price action at $9362.32, the entry would not have been before 5pm New York time.

Today’s BTC/USD Signals

Risk 1.00% per trade.

Trades must be taken before 5pm New York time today only.

Long Trades

Go long after a bullish price action reversal on the H1 time frame following the next touch of $9727.68, or $9362.32.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is $200 in profit by price.

Remove 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

This is a big moment for Bitcoin. Yesterday the price broke above $10,000 for the first time ever. I expected one of two things would happen, either the price would continue to advance strongly, or make a strong downward movement. In fact, both were correct, as one happened after the other. Volatility is huge. Recent hours have seen both the strongest fast upwards and downwards movements in Bitcoin’s history, at least in Dollar terms, and probably in percentage terms too (I haven’t had the time to check the statistics yet).

Technically, what is interesting is that all the support levels shown in my charts (see below) are still holding, although they were briefly violated in the high volatility. I think it is also significant than an hour after the London open, the price is trading above the psychologically key level of $10,000. This makes me believe a bullish outcome is more likely than a bearish one. Yet there is danger in the high volatility. Short-term traders should be extremely cautious and watch the charts like hawks, and trade using only extremely small position sizes. Long-term investors should be thinking very seriously about taking profits or cutting losses. The coming days are likely to be crucial to the future of Bitcoin’s price.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm.London time.