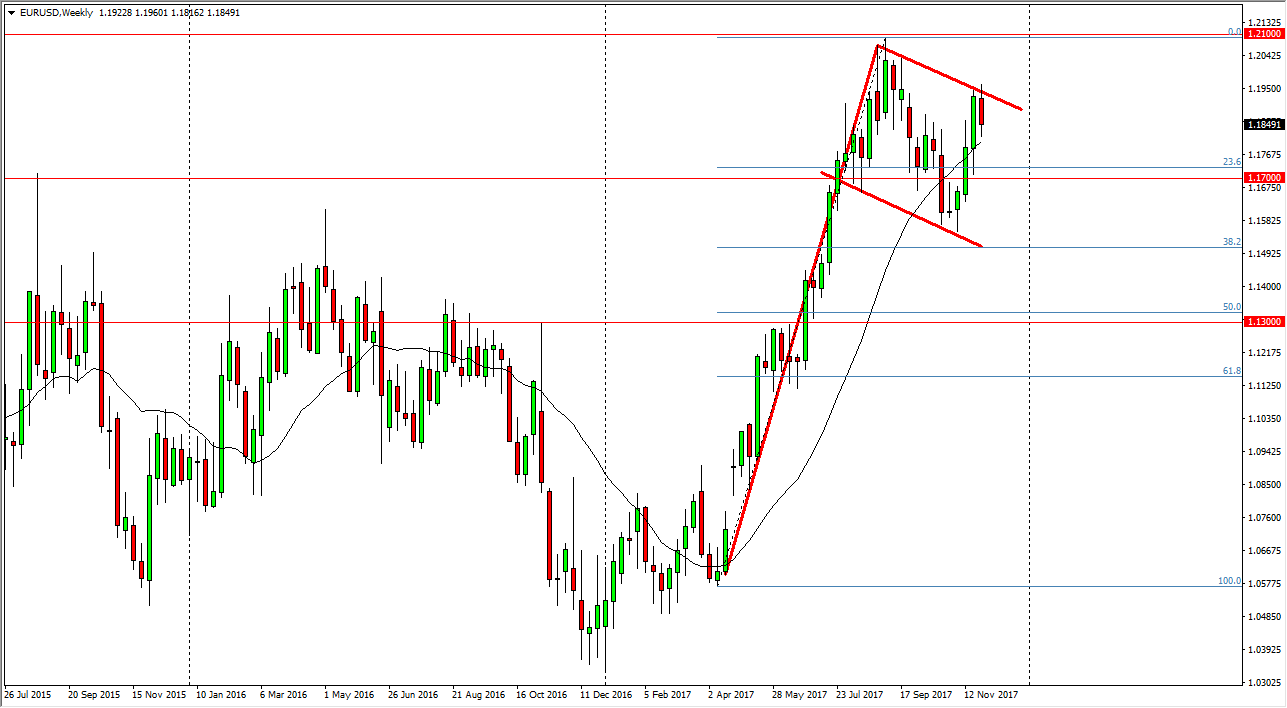

For me, this is going to be the market to pay attention to in the month of December, and probably January 2018 as well. This is because as you can see on the chart, I have drawn out a bullish flag. If we can break above the candle from the last week of the month in November, that triggers a buy signal, and could send this market towards the 1.21 level above. A break above there would be a sign that we are ready to fulfill a measurement of this bullish flag, which could send the EUR/USD pair to the 1.32 handle. Ultimately, the market continues to be very volatile, especially considering that the US dollar has a lot of headlines going back and forth involving the tax bill. If the US Congress passes a less than desirable tax bill, it’s likely that this pair will take off to the upside.

Another potential driver of bullish pressure will be that the German economy is starting to show signs of inflation. If that’s the case, the Euro should continue to go higher. Pullbacks at this point should find support near the 1.17 level underneath, which has been important in the past. I think waiting for some type of supportive candle on a pullback might be the easier way to go, but maybe perhaps on the daily chart. Again though, if we break out above the top of the flag, then there’s no reason to wait. Keep in mind that liquidity is going to get very thin towards the end of the month, and that could facilitate a large move, as it has more than once in the past. I don’t want to short this market, unless of course Congress somehow shocks the world it does its job. Being an American, I know better than to expect that.