The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 5th November 2017

Last week, I saw the best possible trades for the coming week as long USD/CHF, short EUR/USD, and long of the S&P 500 Index in U.S. Dollars. The overall result was positive, as the USD/CHF rose by 0.28%, the EUR/USD rose by 0.02%, and the S&P 500 Index rose by 0.17%, producing a small average win of 0.14%.

The Forex market over the past week has continued a little in favor of the U.S. Dollar again, and seems now have invalidated the long-term bearish trend in the greenback. Although there was major news concerning the USD, the dominant even in the Forex market was the “dovish rate hike” by the Bank of England, which saw the British Pound fall by more than 1% against a basket of currencies.

The news agenda this week is almost certainly going to be dominated by monthly guidance and interest rate decisions due from the Australian and New Zealand central banks respectively. The New Zealand Dollar has been in focus with high volatility and active trading with large directional movements. As the price is near a long-term low, this situation is likely to persist and should be boosted by any surprise move by the RBNZ.

The American stock market is still making new all-time highs which is always a bullish sign, despite the relatively low volatility.

Following the current picture, I see the highest probability trades this week as long of the U.S. Dollar against the Japanese Yen, and long of the S&P 500 in U.S. Dollar terms. Apart from the stock market, there are very few clear strong trends in the market now.

Fundamental Analysis & Market Sentiment

Sentiment is currently a little less bullish on the U.S. Dollar and stocks following disappointing Non-Farm Payrolls data which was released at the end of last week, although the Unemployment Rate showed a tightening which is likely to help the greenback to stay strong. Geopolitical factors may move to the fore, as President Trump begins a visit to Japan and other Asian countries in the wake of increased Korean tensions, and the world digests the implications of an Iranian attack by proxy upon the capital of Saudi Arabia by ballistic missile which occurred yesterday.

The Japanese Yen is sitting on an important technical point, with the USD trying to push it beyond the long-term resistant inflection just above 114.00.

Technical Analysis

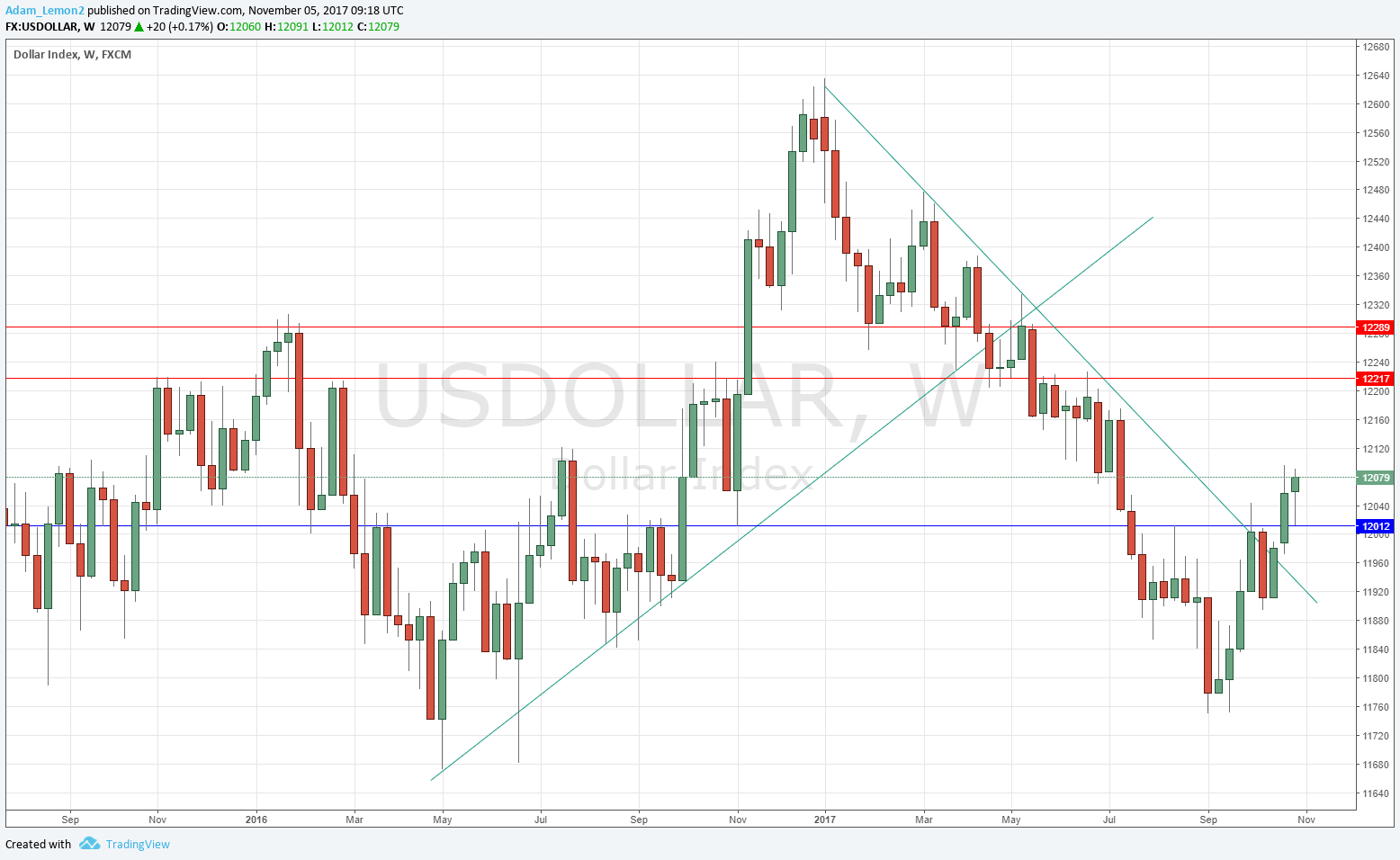

U.S. Dollar Index

This pair printed a bullish inside candlestick, continuing the invalidation of the long-term bearish trend and turning the former resistance level at 12012 into clear support. However, there remains an indication of the price running into resistance just below 12100 which may make a further immediate advance difficult. It would not be a surprise if we begin a period of consolidation and uncertainty following the end of the recent bearish trend, so I can’t be strongly bullish on the greenback right now. I have a weakly bullish bias.

USD/JPY

This pair is an upwards trend and it has some bullish momentum behind it. However overall it looks weak. The price is struggling to breakout past an area of long-term resistance between 114.25 and 114.50 which has held firm for over 6 months. It is far from clear that this breakout is about to happen, but if it does happen it is likely to be powerful, and so probably it is worth a low risk, high reward gamble. The bullish case is strengthened by the fact that we just saw the highest weekly closing price since mid-March.

S&P 500

We again see new all-time highs here, and the chart below shows just how steadily bullish the trend has been. There is every reason to continue to be bullish despite the endless articles in the press forecasting an imminent market crash. This talk has been going on for months while the market just keeps going up and up, albeit on very low volatility. Trade what you see, not what the papers say, and what we see here is a strongly bullish market.

Conclusion

Bullish on the U.S. Dollar, and the S&P 500; bearish on the Japanese Yen.